- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

I have a Publicly Traded Partnership that owns three other PTPs and includes all the values for each item of the K-1 for every partnership. My question is should similar items for each PTP be summed and entered as one value or all values entered under a separate K-1 with the same partnership ID?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

You'll want to create separate K-1s for each sub-entity. There's a couple reasons for this:

- The IRS rules on PTPs state that losses from one PTP can't be used to offset income from another. So if you sum across all sub-entities, you can violate that rule. Even though a parent PTP owns the shares of the sub-PTPs on your behalf, you still can't violate that rule.

- If the parent sells off one of the sub-entities in the future, you'd be entitled to recognize any prior year suspended losses for that sub-entity. That only works, though, if you've been keeping separate records.

You also mentioned entering each sub-entity with the "same partnership ID". If you're referring to the 9-digit number that's tied to the PTP, usually the parent PTP provides IDs for each sub-PTP.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

You'll want to create separate K-1s for each sub-entity. There's a couple reasons for this:

- The IRS rules on PTPs state that losses from one PTP can't be used to offset income from another. So if you sum across all sub-entities, you can violate that rule. Even though a parent PTP owns the shares of the sub-PTPs on your behalf, you still can't violate that rule.

- If the parent sells off one of the sub-entities in the future, you'd be entitled to recognize any prior year suspended losses for that sub-entity. That only works, though, if you've been keeping separate records.

You also mentioned entering each sub-entity with the "same partnership ID". If you're referring to the 9-digit number that's tied to the PTP, usually the parent PTP provides IDs for each sub-PTP.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

I think the answer is Yes, but wanted to double-check, since I heard a bit different opinion.

Do I have to make 3 separate K-1 entries on TT, even if I had the interest only in one of the partnership?

Ex. I had interests in EnergyTransfer LP via a brokerage firm and I sold all of them in 2019. I received the K-1, with the supplemental K-1 information statement, where it has the chart with other 2 tiered(sub)PTPs of USAC and SUN. I have never had any interests in those 2 partnerships.

Thanks for any inputs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

@USAnyc1, I'm in the same boat as you (i.e., I also own units in Energy Transfer LP). As it relates to your question, as @nexchap stated above, "Even though a parent PTP owns the shares of the sub-PTPs on your behalf." In other words, yes, even though you don't directly own interest in the sub-PTPs/lower tier partnerships, my understanding is you need to enter separate K-1's for them, using the dedicated FEIN for each that appears on the "Supplemental K-1 Information Statement for Tax Year XXXX" page. One thing that was unclear to me is whether to use the same entity name for each (i.e., the name that appears on the actual Form 1065) or use the entity names that appear on the "Supplemental K-1 Information Statement for Tax Year XXXX" page. Can anybody speak to that?

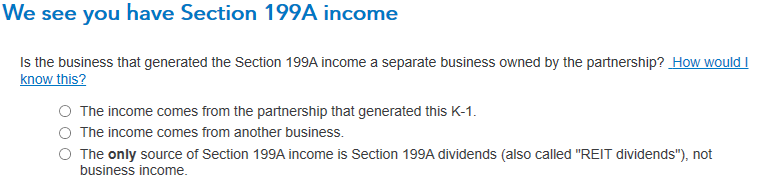

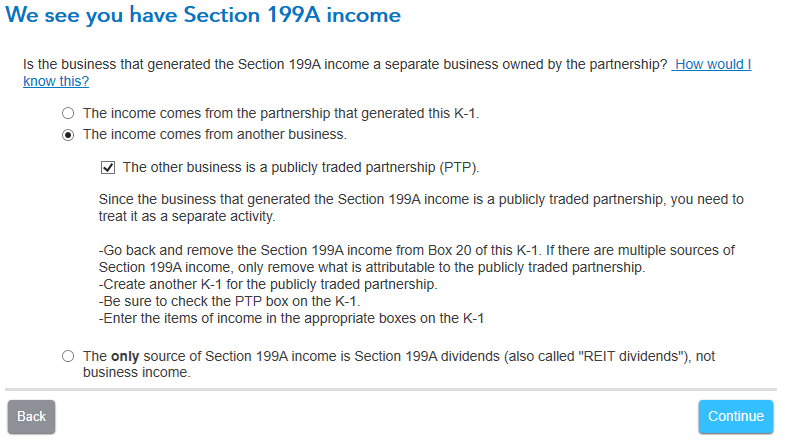

Also, see the first screenshot below from TT that appears when entering each K-1. For the K-1 for the parent company (i.e., Energy Transfer LP), I assume we select "The income comes from the partnership that generated this K-1" bullet. However, what about for the sub-PTP/lower tier partnerships? I thought we may need to select the "The income comes from another business" bullet, but if you do, then TT suggests going back and removing the 199A income from Box 20 and filing separate K-1's (as shown in the second screenshot below), which doesn't seem right, since that's already what I am doing. Can anybody clarify?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

Hi, @nexchap since now we split the data into three k-1 for ET, USAC and SUN, how do you enter the info on sales schedule? Any help is appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

@sparky8 Assuming you're following the advice to only report the Ord Gain in the K-1 interview (https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/how-i-report-the-sale...:( If its a complete sale, it won't matter. All the suspended losses from the sub-entities are going to be released regardless, so the simplest thing to do is to put all the Ord Gain on the ET entry. If its a partial sale, the technically perfect way to do it would be to split the Ord Gain between the sub-entities that created it (since then TT can release the matching suspended losses from the correct sub-entity). If that data isn't reported (and isn't available from taxpackagesupport), then you could either get the help of a CPA, or make a judgement call on how to split it (e.g., proportionally) or whether to bother (if the dollars involved are really small).

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

@nexchap it was a partial sale. To split the ordinary gain, I studies the k-1 package, the box 20 code AB ( section 751 gain(loss)), that listed numbers for each sub-ptp. When I added up the number there, it happens to be the same ordinary gain number on my sales schedule. So, I think maybe I can use that? This is for Energy Transfer stock I own and sold partially. Does this sound right to you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

@sparky8 Yes. The "Ordinary Gain" that gets discussed is a form of Section 751 Gain. So if those numbers add up, you've got the split.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

@nexchap , thanks for the helpful post.

I noticed on the IRS guidance for Schedule k-1 (1065) it said this on the first page: "The partnership uses Schedule K-1 to report your share of the partnership's income, deductions, credits, etc. Keep it for your records. Do not file it with your tax return unless you are specifically required to do so."

Is there a time you don't have to file your K-1 on an individual tax return? Also, when is a separate 8865 required to be filed for a foreign partnership?

Thanks.

-Luke

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should tiered Publicly Traded Partnership K-1 data be entered into TurboTax? Should similar entries be summed or entered under separate K-1s with same partnership ID

@Luke215 That guidance on the K-1 dates back to olden times when people filled out forms by hand and mailed them all in. Its advising not to dump the K-1 into that pile. BUT that doesn't mean you don't enter all the info into TT. That you definitely do, so all the data gets processed appropriately. But you'll notice, if you have TT print out your return for filing, there won't be anything labeled K-1 in the printout.

As to 8865, I'm not sure about that. Best to post it as a separate question.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Martin Yue

New Member

JamesT81

Level 2

J3SS1CA

New Member

WhatsUpChknButt

Level 1

HardtoKeepUp

Level 2