- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Undo IRS Covid Non-filer to file 2019 Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

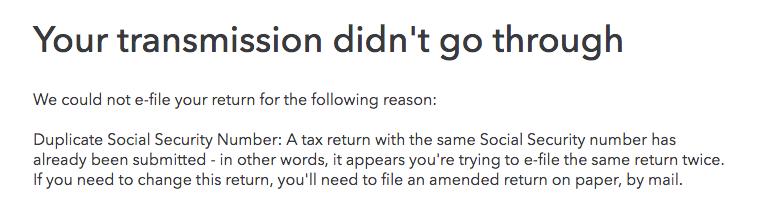

How do I undo a non-filer return to file my 2019 return? The IRS website prompted me to input my bank account information using the "non filers" section for stimulus return. (I thought it would simply help update my banking information.) Now I'm stuck with the dilemma of a "duplicate SSN's filed" as I attempted to transmit my 2019 taxes using Turbo via e-file. Is there a way where I can get the non-filer rejected or undone so I can just e-file my 2019 taxes. The Turbo tax system won't let me amend my 2019 file because there is nothing to amend clearly. (First time doing my taxes this year.) I'm out of sources since the IRS hotline is not around and in need of desperate help. Please and Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

Sorry, if you have officially told the IRS that you were not filing a tax return, and then you try to file a tax return, they view that as suspicious and reject it. You will have to print your return and file by mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

if you are a taxpayer and file a tax return, it says right on the IRS page, for non-filers only

"Do NOT use this tool if you will be filing a 2019 return"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

Is there any directions or how to? How long does this process take? Do I just send the 1040 form as is or do I just use another form (the amend-x)? Where do I send the form also?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

@fanfareIt's funny when I checked out the site today it's there all highlighted in bright yellow.. but trust me sir when the site first opened and I checked it out. The information was not as "BOLD" as it is now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

Start the file interview again and check the box for file by mail instead of e-filing. TurboTax will tell you to print your tax return, and I will also print a cover page with instructions. Follow the instructions on the cover page. You may need to attach your W-2 or certain other documents by stapling them to your tax return. Sign page 2 of the tax return in the box for your signature. Mail it to the IRS at the address on the instruction page. You may want to go to the post office and use tracking or certified mail so that you have proof of delivery. Don’t forget that you will also need to sign and mail your state tax return, because you can only e-file a state tax return if you e-file your federal return at the same time.

Normally, it takes 4 to 5 weeks to process emailed a return instead of 2 to 3 weeks for an e-file return. However, at this time, the IRS is not processing paper tax returns due to the coronavirus emergency so there will be a backlog and you should expect it will take significantly longer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

I feel like there are others and are possibly going to be much more who made the same mistake. You think the IRS would change the issue electronically? Or should I just get started in administrating physical copies.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

is there any way you can send me the cover page of instructions for this? i was mistaken in filling out the info for the stimulus check and filed under non-filers... now my tax returns wont go through. There is no way to contact the IRS electronically to have them cancel that filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

There is no way to file your return electronically after filing the non-filer submission, because that submission created a tax return entry for you, with all 0s on it and cannot be canceled. For security purposes, only one electronic submission per tax year per taxpayer is allowed.

You will need to print your return, and file by mail.

You should attach an explanation to your return indicating that this is a correction of a 0 return previously filed, or attach a blank copy of Form 1040X (signed) to the front of the return or make some other indication to let the IRS know that the return is intended to replace the original filing so that it is not rejected.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

I did the same thing. I been looking for a answer all over and now I see I'm not the only one and out sucks because mailing we'll be back logged. I will have to pay150 fee before even printing. Which puts me in another dilemma.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

Hello my name is David and I recently filed for a non filers economic impact payment which I did receive 12,000 but now Iam trying to submit my 2019 tax return and it keeps saying duplicate social security number has already been submitted my birthday is <DOB removed> and my social security number is [social security number removed] please check this information out because I need my federal refund sent to me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

Here's the TT FAQ on this issue:

For those concerned with the TT fee; it's the same whether you e-file or print.

TurboTax also has another free product called the Free File Edition (not to be confused with the regular Free Edition). It has free Federal preparation and free State preparation. There is no efiling fee. It is not available after October 15

The Free file Edition can handle a 1099-MISC.

The Free file Edition is more fully-featured than the regular Free Edition. The Free File Edition can prepare Schedule A, C, D, E, and F that the Free Edition cannot.

For Free File Edition a user needs to meet only ONE of these qualifications:

- AGI of $36,000 or less

- or active duty military (including Reservists and National Guard) with a military-issued W-2 and a 2019 AGI of $69,000 or less

- or eligible for the Earned Income Credit (EIC aka EITC).

The FREE FILE Edition is located at:

https://turbotax.intuit.com/taxfreedom

How to switch and start over in Free file Edition

https://ttlc.intuit.com/questions/2026912-how-do-i-switch-to-turbotax-freedom-edition

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

What do I need to do to undo Non-filer tax return so that I can file my 2019 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

@pcrossen1957 wrote:

What do I need to do to undo Non-filer tax return so that I can file my 2019 taxes?

You can't undo a non-filer form. It was just as official as filing a tax return. You will be blocked from e-filing your actual tax return so you will have to print it, sign it, and mail it to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Undo IRS Covid Non-filer to file 2019 Taxes

@pcrossen1957 wrote:

What do I need to do to undo Non-filer tax return so that I can file my 2019 taxes?

You cannot.

See this TurboTax support FAQ on how to proceed in filing the 2019 tax return - https://ttlc.intuit.com/community/tax-topics/help/stimulus-how-to-file-your-return-after-getting-rej...

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rpruiz23

Returning Member

Mom2twingles

Returning Member

55442

Returning Member

the-havens

New Member

tuyentran512

New Member