- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My Kentucky family size tax credit is 1, my federal adjusted gross income is equal to my Kentucky adusted gross income which is $14,416.00 what is my family size credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Kentucky family size tax credit is 1, my federal adjusted gross income is equal to my Kentucky adusted gross income which is $14,416.00 what is my family size credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Kentucky family size tax credit is 1, my federal adjusted gross income is equal to my Kentucky adusted gross income which is $14,416.00 what is my family size credit

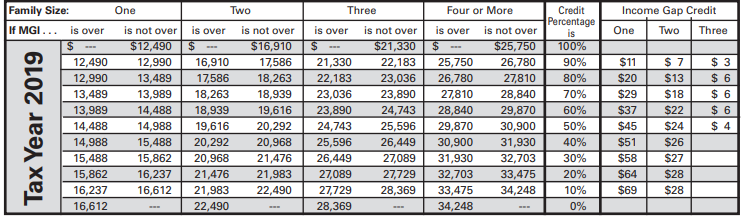

It depends. Kentucky's family size tax credit is not expressed in an amount but in a percentage. If you are declaring by yourself, your family size tax credit is 40% of the amount of KY tax calculated for your income. Thus, if your KY tax were $500 on your income, you receive a credit of $200 and your total KY tax is $300. Your refund will be the amount of KY tax you have paid in minus $300.

However, if it is you and a child, your Family Size tax credit is 100%. You would not owe KY state tax and would get a refund for all that you pay in. And even if you are not claiming other children on your tax return, you may still claim children living with you for the purpose of this credit. They do have to be children that essentially qualify for earned income credit for this to be the case.

Please see the following link for more information: http://revenue.ky.gov/Forms/2016_42A740(PKT).pdf (pages 12 and 13 of document)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Kentucky family size tax credit is 1, my federal adjusted gross income is equal to my Kentucky adusted gross income which is $14,416.00 what is my family size credit

So what if my adjusted gross income is $28,000 and family size is 1. Is it still 40%

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Kentucky family size tax credit is 1, my federal adjusted gross income is equal to my Kentucky adusted gross income which is $14,416.00 what is my family size credit

Actually wrong question. If my tax amount is 1472 on line19. My family size is 1..is that 40% as well?. Whatever happened to getting forms in an instruction book??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Kentucky family size tax credit is 1, my federal adjusted gross income is equal to my Kentucky adusted gross income which is $14,416.00 what is my family size credit

The instructions are published on page 21 of https://revenue.ky.gov/Forms/2019%20740(P)%20Instructions%20only_FINAL_rev%[social security number r...

About your case:

> adjusted gross income is $28,000 and family size is 1

> If my tax amount is 1472 on line19. My family size is 1..is that 40% as well?.

Use your adjusted gross income ($28,000) and family size to look up the percent in the "Family Size Table" :page 2 of https://revenue.ky.gov/Forms/Schedule%20ITC%20-2019.2.pdf

Your percentage is 0%, and your Income Gap Credit is $0

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Eddie0819

New Member

08815bb85d87

New Member

hannahneal79

New Member

wgefpilot

New Member

Creek_Jumper

Level 1