- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Selling Gifts from Employer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling Gifts from Employer

I often receive an end of the year gift from my employer (ex. iPhone) that is included in my W2 income (so taxed as income). If I sold this on eBay, do I need to pay additional income taxes on the sale? I received a 1099 K form from eBay.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling Gifts from Employer

@Fred92 wrote:

If I sold this on eBay, do I need to pay additional income taxes on the sale? I received a 1099 K form from eBay.

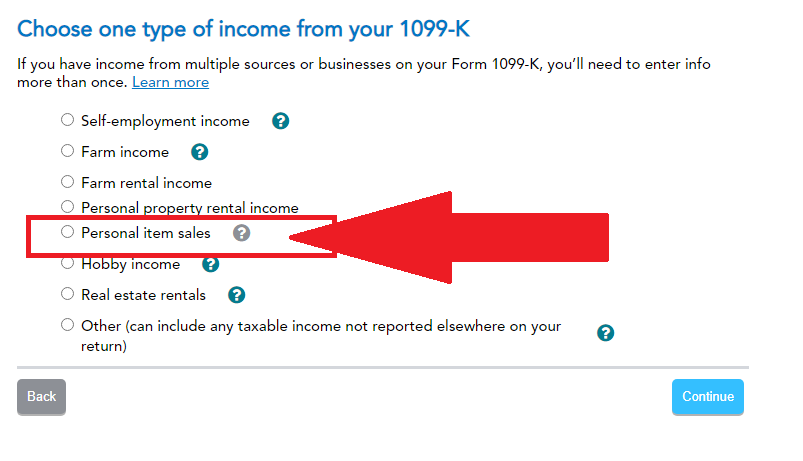

For the 2022 tax year, TurboTax (at least the higher versions) have a 1099-K entry screen where you will enter the sales price (on the 1099-K) and your cost basis. You will report the sale but will not have a gain (that could potentially by taxed) unless the sales price is higher than your basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling Gifts from Employer

@Fred92 - depends how much you sold it for... if you sold it for less than the value you 'paid' for it in your W-2, then that is a personal loss and not deductible in any event. your cost basis is what you "paid" for it in your w-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling Gifts from Employer

@Fred92 wrote:

If I sold this on eBay, do I need to pay additional income taxes on the sale? I received a 1099 K form from eBay.

For the 2022 tax year, TurboTax (at least the higher versions) have a 1099-K entry screen where you will enter the sales price (on the 1099-K) and your cost basis. You will report the sale but will not have a gain (that could potentially by taxed) unless the sales price is higher than your basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling Gifts from Employer

Excellant ... glad the program is addressing this 1099-K issue that many will find themselves caught up in this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Selling Gifts from Employer

@Critter-3 wrote:

Excellant ... glad the program is addressing this 1099-K issue that many will find themselves caught up in this year.

I agree, @Critter-3. However, I believe the developers should have provided an option to select a line that indicates the amount listed on the 1099-K is not taxable (i.e., a 100% offset).

For example, in the case of a gift (loan repayment or whatever), the taxpayer needs to enter an offset and there is no way to do that with the choices provided on the 1099-K screen. Hopefully, they will add such a line in a future update.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rmul32

New Member

Talk34384

Level 2

avigo45

Level 3

4-Speed

Returning Member

Shogun159

Level 2