- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Sale of Vacant lot

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

Yes.

- Click "Federal Taxes" tab

- Click "Wages & Income" tab

- Find the Investment section

- Click "Update" for the Stocks, bonds, etc...

Now you will see what sales are listed.

"Edit" the investment account(s) to find what doesn't belong and delete it. If there should be only one sale then delete the entire investment account.

Then follow the steps outlined in the thread to enter the land sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

@DMarkM1 wrote:Then follow the steps outlined in the thread to enter the land sale.

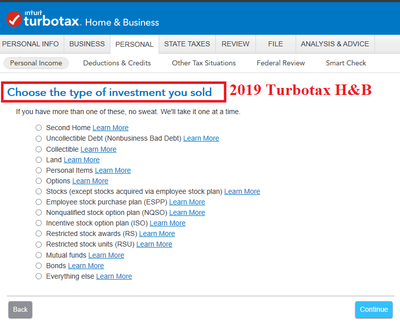

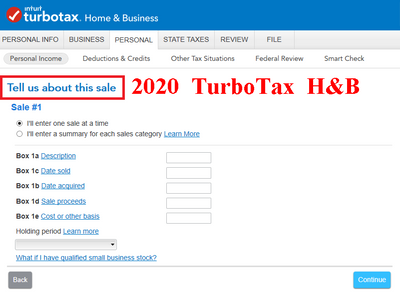

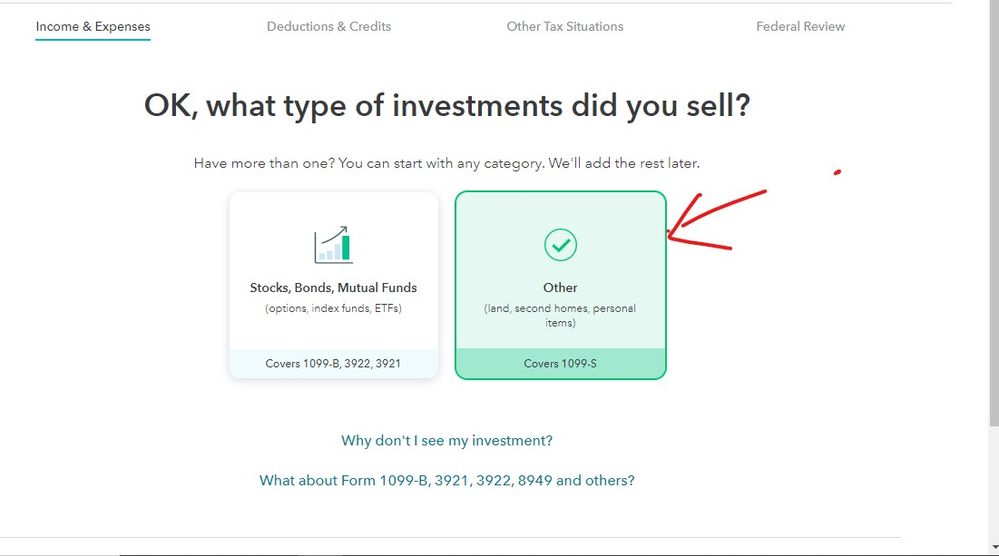

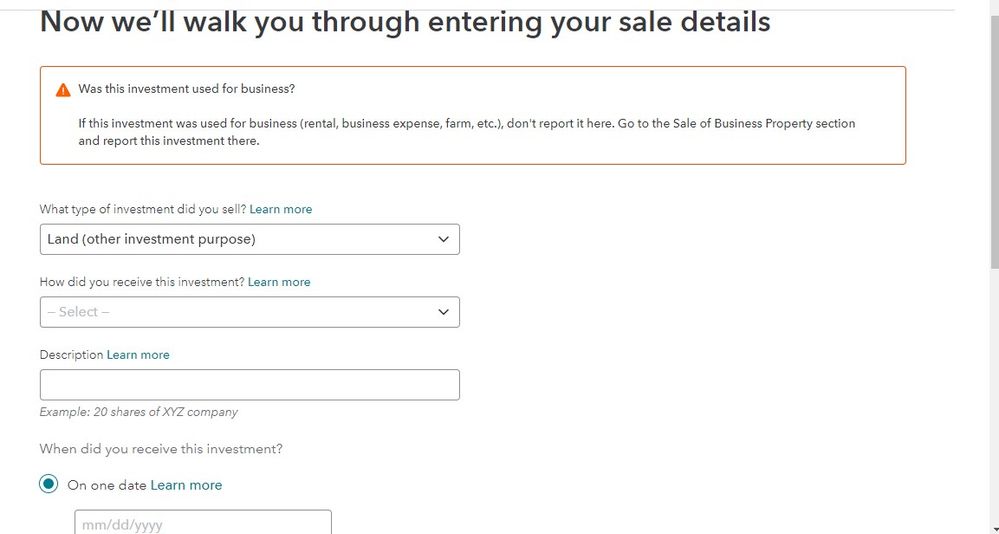

That cannot be done, respectfully. The reason being a screen has been removed from the 2020 edition of TurboTax (see screenshots below).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

I have reported this as well, they say new forms are coming out. I think this is a bug but its hard to get to the right people

I don't believe a tax consultant can get this fixed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

