- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

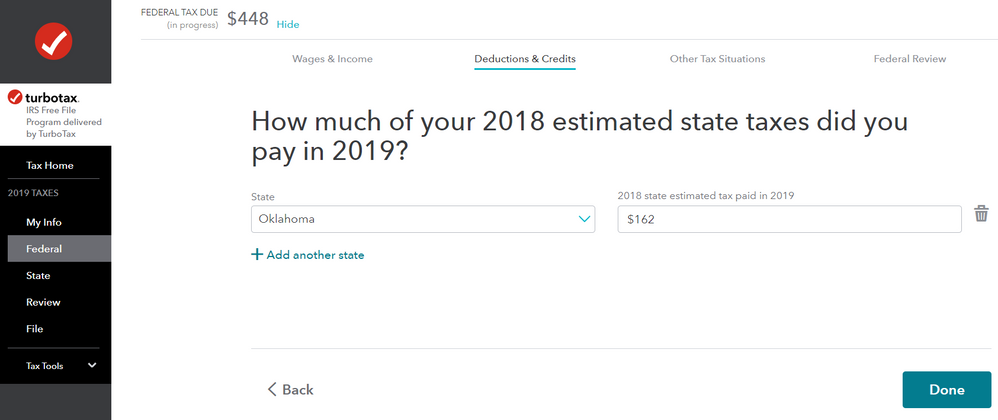

I have the same question. I paid four quarterly estimated tax payments to OK for 2018. The last one was $162 and was paid in Jan of 2019. So do I include that payment in this field? I entered all four on my 2018 taxes. Take a look at the following screenshot for this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

Yes the amount in that box is the amount you paid in 2019.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

Where do I find this information? Do Ilook on my w2 form from last year or this year? I don't know where to find it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

Typically, you would have this if you were required to make estimated tax payments quarterly. There is a payment that is due on January 15th of each year.

Please see the attached for more specific information as it applies to your particular state. Depending upon your state, you may be able to view your payments in your account. This may assist you in determine if you made any payments in 2019 for your 2018 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

Does this include the amount paid when filing for an extension?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

NO ... estimated tax payments and payments made with an extension are NOT the same thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

Let me be more specific ... everything has its own place in the program ... do NOT be in a hurry to enter something in the wrong place as it will mess things up on both the fed & state returns ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

Thanks for the detailed reply, @Critter-3 , and I learned the answer a minute later when I got to the next page.

Everything I've read previously says overpayment applied to the next year counts towards your quarterly balances, hence the confusion in the moment. TurboTax is riddled with things like this - situations where a simple one line phrase would eliminate the most basic confusion on the issue. ("Don't count overpayments from last year here.") I mean dozens of things could *very* easily come with a bit more guidance and improve the product greatly. TT is geared for home users, not professionals, so it's disappointing that after all these years it isn't better at the most simple guidance. I often find myself finding clarity on an issue as I'm going and have to backtrack and change things. I wish more thought was put into the customer prompts and guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i put for How much of your 2018 estimated state taxes did you pay in 2019?

Because of users feedback over the years that the program screens were too complicated and densely packed they have reduced the information on the pages (too much in my opinion) to bare bones ... the majority of the questions on this forum (and the ones I used to answer on the phone as a TT tax expert) resolve themselves if the user would simply clicked the continue button and/or read the blue "Learn More" links. The thousands of income tax return forms and their instructions are boiled down to an easy to follow (but sometimes frustrating) interview based "path" that must be followed step by step.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

freeyung2020

New Member

needtaxhelp808

New Member

acumbo1980

New Member

mikedeweese69

New Member

josephetc

New Member