- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why does my unemployment need review?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my unemployment need review?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my unemployment need review?

If the form you have looks different than the screen then you may be in the incorrect place since a 1099-G reports more than just unemployment.

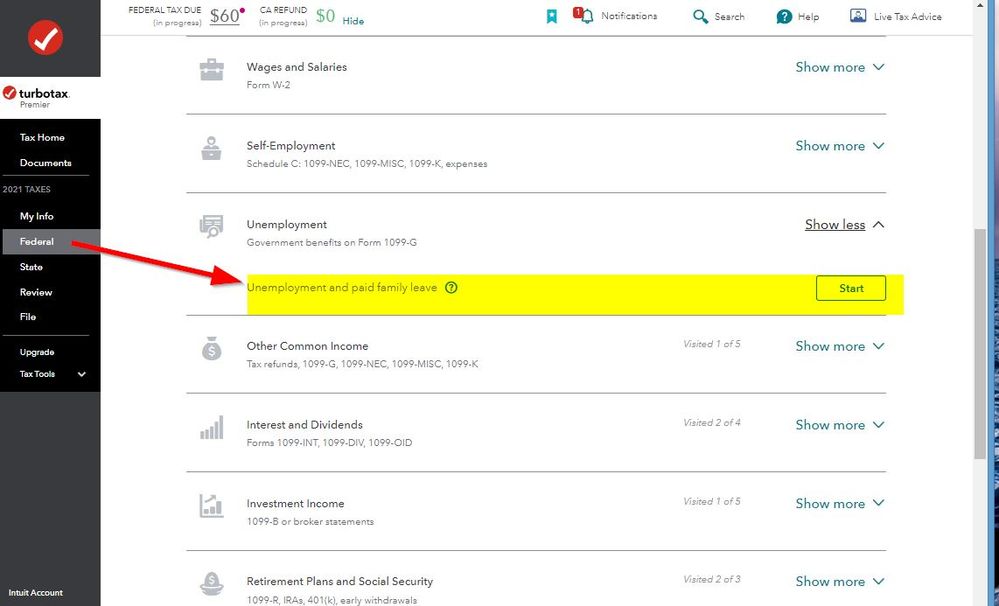

To enter unemployment income--go to Federal>Wages and Income>Unemployment.

The 1099-G is issued if you received certain payments from federal, state, or local governments. Form 1099-G covers two types of government payments:

- Unemployment compensation or paid family leave, or

- Other Types of 1099-G income, including

- State and local tax refunds

- Business or farm tax refunds

- Market gain on Commodity Credit Corporation loans

- Taxable grants

- Alternative Trade Adjustment Assistance (ATAA/RTAA) payments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does my unemployment need review?

What box is the amount in? Unemployment is in box 1. You may be trying to enter it in the State Refund section or somewhere else. Delete this one and enter it in the right place.

Enter a 1099G for unemployment under

Federal on left

Wages & Income at top

Unemployment - Click the Start or Update Button

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

chanceajmom

New Member

imthetaxman1

Returning Member

gredeich

New Member

abbytax123-

New Member

jmzchz5560

Returning Member