Since the IRS will not start processing anything until 2/12 there is time for the program fixes ... everyone needs to continue to be patient a while longer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

Enter the sales proceeds and your cost basis in the second screen in the message I posted earlier.

TurboTax (Intuit) has changed the calculation metrics for investment sales and you will only see the screen depicted in which to enter information from your 1099-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

all of the suggested solutions imply that there is a prompt asking what was sold. This may have existed in prior year versions of TT but is not there on TT Premier 2020. How are we supposed to enter sale of land if the only option for what was sold are related to sales reported on form 1099-B?

The tax laws did not change regarding sale of land for 2020 vs 2019 yet the turbotax program is lacking the required input options. When will this be updated and corrected?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

@Greenyob wrote:

....How are we supposed to enter sale of land if the only option for what was sold are related to sales reported on form 1099-B?

Simply indicate that the sale was not reported on Form 1099-B and proceed from that point.

The proper calculations are now done programmatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

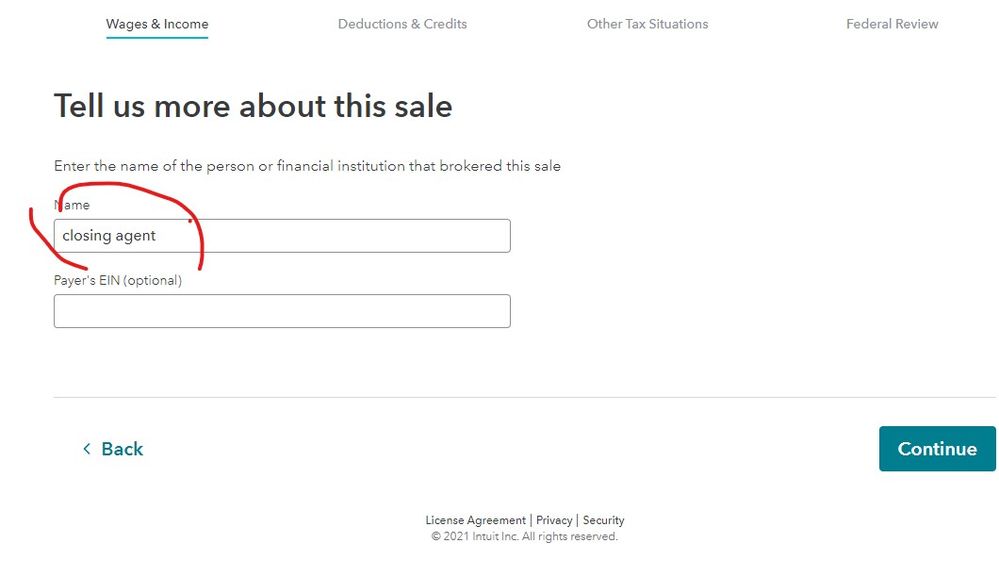

The sale of land is reported on sch D.

