- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Selling real property - errors when I first purchased it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

I’ll use fictitious numbers here, so don’t be misled please.

In 2011 I purchased a townhouse for $500. When I created that property in TurboTax, I specified $10 as the land value. I got that figure from the property tax bill.

What I did not notice at that time was that the $10 was then added to the purchase price, thus establishing the improved value as $510.

I sold that property in 2018 for $1,000. I discovered the above error while preparing my tax return. As I was close to the April 15 filing deadline when I made that discovery, I filed an extension.

I’m wondering what might be the appropriate action at this time.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

@gregdinger1525 wrote:What I did not notice at that time was that the $10 was then added to the purchase price, thus establishing the improved value as $510.

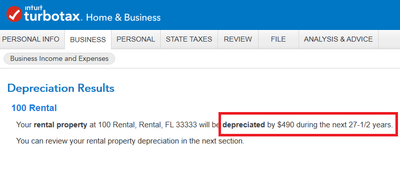

What is odd about your scenario is that the $10 should have been subtracted from the improvement value rather than added to it (so, just making sure your depreciation was actually calculated on $510, rather than $490). When I input your numbers into my test return, the result appears in the screenshot at the bottom of this post.

In any event, since you sold the property, you will reduce your basis by the amount of depreciation allowed. Per Publication 946: If you deduct more depreciation than you should, you must reduce your basis by any amount deducted from which you received a tax benefit (the depreciation allowed).

See https://www.irs.gov/publications/p946#en_US_2018_publink1000107377

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

You're talking about a $10 difference that will not make *one* *single* *penny* of difference in your tax liability on your tax return. Leave well enough alone and report it with a cost basis of $510.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

@Carl wrote:

You're talking about a $10 difference that will not make *one* *single* *penny* of difference in your tax liability on your tax return. Leave well enough alone and report it with a cost basis of $510.

But we don't know the actual value; the OP stated the numbers were hypothetical (fictitious). So, the $10 could, in reality, be $10,000, $100,000, or whatever.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

I realize that. the figures provided just aren't realistic though. Don't know why the real numbers are such a big secret anyway. Most commonly though, folks misread the screen that asks for that cost and cost of land data. They don't read the small print.

COST - What was paid for the property in it's entirety.

COST OF LAND - How much of the amount entered in the COST box, was for the land.

The program then subtracts COST OF LAND from the COST and the result is of course, the value of the structure. It's that value that gets depreciated over 27.5 years. When people don't read the small print, that's when they enter incorrect values resulting in the incorrect amount being depreciated. They also end up having the incorrect amount of taxable gain at the time of sale too. My impression is that the numbers were entered correctly and the OP mistakenly thinks that COST OF LAND is added to COST.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

purchase was around 50k, the land was around 10k, sell was 110k.

I'm sitting here trying to absorb the initial response from Tagteam, and how to apply a fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

I've got my 2011 TT open and am working through the screens, trying to make sure I understand clearly what went wrong. I have to run out a bit, and just want to thank both of you for looking at this with me. More later or tomorrow. Again, thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

Ok @tagteam @Carl, I have further reviewed this property’s setup in TT, and can now make a clarification. I misread screens and numbers, and made poor assumptions as to what happened. That was back in April when I was ill, freaked out over this mess and ended up filing an extension. Your remarks led me to dig into this more closely and better understand what I’m dealing with. Here are the entries from when I established the property in 2011.

1 - Original purchase price (including land) is correct @ $54,900.

2 - Next screen is escrow fees - I listed the title and other closing costs $456

3 - Seller-paid points – none

4 - Improvements - $22,248

5 - Other payments – none

6 - Other adjustments- none

7 - Enter Property Tax Values.

This is where I got confused. Land value is 10,075, and Improvement value is 62,970. Both are from the tax bill.

Back in April, when I was meeting with my CPA to review my 2018 T/R, he asked me to “bring the land into the original basis of this property so that there is only one line”. As I attempted to follow through on that request, I looked at the purchase price, and the land cost + improved value from the tax statement, and made a poor assumption as to what had occurred. But obviously the math does not work, and my failure to read that screen carefully set me up to an incorrect assumption. So my description of the problem in the OP is out the window. Disregard that assertion please.

But there is still this problem, and I’m not sure what to do. As I stated above, the CPA asked me to “bring the land into the original basis of property-x and adjust it so that there is only one line”. I think his point was that he wanted the land and improvements to represent a single line on the 4797.

