- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

Could be a corrupted 1099-INT form (somehow..especially if imported).

Go back into the 1099-INT section and see if any $ are showing the the table of 1099-INT forms you've already entered. IF there are $$ showing, and none on the "Your Income" menu page, then delete any 1099-INT forms in that table and re-enter new ones manually (don't import any)...use the "I'll type it in myself"

IF the table of 1099-INT forms shows all zero's to start with, then you have to edit them and enter their values first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

I deleted all of the 1099-INT and reentered one. I did not import. "your income" was still blank. I signed out to "save" and signed back in. "your income" was still zero.

Any other ideas?

Thanks for the quick reply!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

...exactly which boxes are filled in with real $$ amounts on that 1099-INT ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

Box one is the only box filled in on my 1099-INTs. I have another 1099-INT from US Treasury for savings bonds that only has box 3 filled in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

Wow...that's just inconceivable, that the menu page display wouldn't show those numbers....unless:

1) it's some strange browser issue. (log out and log in on a different browser?...and make sure you are using a computer with a large screen....(((never use a phone)))

or

2) (maybe) Your file is located on some server with some real off-the-wall software problems. ( I don't see such behavior in any of my test files).

Customer Support may need to get Tech People to investigate..you'd have to call them on the phone to get them involved, here:

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

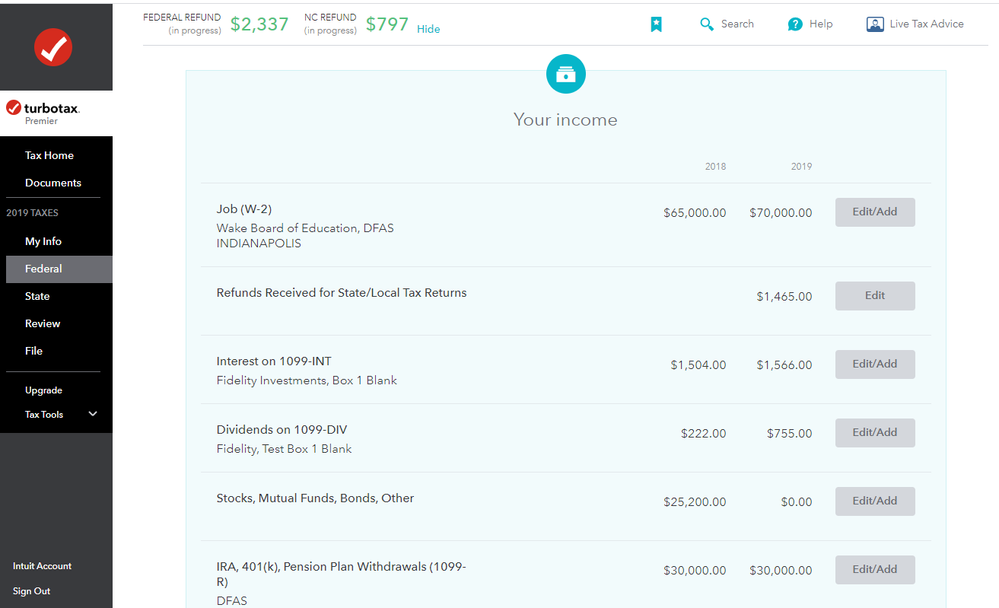

@rickbarg Here's a picture of what my Your Income menu page shows after entering a couple 1099-INT forms. (test account...not a real tax return)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

I am not using my phone. I am using a HP laptop 17 inch screen with Windows 10. I am using Google Chrome browser. I do have to scroll a little sometimes, but it isn't bad.

I tried using Microsoft Edge on the HP laptop and got the same results.

I went to my desktop running Windows 7 and tried with Google Chrome, same results.

I tried Microsoft internet explorer and after I got into TurboTax, it asked me to update my browser! I dont want Windows 10 on that PC, so I logged out.

I strongly prefer Google Chrome.

This is the first problem I have ever had with TurboTax in all the years (at least 10) I have been using it!

I'd really rather not have to switch to some other preparation software!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

Where your test account has 1,566,00, my screen has 0.00 after entering my 1099-INTs. I have savings bonds that were cashed in and used for most of a 1098-T, educational expenses. Do your tests check that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

I would try looking at the Form 1040 in TurboTax Online to see whether the interest is showing up on line 2b. If it is showing up on the form in the correct spot you do not have to worry about it.

While signed in and working in TurboTax:

- Click on Tax Tools in the left-hand black menu

- Click on Tools

- On the popup window, click on Tax Summary.

- The left-hand black menu has changed, click on Preview My 1040.

- Scroll down until you get to page 1 of the Form 1040, look at line 2b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

Thanks for pointing that out. Unfortunately, line 2b is zero. :(

I am in the phone queue with a wait time of 16 minutes. Yesterday, I never heard back, except from you. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

I talked with support person. They will open a ticket. Thanks for everyone's help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

It looks like when I enter the EE Savings Bonds information and use them for education payments, the total for the 1099-INT on the Your Income screen is zeroed out. It is still a problem!☹️

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

Was all of your interest reported from these EE bonds? The savings bond education tax exclusion permits qualified taxpayers to exclude from their gross income all or part of the interest paid upon the redemption of eligible Series EE and I Bonds issued after 1989, when the bond owner pays qualified higher education expenses at an eligible institution.

Therefore, if this was your only interest income, and it was all used for higher education expenses, you should not see any taxable interest.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the "your income" screen, my 1099-INT amounts for 2019 are still zero. I entered the info, waited 5 days and it is still zero. Is this supposed to happen?

Thanks for replying.

In addition to the EE bonds, I also had bank account 1099-INT with interest in box 1. TurboTax excluded that too.

Turbotax support opened a problem for their programming staff to fix. I am curious when I can expect a fix.

I have one more year of tuition payments and a couple more bonds that I wish to use next filing season so they should fix it going forward!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zzz8881

New Member

Cdubs

New Member

333ef67c1c11

New Member

Lynette Mitchell

Returning Member

6bd1dc9d71c3

New Member