- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Underpayment penalty for large uneven capital gains

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty for large uneven capital gains

I had a few months in 2020 where I sold a large amount of stock for long term capital gains. Couple of questions:

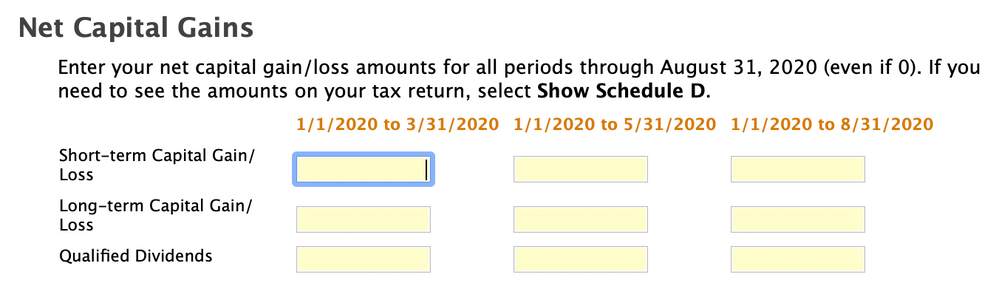

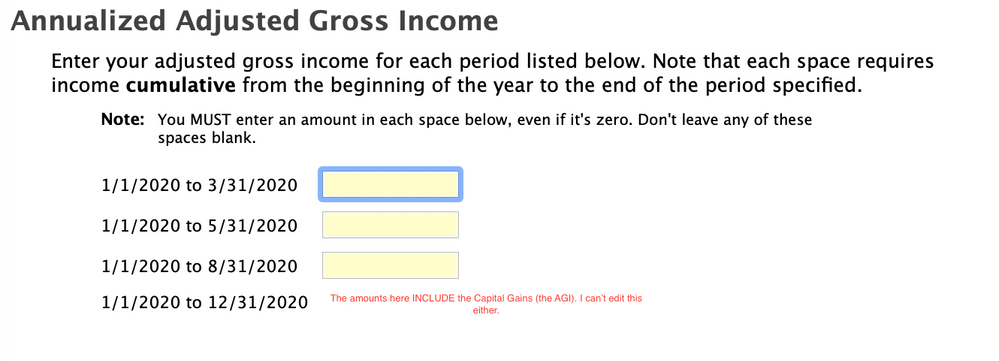

- Tried to Annualized Income Method but it's a bit confusing. My capital gains are included in the AGI. In TT, there are two interview questions a) Asks my total AGI (which includes the capital gains) over the last year b) Then it asks again what my capital gains were over the year. Is it double counting - since the gains were already in the AGI?

- Penalty seems to be almost around $400. Should I pay this amount and let IRS calculate the penalty for me so there are no mistakes?

Thanks!

See photos

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty for large uneven capital gains

The IRS will not use the annualized income method. Net long-term capital gains and qualified dividends are needed because there's a special tax computation when you have those.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty for large uneven capital gains

That's good to know that IRS doesn't use annualized, sounds like I should.

I get capital gains are taxed differently but why are the Gains included in the AGI. The AGI includes these capital gains, so will it tax my AGI income (which includes the long term capital gains) as a higher rate!?

But why is this so complicated for IRS to figure out automatically or even have TurboTax figure this out... suggest what is the best option for me instead of me having to fill these numbers our manually. They have my 1099s/Schedule D and the dates of when I sold them!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty for large uneven capital gains

When you enter your transactions into TurboTax, TurboTax will calculate the taxes on capital gains. It will then add the capital gains to your AGI. You do not need to do that manually.

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Adjustments to Income include such items as Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account. Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

riogrande

New Member

tgirl0527

New Member

cindytim00

New Member

amallorythomas-g

New Member

lauraj2

New Member