When I look at the 4797, line 2 contains the following:

2a: “residential land”

2b/c: the buy/sell dates

2f: 10,704

2g: -10,704

Line 6: 55,492

Line 7: 44,788

I don’t understand what’s going on here. Obviously, 55,492 less 44,788 = 10,704. But where does the 10,704 come from? It is neither the land cost ($10,075) nor is it the result of any math I have been able to recognize.

And why does column 2a” show “residential land”. Why doesn’t it list the actual name of the property (the physical property street address) that I assigned to it in 2011? Column 2d is empty. Why is that not the $110k sale price?

I don’t understand how this form is being assembled by the program. I'm just struggling with this.

When I drill into the "property assets" of this rental property, I have this:

- On the first page, it lists depreciation at 1,115.

- Clicking EDIT from that screen, I have these details:

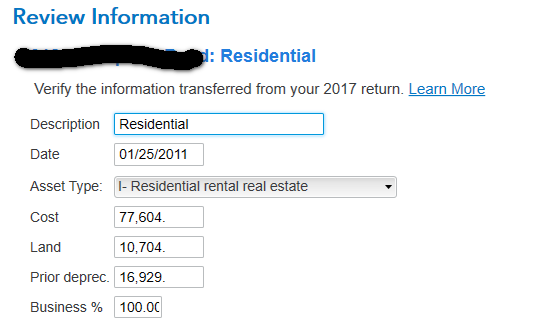

- Description - Residential

- Date - 1/25/2011

- Asset Type – Residential rental real estate

- Cost – 77,604 (this precisely matches purchase price + closing costs + remodeling)

- Land – 10,704 (I don’t understand this number since 10,075 is the land cost from the initial purchase setup screen, and to the best of my knowledge, I did not input this number. It was supplied by the program)

- Prior Depreciation - 16,929 (precisely matches prior returns – I just confirmed)

- Business % - 100

Did you stop using this asset in 2018 – YES

Disposition – I entered the sale and acquisition dates

Special handling – NO

Home Sale – Was this asset included in the sale of your main home? - NO

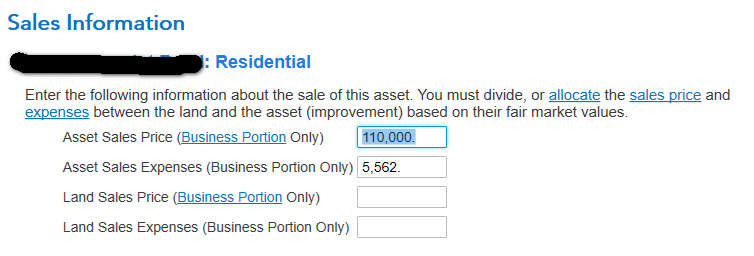

Sales Information

- asset sales price – 110,000

- asset sales expenses – 5,562

- land sales price – 0

- land sales expenses – 0

Personal residence – did you use this rental property as a personal residence - NO

Installment Sales – Do you want to report this sale using the installment method - NO

The next screen (page title = "results") tells me:

You have a gain of $55,492 on your disposition of Residential.

Your depreciation deduction for Residential for 2018 is $1,115.

We'll transfer these amounts to the correct forms for you, and goes on to discuss "unrecaptured section 1231 losses".

The next screen (page title = "Loss on this Asset's Land") tells me:

Based on our calculations, you have a loss of $10,704 on your disposition of the land for Residential.

We'll automatically transfer this loss to the correct IRS forms for you.

At this point, it goes back to the main "property assets" screen.

So again, the principal questions I have are as follows:

- why the 10,704 on the Property Asset screen and on column 2f/g of the 4797?

- why is the 4797 listing this as "residential land" when what I have this configured at is a townhouse, and named by the street address?

- why is the 110,000 sale price not appearing on column 2d of the 4797?

None of this makes sense to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

@gregdinger1525 wrote:...the CPA asked me to “bring the land into the original basis of property-x and adjust it so that there is only one line”. I think his point was that he wanted the land and improvements to represent a single line on the 4797.

If that is the case then there would be nothing (no entry whatsoever) in Part I of Form 4797.

Rather, the entire sale would be entered in Part III of Form 4797, where the property would appear as "Property A" (assuming you had just this one particular sale).

It appears as if the program carried the originally entered land basis (and sale) to Part I of Form 4797 based upon your input and you either failed to enter the sales price (and selling expenses) in the relevant section of the program *or* you failed to notice the part of the sale that was reported on page 2 of Form 4797.

Frankly, you might want to think about starting over just with respect to your cost basis and sales entry figures because something is seriously out of whack. Ensure that you SAVE the file with which you are currently working and create another file where you can input the all of the figures in the correct amounts and in the correct order.

