- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Sold employee stock but not given 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold employee stock but not given 1099-B

Hello,

I sold stock in a privately held corporation. However, the company does not provide a 1099-B or any other tax docs related to the stock. Stock was purchased with after tax dollars over the past several years.

How / Where can I enter the sell transactions? I'm using Turbo Tax online -- not sure which edition.

Thx!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold employee stock but not given 1099-B

First you need the premier to enter stock sales ... and they are entered in the same way as if you did receive a 1099-B ... follow the interview screens.

Here are several ways to get to the interview for your 1099-B:

- Open your return (if not already open).

- In the top right corner, click the Search tab.

- Enter 1099-B without quotes.

- Choose Jump to 1099-B.

- Next screen: "Did you sell any investments in 2015?" Yes (if so)

- Next screen: "Did you get a 1099-B or brokerage statement?" Yes (if so).

- Next screen: Choose your financial institution for importing (if you wish to import the document.) Or you can choose to enter the info yourself.

- If you want to import, and your institution is not pictured on the page, when you start entering the name of the institution where it says "Find your bank or brokerage," you will see a dropdown menu listing a bunch more.

NOTE: If you decide to import the 1099-B, be sure to examine the data to be sure it imported correctly, and be sure that any follow up questions in the interview are answered. If it also imports 1099-INT or 1099-DIV data at the same time, you also need to go through those interviews as well to edit the data and answer any follow up questions in those categories, too.

Alternate method:

- Open your return (if not already open).

- Once the return is open, click on MY ACCOUNT at the top, then TOOLS.

- In the Tools window, choose TOPIC SEARCH.

- Enter 1099-B without quotes.

- Make selection and click GO.

A third method:

- Federal Taxes tab.

- Sub tab Wages & Income.

- All Income.

- Scroll down to Investment Income.

- At subtopic Stocks, Bonds, Mutual Funds click START (or revisit).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold employee stock but not given 1099-B

Thanks for the reply -- none of those options work for this online version.

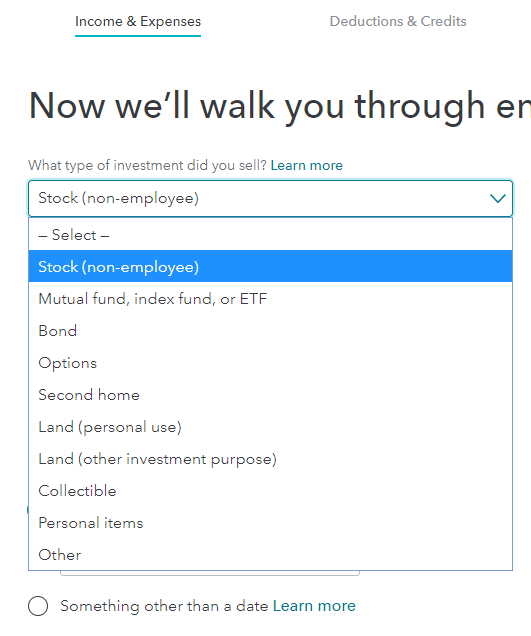

I can find the spot to manually enter a stock sale ... but my only option from the drop down choice is:

Stock (non-employee)

Please see attachment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold employee stock but not given 1099-B

JUST USE THE STOCK OPTION ... FIRST CHOICE.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ataguchi

New Member

carolynpaine

New Member

erikaeriga

New Member

69billabong69

New Member

Irasaco

Level 2