- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where do I report income less than $600 if I don't have a 1099?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report income less than $600 if I don't have a 1099?

Aside from my day job that has a regular W-2, I'm also an independent author, so I receive a small amount of income from various book distributors each year. In 2019, I made over $600 in royalties through Amazon, so I downloaded my 1099-MISC and entered it into my tax return with no problem (I use TurboTax Self-Employed and I treat my writing as a small business). However, I also sell through other retailers like Barnes & Noble and Apple Books, and I didn't make anywhere near $600 from any of those other platforms. If I understand correctly, I still need to report the income I received from these retailers, but because I made less than $600, they may not actually send me a 1099-MISC. I kept track of all my royalty payments throughout the year so it'll be easy enough to figure out the amounts, but where do I enter this information on my return if it's not available on any sort of form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report income less than $600 if I don't have a 1099?

@taythomp04 wrote:

....where do I enter this information on my return if it's not available on any sort of form?

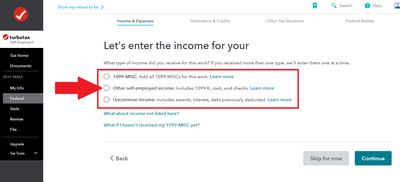

You can use one of the other categories in TurboTax Self-Employed (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report income less than $600 if I don't have a 1099?

Let me lead you through the steps of entering that extra money.

1. Log into your return

2. select Pick Up Where I Left Off

3. In the top right corner, locate the Magnifying glass/search

4. enter the exact words sch c

5. Enter

6. Select the first entry Jump to sch c

7. Misc Income click on REVIEW

8. click on Add income for this work

9. Select the middle option for cash and checks.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

wvla

New Member

championjerry

New Member

SoCalRetiree

New Member

tdasha10

Level 1

ayubruin7777

Level 1