- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Should PFL wages be deducted on my CA 540?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

We received the following CA FTB notice: "We disallowed the deduction for those wages you subtracted on your Schedule CA 540. All your wages are taxable, including those wages earned outside of California." The only deduction is Paid Family Leave Insurance benefits and those were not earned outside of CA, nor did we claim they were. I am confused by the reference to wages earned outside of CA. I was paid SDI via EDD from my employer while on maternity leave & family bonding and followed the Turbo Tax prompts/recommendations when completing our 2013 tax return. We are now being asked to pay a significant additional tax amount for 2013. We have until 10/1/17 to protest - PLEASE HELP!!!

Should my PFL wages be deducted on my CA 540?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

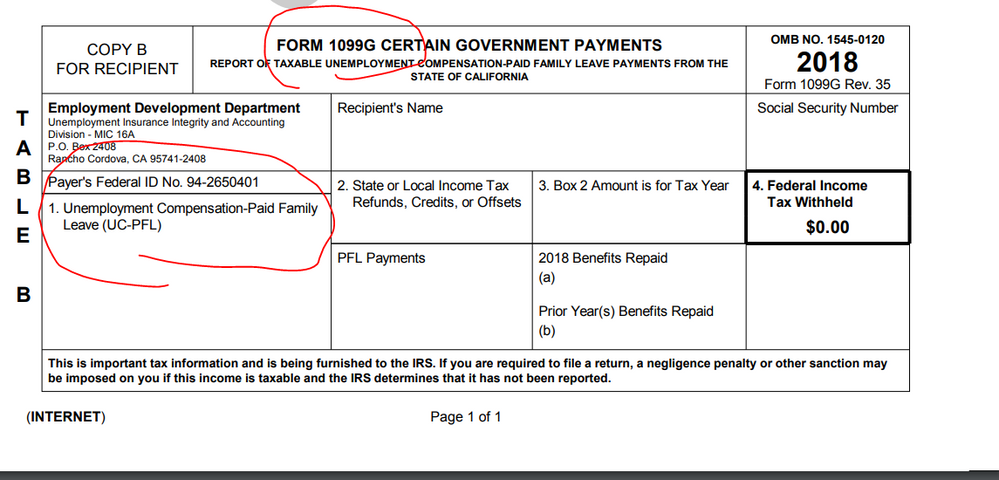

"PFL benefits are reportable for federal purposes but not state tax purposes. The EDD will provide all claimants with a 1099G form and forward a copy of the 1099G to the IRS. PFL benefits are not taxable or reportable to the California State Franchise Tax Board."

http://www.edd.ca.gov/Disability/FAQ_Employers_Benefits.htm

You may want to contact the Franchise Tax Board for more information regarding the letter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

PFL paid by the Calif EDD is reported on a Form 1099-G as TTWesley indicates, and is not included in your W-2 wages. If you indicated on your TT W-2 entry screen that some or all of the wages were PFL then that is an error and FTB is correct in disallowing the subtraction on your Calif return since your 1099-G PFL income has already been excluded from California income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

This just happened to me too?

The only deductions we had that year were PFL and I am pretty sure I set it up so that we got less PFL each month because we had them take taxes out? Or maybe that was another part of my maternity leave? Not sure. But I'm having a bit of a panic attack seeing what we're being asked to pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

this happened to me too for 2015 tax year. Anyone figure out how to fix this or get help. The whole thing is confusing to me. Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

like if I want to protest this what do I say?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

I had the same thing happen to me and I suspect there is something with the 2015 software that was confusing when it came to correctly inputting wages and PFL information. Anyone able to resolve this either with State or with Intuit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

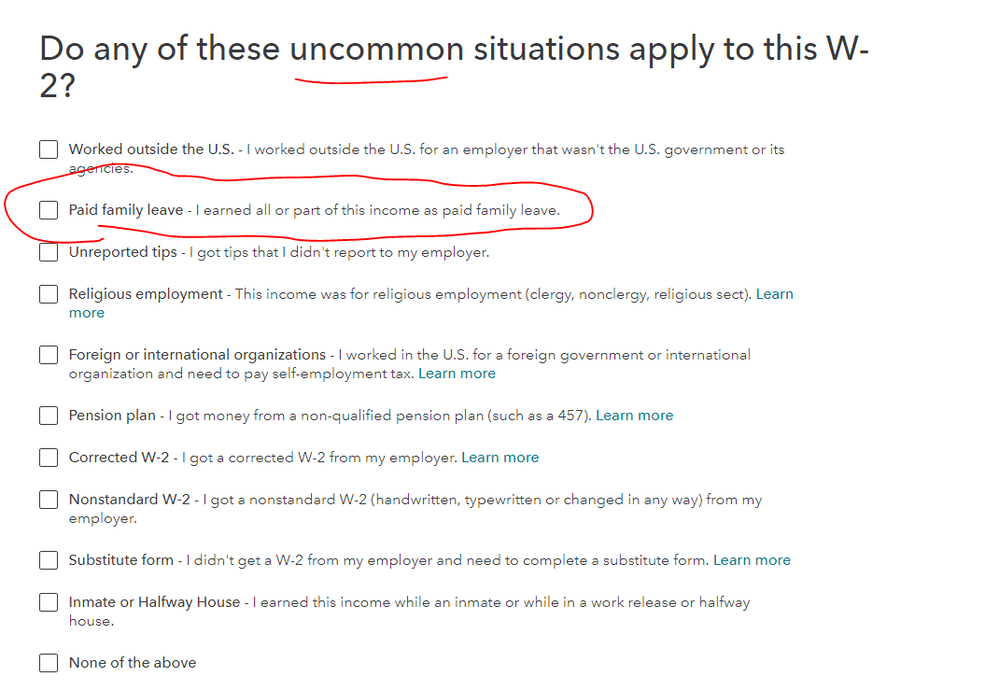

My issue isn't resolved, but intuit did respond and say and showed a box that I clicked under my Employer's W2 claiming "Paid Family Leave" when it should not have been clicked, as Paid Family Leave is it's own source of income. Obviously this was confusing, it seems like this has happened to multiple people. We will see what the State says

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

Did Intuit count that as a mistake on their behalf? I called them and they want me to file a claim about what happened.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

You can file an accuracy claim if you believe the program handled the issue incorrectly ... however this is more likely a user input error and not a program defect. Most likely you did not know if the W-2 had the paid family leave on it and you did not ask the employer for clarification prior to filing ... as mentioned above the PFL in CA is reported on a separate tax form and is NOT included on the W-2 which is why it is uncommon if not impossible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

The same happened to me in 2015. The content in the checkbox "Paid family leave - I earned all or part of this income as paid family leave" was really confusing and an incorrectly checked. Because of that, I needed to pay ton of money + interest to CA 4 years later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

It happened to me too. I was paid for family leave and CA tax form from intuit subtracted this amount from wages so now I was asked by FTB to pay a big chuck of money + interests accumulated for 4 years... Need someone from Turbo Tax to explain why would this happen...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should PFL wages be deducted on my CA 540?

Same thing here. Completely misleading from turbotax. I have used this service for the past 10 years, and I will definitely not be using them again nor will I recommend it to anyone I know. The whole purpose of turbotax is that its suppose to be simple/intuitive and you shouldn't have to be a tax expert. Extremely disappointed.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

PetuniasAuntie

Level 2

Taylogm

New Member

pkelly

Returning Member

pkelly

Returning Member

doingtaxes15

Returning Member