- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: The standard deduction was chosen on my 2019 taxes when I filed married filing separated and affected my economic stimulus payment using turbo tax, how are you fixing it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The standard deduction was chosen on my 2019 taxes when I filed married filing separated and affected my economic stimulus payment using turbo tax, how are you fixing it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The standard deduction was chosen on my 2019 taxes when I filed married filing separated and affected my economic stimulus payment using turbo tax, how are you fixing it?

Turbo Tax is investigating this issue, sign up here

Can you check your 2018 returns and see if that was checked back then too? We are seeing reports it was. So that may have started in 2017 or 2018 and transferred to 2019. Probably never would have been a problem and caught except now because of the Stimulus Check.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The standard deduction was chosen on my 2019 taxes when I filed married filing separated and affected my economic stimulus payment using turbo tax, how are you fixing it?

There's nothing "broke" with TurboTax concerning stimulus payments; therefore one can't fix what isn't broke.

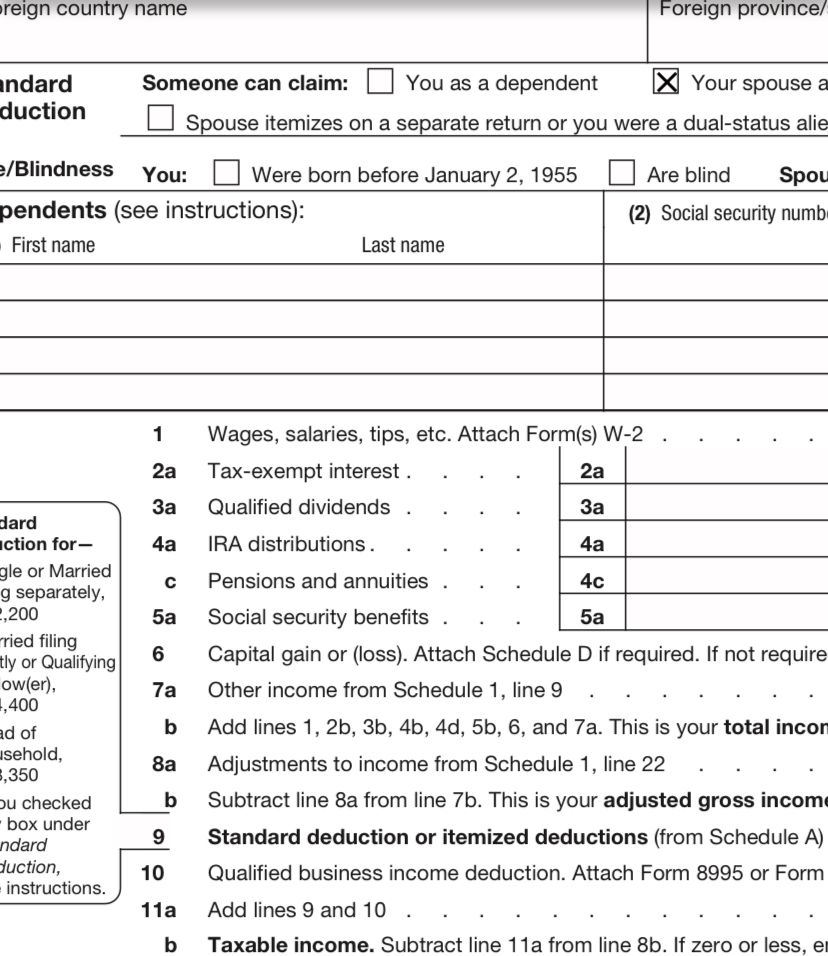

I am showing as a dependant for my spouse

Not possible. A married person can *NOT* be claimed as a dependent on any tax return, except under special circumstances which *DO* *NOT* *APPLY* to your situation. A married couple filing separate can not, under any circumstances, claim their spouse as a dependent. There are no exceptions.

affected my economic stimulus payment

Without the "EXACT" details of just "how" it was affected, it's impossible to provide you with any meaningful or useful feedback on this. But see https://www.irs.gov/newsroom/economic-impact-payment-information-center-calculating-my-economic-impa... as it might answer the question of why the amount of your payment is not what you expected.

Finally, understand that when a married couple files separate, both you you *automatically* disqualify yourselves for quite a number of deductions and credits that you would receive if you filed joint.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The standard deduction was chosen on my 2019 taxes when I filed married filing separated and affected my economic stimulus payment using turbo tax, how are you fixing it?

Turbo Tax is investigating this issue, sign up here

Can you check your 2018 returns and see if that was checked back then too? We are seeing reports it was. So that may have started in 2017 or 2018 and transferred to 2019. Probably never would have been a problem and caught except now because of the Stimulus Check.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The standard deduction was chosen on my 2019 taxes when I filed married filing separated and affected my economic stimulus payment using turbo tax, how are you fixing it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The standard deduction was chosen on my 2019 taxes when I filed married filing separated and affected my economic stimulus payment using turbo tax, how are you fixing it?

Thank you @VolvoGirl

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dad2greta

New Member

ddubs82

Level 2

sirajhasan

New Member

abachmuth

New Member

smokeydokey

New Member