Post again with your results or if you have further questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

ok, that was an interesting exercise. I'm a computer programmer, and I've been doing that work since the early 70's. What I found to have caused the problem is bizarre. Is it a bug, a design flaw, or is there good reason for it? I'm not sure.

With a lot going on at the moment, I failed to note while preparing earlier posts in this thread, that there were indeed figures in Part III, as well as Part I which was the problem. I did follow your suggestion to create a new return, focusing on the property which is the subject of this thread.

The issue that I found is that when the "Land Sales Price" in the 2nd screen capture below was 0, that caused the program to treat the land aspect of the property as having been sold at a loss. And back when I had (mistakenly?) first placed the land value into that column, then replaced it with zero, that triggered the land entry into Part I of the 4797. When I cleared the field entirely, eliminating that 0 and leaving simply a blank input field, Part I (of the 4797) goes blank and Part III is completed accurately. I am ever so happy to have this behind me.

I do have a question, however. In the 1st screen capture below, there is a "Description" title. I have "residential" in there. And that results in that word:

- Being concatenated to the end of the property name in a variety of screens

- Appearing exclusively in column 19A of Part III of the 4797.

What would one typically place in that field? I just tried emptying that field, and that resulted in 2 outcomes.

- As I advance through subsequent screens, where "residential" formerly appeared as "123 property address: residential", that title now appears as "123 property address: this asset".

- Also, and this is mind-boggling, the simple absence of that description has resulted in the program generating a Federal refund that was not present previously. It also throws an error, reporting that the description field is a required entry, so that would presumably not survive a well-reviewed completion of the tax return. Just odd that this was a side-effect.

In the screen captures below, the redacted section is the street address. When "residential" appears, what might typically be the description one would choose to place there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

I am not certain exactly which answers you are seeking but, for one thing, I would enter the same description on Form 4797 that appears (and has been used in past years) on Schedule E (which is the physical address of the property).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

@tagteam ok, will do. That was my remaining question in that response, at least at that point.

Unfortunately, as I ran the final review and "check for errors", the program is now bitching that the land sales price is empty. Emptying that field, as I mentioned, resolved the issue on the 4797. I don't understand why it requires a land value when the sale of the rental property did not designate a breakdown between land and structural improvements.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

@gregdinger1525 You might have to go back through the Rental section and just dispose of the land (i.e., since the land and improvements are wrapped into one, single transaction, dispose of the land in that section so it is gone completely).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

One thing to note here, and if you don't pay attention, you will have problems. I guarantee it.

When reporting the sale of multiple assets on rental property, if sold at a gain then you *MUST* show a gain for each assets - even if the gain on some of them is only $1. LIkewise, if you sell at a loss, then you *MUST* show a loss for each asset - again, even if that loss is only $1.

Failure to pay attention to this detail will screw up the 4797 every time.

When allocating your sales price across multiple assets, you will ***NOT*** allocate the land sales price, since land is not depreciated and there's no depreciation to recapture. You will only allocate the structure sales price across other depreciated assets. Keep in mind that gain or loss is based on the "ADJUSTED" cost basis of each asset. The adjusted basis of an asset is what you paid for it, minus the recaptured depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling real property - errors when I first purchased it

I have attempted both strategies you proposed.

Where we left off is that when I included the land component into the initial acquisition, I show the gain as $44,878. But because I did not list a value for "Land Sales Price", the program complains about the absence of that value on the Federal return.

Editing the property, and excluding the land cost component from the initial acquisition, I show the gain as $45,117 – but with the errors listed below needing to be addressed. These issues appear on the "California Asset Entry Worksheet".

- Line 17 - Enter the IRC section under which you amortize the cost of intangibles (asset type L)

- Line 23 - Land sales price is zero.

I then tried a third strategy based on Carl's comments. On the sales information screen, I changed these values:

Asset Sales Price - 99,295

Asset Sales Expenses- 5,562

Land Sales Price - 10,705 ($1 profit over original cost.)

The outcome is that I now see "townhouse land" listed in Part I, and the rest of the figures in Part III, which is what the CPA wanted to avoid.

After all of that, I presented all 3 results to my CPA and he told me to reach out to TurboTax support, and offered me best of luck - can't help any further.

Is there a way that I can get direct support (paid or otherwise) where someone looks over my shoulder and we get this over with? I'm running out of time, relative to Oct 15.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jb_atl

New Member

theresa-chiang

New Member

pottermelanie12

New Member

TaxPay3r

Level 2

laurence-beaver-

New Member