- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Report tax-free income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report tax-free income?

I am receiving a monthly social security payment from a foreign country. A tax treaty with this country makes social security equivalent income taxable only in the country where the payment comes from. Since there is no tax on this income and it amounts to less than $ 10,000.00 a year, do I still have to report it on the federal tax return? I live in Ohio and Ohio also adheres to the tax treaty and does not tax foreign social security equivalent incomes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report tax-free income?

For IRS reporting requirements, report the income in the social security section of your tax return, then make an adjustment on the line 8 of Schedule 1 as a negative number, Then it will transfer the total of Schedule to the 1040, line 8a. It will net to zero on your tax return.

To remove the income from your return;

Select Less Common Income,

Miscellaneous Income,

Other Reportable Income. Enter a description, then a negative number. See the below links.

Claiming Tax Treaty Benefits | Internal Revenue Service

If a tax treaty between the United States and your country provides an exemption from, or a reduced rate of, withholding for certain items of income, you should notify the payor of the income (the withholding agent) of your foreign status to claim the benefits of the treaty. In addition, you should complete Form 8833 Treaty-Based Return Disclosure, and attach it to your 1040.

You will need to print and mail your return and attach the completed Form 8833 to your return before mailing. You cannot e-file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report tax-free income?

Thank you very much KarenJ2! I think I understand almost all of your advice. I am just not clear on how to report the income in the social security section of my tax return, since I don't have a form 1099-R for this income. It's from a foreign country and does not come with any forms. Do I need to fill out a form 4852 or is there another way to report it?

Kind regards,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report tax-free income?

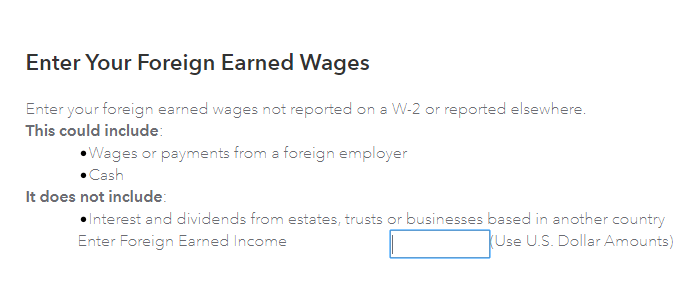

You do not need to file a Form 4852. To enter your foreign wages you would:

- Enter foreign wages in the Search Magnifying Glass in the upper right hand corner of your screen.

- Select Jump to foreign wages.

- Answer the questions on the screens.

You will come to a screen to enter your wages in U.S. Dollars.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Sanctuaryrh

New Member

kyondacooper

New Member

magellan0

Level 3

ashleyhudd229

New Member

grandpiano

New Member