Go to income section

1. click on Add More Income

2. scroll down to Investment Income

3. Show more

4. Select Stocks, Mutual Funds, Bonds, Other

5. Start: Continue answering the questions.

- Select Yes,

- 1099-B? - Select no

- Select I'll enter one sale at a time

- the boxes appear for your entries for the lot

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

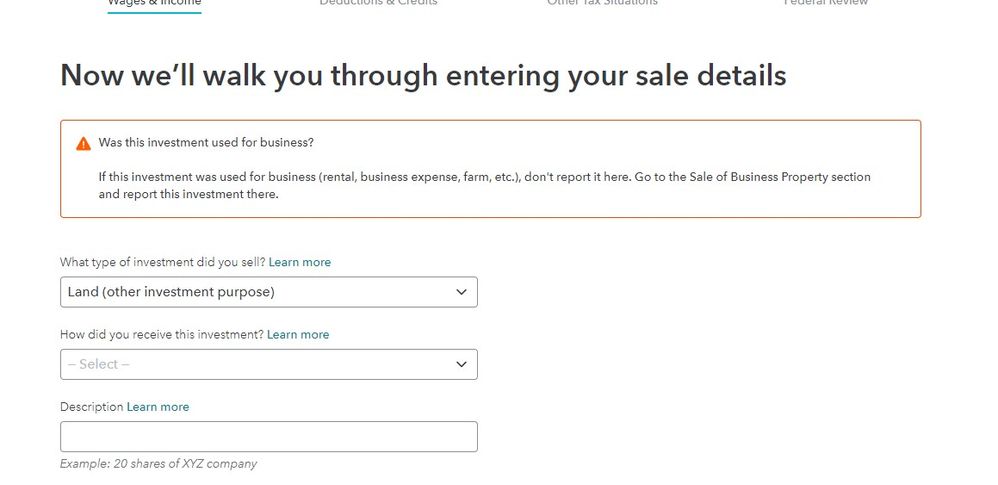

Respond "yes" to Did you sell any investments? You'll then be asked Did you get a 1099-B or brokerage statement? and you'll answer "no." Then you'll be shown a list of various investment sales and you'll select "land."

This doesn't happen in my software when I try to enter the sale of a piece of land. My software goes directly to enter a stock sale.

What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

@081853gb wrote:

Respond "yes" to Did you sell any investments? You'll then be asked Did you get a 1099-B or brokerage statement? and you'll answer "no." Then you'll be shown a list of various investment sales and you'll select "land."

This doesn't happen in my software when I try to enter the sale of a piece of land. My software goes directly to enter a stock sale.

What do I do?

The screens were changed for 2020. Simply enter the information you have in the program as in the directions posted by @AmyC:

4. Select Stocks, Mutual Funds, Bonds, Other

5. Start: Continue answering the questions.

- Select Yes,

- 1099-B? - Select no

- Select I'll enter one sale at a time

- the boxes appear for your entries for the lot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

They have really made this much simpler ... go to the investment section ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

@Critter-3 wrote:

They have really made this much simpler ... go to the investment section ...

Amazing! It appears they updated the online versions but have yet to update the desktop versions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

I am using Turbo Tax for MacOS and the screens do not follow the flow outlined below even after upgrading to the Premier edition which seemed to be a pre-requiste for entering the sale of land. After answering the question "Did you get a 109-B or a brokerage statement for these sales?" as No, the next screen is "Tell us about this sale". The list of investment sales where "land" can be selected does not appear. What is the correct series of steps for TurboTax 2020 Premier edition for MacOS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

They have made it too simple this year ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

Unfortunately, they only made it simple in the online versions.

The desktop versions are still lacking any guidance with respect to the type of investment sold.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

cparke3

Level 4

johnjames9

Level 2

acmeacme

New Member

glabold

New Member

mstruzak

Level 2