- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My wife's 1099-G

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife's 1099-G

Hello,

I just completed the income sections and about to go to the Deductions. Since I have been using using TurboTax for years, all the info imported is for myself. This year is different as my wife are doing ours together. But for some reason I did not see where to enter my wife's 1099-G form she received last year. The program already had that info and I did not have to enter it.

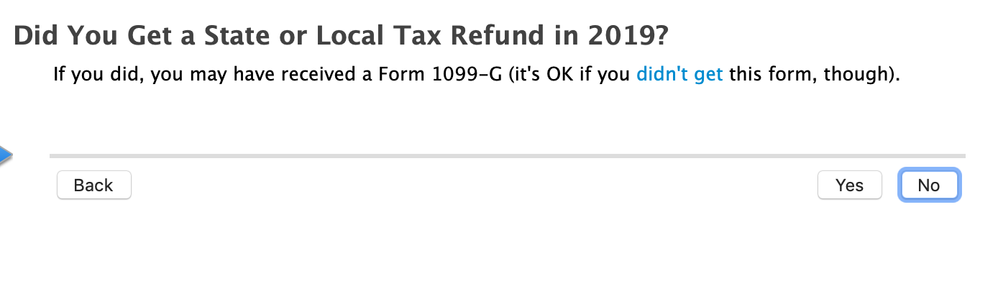

1) I answered yes to "Did you get a State or Local Tax Refund in 2019" - Yes

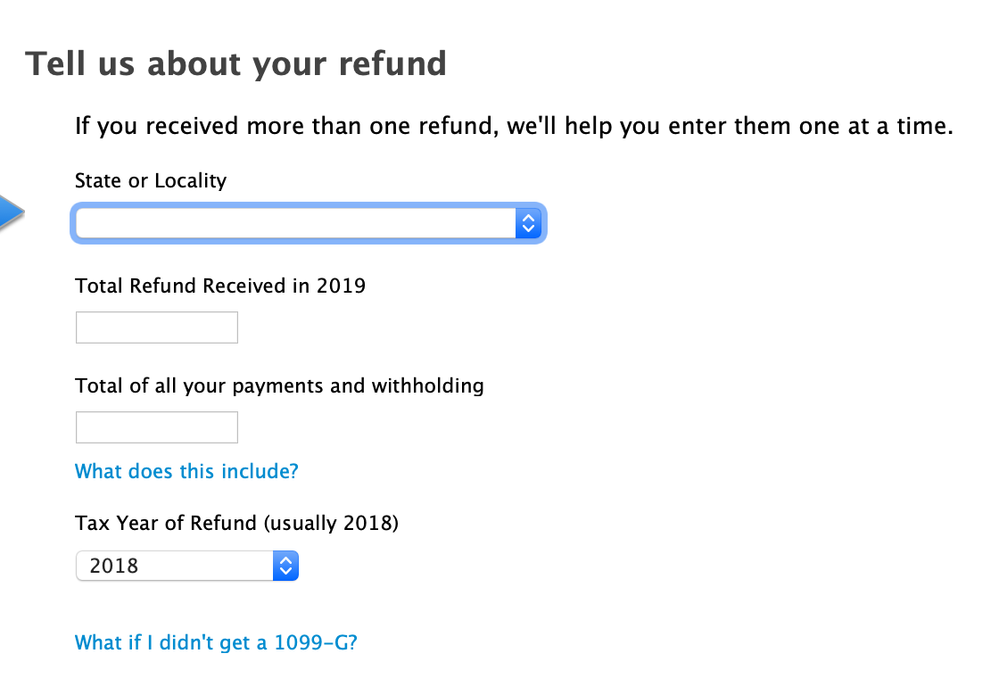

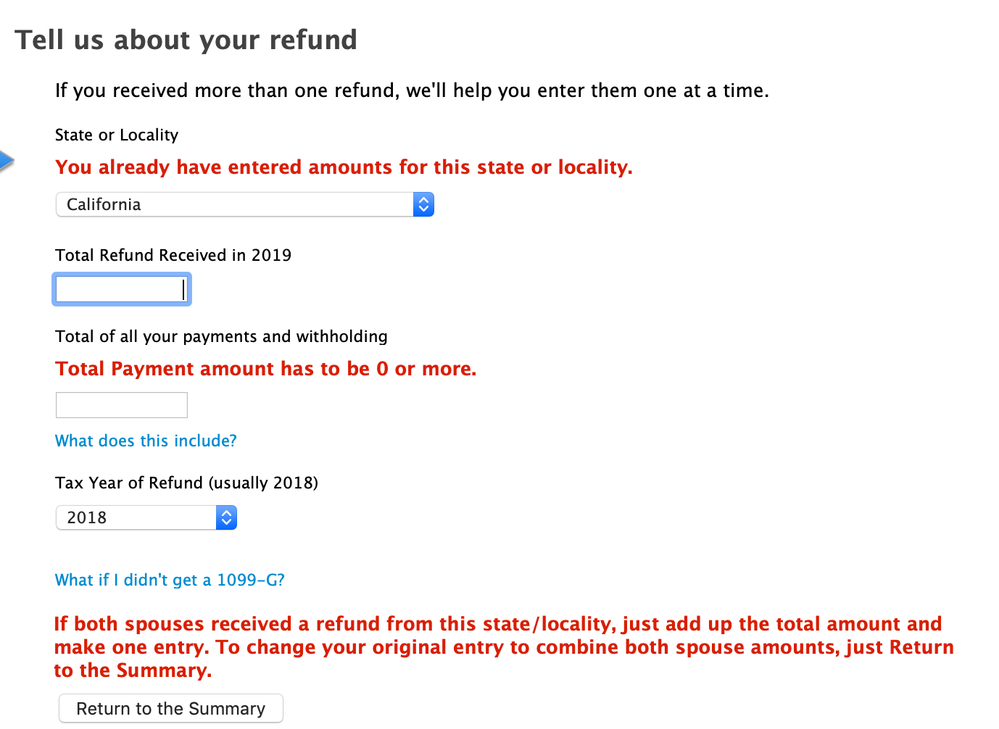

2) Then it asks "Tell us about your Refund"

* here it tells us we have to add the refunds to make one entry

* how do I find out what the total of all payments and withholdings are for her and me since TurboTax pre-filled it for me, but I don't have my wife's info?? See screenshots.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife's 1099-G

You will add the two together and enter the sum of both your state and local tax refund and your wife's refund. You will need to look at her 2018 tax state tax return to determine the amount of the refund. The refund is only taxable in 2019 if you itemized in 2018. If you did not itemize, the refund is not taxable and can be disregarded.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife's 1099-G

Thank you so much!!!

But in both our cases, last year I did not itemize, but my wife did. Do I still continue to add?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife's 1099-G

Yes. But, if you filed married filing separately, if one spouse itemizes the other must itemize also, even if there are not enough deductions to exceed the standard deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife's 1099-G

Sounds good!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

terrys-mail2

New Member

tomsky48

New Member

05aj990006

New Member

graphicglobe736

New Member

pleasanthillchir

New Member