- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Rental expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

Why are only interest, real estate and management fees listed in Expense Summary Details when I entered many more expenses?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

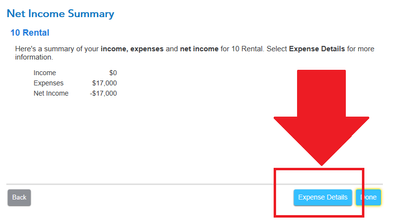

Which version of TurboTax are you using? Have you clicked the Expense Details button (see screenshot)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

Yes I have viewed the Expense details screen. I entered 13 different expenses but the only ones showing up in the detail (and on Schedule E in the forms) are mortgage interest, property tax and management fees. My rental expenses exceed my rental income so is there a limit and why these 3 versus others.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

@jimb108 wrote:

My rental expenses exceed my rental income so is there a limit and why these 3 versus others.

They are placed in an order of priority. Your suspended passive losses will carry over to the next tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

thanks. But I indicated my participation was ACTIVE because I own the house (and rent out one room) occasionally, i do interact with tenants and make all the management decisions. why would these be considered passive losses? what defines the order of priority, since management fees (host fees) was the smallest fee yet was included.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

Are you in fact operating something on the order of a bed & breakfast? If you are providing services of that nature to your guests then you should probably be reporting on Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

No, I rented out 1 bedroom for 95 days out of the year, no services provided. My expenses, especially when i include interest and taxes exceed my income of $3310 by $1400, projecting a nice return. But I want to make sure it is correct. Turbo tax asked how may days i rented but it did not ask how many rooms I have or the size of the room i rented compared to the size of the house. Shouldn't that be included?

PS: I also indicated this was not Qualified Business Income which I hope is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

Did you check the box (in Property Profile) indicating that you rent out part of your home? The guidance for that scenario appears below.

If you rent part of your property, you must divide certain expenses between the part of the property used for rental purposes and the part of the property used for personal purposes, as though you actually had two separate pieces of property.

You cannot deduct any part of the cost of the first phone line even if your tenant has unlimited use of it. If you install a second phone line strictly for your tenant's use, all of the cost of the second line is deductible as a rental expense. You do not have to divide the expenses that belong only to the rental part of your property. For example, if you paint a room that you rent, or if you pay premiums for liability insurance in connection with renting a room in your home, your entire cost is a rental expense.

You can use any reasonable method for dividing the expense. The most common methods for dividing an expense are based on the number of rooms in your home or based on the square footage of your home.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

I can see now that TT is adding interest and taxes from Schedule E to those already reported on Schedule A. I don't see where I can split the costs between rental space and personal space nor where I determine what % of the house was rented (1 room out of 5). Any help is appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

yes, I checked the box stating "I rent out part of my home" but I was not asked about the % of the house rented. sorry for all the questions. I've use TT premium for years but this time I'm stumped.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

You should see that screen after you enter the number of days rented.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

After much searching I found that by entering 95 days of rental use and 0 days of personal use TT will now prompt me for the % of space rented (10%). The rental expense summary details look more reasonable at 10% of of actuals and shows a net profit of $682. The problem is that TT is adding 90% of my mortgage interest and Real estate taxes on top of my original entries. Shouldn't it be adding only 10%? how do i correct this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

@jimb108 wrote:

Shouldn't it be adding only 10%? how do i correct this?

Yes, and I suspect the issue might be that you entered the figures prior to checking the appropriate boxes and entering the days of rental use.

You should go back through the Property Profile section and indicate that you want the program to do the math for you and then enter the full amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental expenses

I actually started a new return from scratch to ensure the proper order of things. I entered the rental income and expenses and the screen said it prorated the expenses between personal and rental. At that point I checked Schedule A to see that only my personal % of mortgage interest and RES Tax was applied before continuing (~90%), and it was.

When I get to the "Let's get the details from your Mortgage 1098" screen, I assumed I would enter the numbers directly from my 1098 and TT would allocate accordingly. But at the bottom of this screen it says "We already deducted the personal portion of your property taxes from your rental property in the amount of $xxxx, so don't enter that amount here." That implies I have to manually enter the balance of my interest and taxes on this screen and not enter the info from my 1098. Is that how its done?

If I enter the totals directly from my 1098 the numbers on Schedule A are inflated.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

anon30

Level 3

ambass1977

New Member

roypimjasmine2485

New Member

astrz

New Member

srfrgyrl

New Member