- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

I need help with filing amendment or whatever actions for the above.

Background:

- Recharacterized in Mar 2018 for a 2017 Roth IRA of $5,000 (contributed in 2017) into Traditional IRA. Recharacterized amount = $4,800 (rounded for ease)

- filed 2017 tax with the $5,000 contribution into Roth IRA in Jul 2018

- received 1099R with (uncorrected) with ~$4,800 for Gross Distribution and code R due to the loss in the account

Question:

- I understand that I need to amend 2017 tax. What forms I need to do besides 1040X? What specific areas of these forms I should do?

- Since I didn't meet the income eligibility for 2017 Traditional IRA to be deductible, do I need to remove any excess amount for this recharacterization? What steps and forms should I do with brokerage, IRS, Turbo?

- Do I need to include Traditional IRA and Roth IRA worksheets, which are to be revised, in the 2017 Tax Amendment?

Thanks so much.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

A 2018 1099-R with a code R in box 7 (Recharacterized IRA contribution made for 2017 and recharactorized in 2018) will tell you that you must amend 2017.

A code R 1099-R does nothing whatsoever if entered into the 1099-R section of an amended 2017 return. It does not get sent to the IRS and nothing goes on the tax return at all. The only purpose of the 1099-R is to report the recharacterization to the IRS, but it still must be reported on your 2017 tax return.

The box 1 on the 1099-R will report the total recharacterized amount (contribution plus earnings) but it does not separately report the earnings and box 2a must be zero.

The proper way to report the recharacterization and earnings which is to enter the 2017 IRA contribution in the IRA contribution interview section and then say yes to "Did you switch from a Roth to a Traditional IRA - recharacterize".

The amount The amount of the original Roth contribution must be entered - not any earnings or losses.

Then TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharactorized.

There is no tax or penalty on the before-tax earnings since the earning were simply switched into the recharactorized account.

That is the only way to prepare and attach the proper line 15a explanation statement for a code R 1099-R.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

Since the after-tax Roth contribution is now a Traditional IRA contribution it can be either a before-tax deduction if your MAGI allows a deduction which might result in an additional 2017 refund, or it will be an after-tax contribution reported on a 8606 form (line 1 & 14) as a "basis" in the Traditional IRA that will reduce the tax of future distributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

Thanks for your response. As Amendment has to be done in the Software itself (I'm not allowed to do online), are your steps referring to 2017 Amendment using the TurboTax software?

I received the 2018 1099R form so I have information (Box 1 = $4,800 because of loss, 2a = 0 and nothing else). But I don't know which tax forms to include. I don't want to miss any.

Since I changed 1099 R section, do I still need to edit the contribution? If I changed the number of contribution, isn't it wrong (like backdate)?

Should I still keep contribution for 2017 as $5,000. And only edited 1099R section? The software downloaded doesn't prompt question as the online version so it's not helpful.

Do I have to fix all these 1040X, 8606, 1099R and any other outside of the software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

When you amend your 2017 tax return and answer Yes to the question asking if you switched your Roth IRA contribution to be a traditional IRA contribution instead, indicate that you recharacterized all of the $5,000 Roth IRA contribution. In the explanation statement indicate that the $5,000 recharacterization was accomplished by a transfer to the traditional IRA of a loss-adjusted amount of $4,800.

If you were covered by a workplace retirement plan for 2017 and your modified AGI is above the threshold for your filing status, TurboTax will automatically prepare Form 8606 Part I that needs to be included with your amendment. It should not be necessary to include any worksheets with your amendment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

@dmertz Thank you so much for your response. Please help confirm regarding the Deductions.

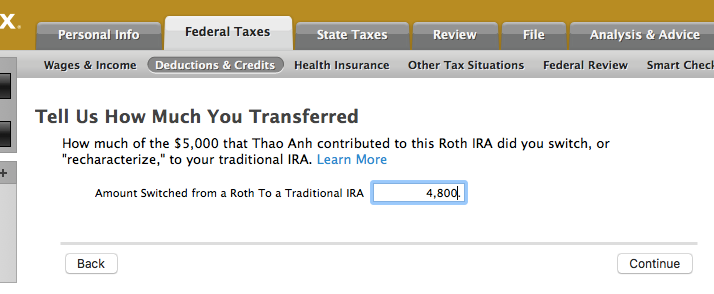

After I provided $5k as Roth IRA contribution. Next step TurboTax screen shows:

TurboTax asked me to provide "Amount Switched from a Roth to a Traditional IRA". I should put $5k or $4,800? So confusing between amount recharacterized vs transferred vs switched. Is switched = transferred = $4,800? Or $5,000 as you advised? Thank you!

(In the Wages and 1099-R section, I provided the information of recharacterization of $4,800 by the way).

@macuser_22 I'm new to TurboTax. I realized the software version also walks me through the steps. I must have chosen to do on my own before.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

Also - Do I need to mail this amended return to the State in additional to Federal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

You enter the $5,000 contribution as dmertz said. The original contribution amount must be accounted for. You state the loss in the explanation statement.

And PLEASE keep all of your questions in one thread. Multiple questions and threads get to be confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recharacterized 2017 Roth IRA into Traditional IRA but didn't meet AGI for Traditional. What to do?

@macuser_22 Thank you so much for your responses!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zzz8881

New Member

bhJogdt

Level 2

VAer

Level 4

bethfly

New Member

illini70

New Member