- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- In TurboTax Business, where to enter 1099-OID line 11 (help article says to put on line 13 of 1099-INT, but software doesn't give me that option).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In TurboTax Business, where to enter 1099-OID line 11 (help article says to put on line 13 of 1099-INT, but software doesn't give me that option).

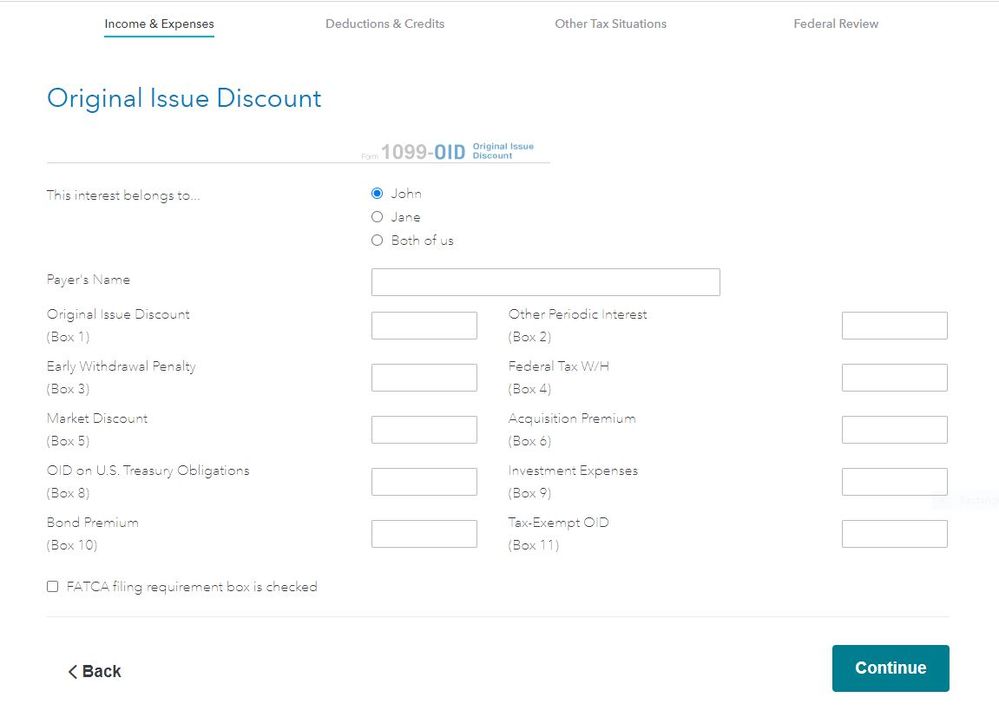

For a business (trust), I have a 1099-oid. The help system directed me to a helpful article on entering 1099-OID in TurboTax Business that says to use 1099-INT. The OID has amounts on line 6 (help says put in box 1 of 1099-INT), line 10 (Help says to put in Box 11 of 1099-INT) and line 11 (help says to put in Box 13 of 1099-INT). I check that I have an amount in Box 11, and get sent to a page that has only a place to put in the box 11 amount, no place to put in the tax-exempt OID (no Box 13 of 1099-INT). How do I enter the 1099-OID line 11 in TurboTax Business?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In TurboTax Business, where to enter 1099-OID line 11 (help article says to put on line 13 of 1099-INT, but software doesn't give me that option).

Original Interest Discount (OID) occurs when a firm issues an instrument of indebtedness (bond, note) at a price below its maturity prices so that holding the investment to maturity yields an otherwise unreported increase in interest income. Further, since a note or bond can be traded - sold in the secondary market - the tax accounting calls for the value of that amount of "over-redemption" to be recognized yearly as if the holder had actually received an interest payment in that amount. This is a frequently executed marketing technique in the underwriting and sale of municipal (tax-exempt) bonds. You want to amortize this OID amount over the holding period because otherwise at maturity you will have created an erroneous appearance of taxable capital gain on the tax-free bond.

Therefore, the appropriate way in Business program to report Form 1099-OID (or frequently the OID for tax-exempt is not reported on a seperate Form 1099-OID) is make entries as if two separate Form 1099-INT were received, as Business program does not have a separate interview entry for OID.

See attached PDF

NOT INTUIT EMPLOYEE

USAR 64-67 AIS/ASA MOS 9301 - O3

- Just donating my time

**Say Thanks by clicking the thumb icon in the lower left corner -it means nothing but makes those than answer feel wanted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In TurboTax Business, where to enter 1099-OID line 11 (help article says to put on line 13 of 1099-INT, but software doesn't give me that option).

Wish I could see the "attached PDF". Intuit's lack of a 1099-OID form in the expensive TT Business is completely unacceptable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In TurboTax Business, where to enter 1099-OID line 11 (help article says to put on line 13 of 1099-INT, but software doesn't give me that option).

I go to the Jump link as per help but never see Miscellaneous income option to chcose 1099 OID. How do you enter this amount? Should add as part of the interview and take you directly to a 1099 OID Worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In TurboTax Business, where to enter 1099-OID line 11 (help article says to put on line 13 of 1099-INT, but software doesn't give me that option).

@normanljr wrote:

I go to the Jump link as per help but never see Miscellaneous income option to chcose 1099 OID. How do you enter this amount? Should add as part of the interview and take you directly to a 1099 OID Worksheet.

The Following is from the TurboTax Self-Employed online edition -

Enter oid, original issue discount in the Search box at the top right of the program screen. Click on Jump to oid, original issue discount

Follow the steps to either import the 1099 or Type it in yourself

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In TurboTax Business, where to enter 1099-OID line 11 (help article says to put on line 13 of 1099-INT, but software doesn't give me that option).

Agree this is unacceptable. I have spent hours on trying to enter my 1099-OID amounts and help says to enter 1099-oid original issue discount exactly like that and it will allow me to jump to the section where I can enter it under "misc investment income" I get to the jump screen but it takes me to the 1099 summary page and there is option for entering misc investment income. If anyone has a workable answer to this, I would appreciate it. Contacting TT takes hours.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

emnem

New Member

mjmoor60

New Member

jose733b

New Member

burner718

Level 2

Magwheelz

New Member