- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short & Long-term Capital Gains from a Partnership Reporting

I have capital gains & losses reported on a K-1 (form 1065). They are listed on the K-1 under Box 11, code I.

I can't figure out how to carry this information over to Schedule D to line 5, column H (short-term) and line 12, column H (long-term)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

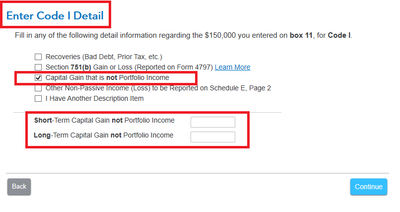

Did you not check the appropriate box on the Enter Code I Detail screen (see screenshot)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks..... it does get my capital gains (losses) over onto schedule D, but not on the exact line my K-1 is telling me to put the amounts on. K-1 states the short-term gain (loss) amount should be on line 5 column H and turbotax is putting it on line 3 columns E & H, and the K-1 states the long-term gain (loss) should be on line 12 column H and turbotax is putting it on line 10 column D & H.

At this point, I'm glad that it's on the schedule D and demonstrates that I made an honest attempt. Should I be concerned that the amounts are on the wrong line?

Thanks for the fast response.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@MrBolts wrote:

...K-1 states the short-term gain (loss) amount should be on line 5 column H and turbotax is putting it on line 3 columns E & H, and the K-1 states the long-term gain (loss) should be on line 12 column H and turbotax is putting it on line 10 column D & H.

Not that it matters much in your case, but the amounts would be on the lines your K-1 indicated if they were reported on Lines 8 and 9a on your K-1. Rather, they appear to have been reported as other income on Line 11(I).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks for your guidance.... very much appreciate.