- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

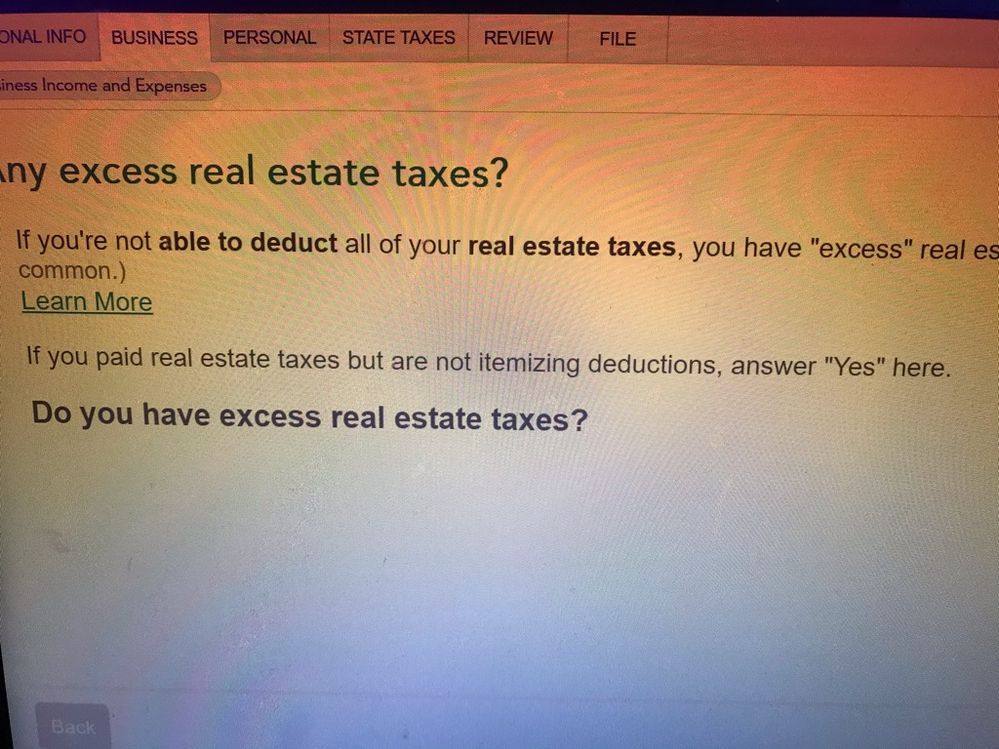

Excess Real Estate Taxes

I’m thoroughly confused here

I paid over 11k in RE property taxes. What am I supposed to do here?

Topics:

July 15, 2020

8:19 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hope this helps:

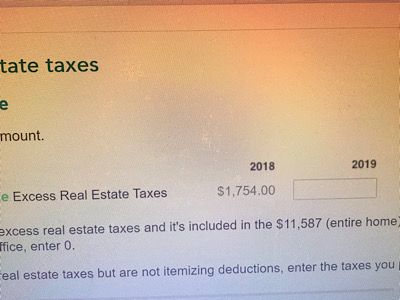

Beginning in 2018, the total amount of deductible state and local income taxes, including property taxes, is limited t $10,000 per year.

July 15, 2020

8:29 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If this is form 8829 then it would be the excess over $10,000. So it looks like in your case that would be $1,587.

July 15, 2020

8:42 PM