- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

Hello,

I am living and working abroad in China for a Chinese company. I have received stock options that I needed to exercise in 2019. Since I was working in China, the stock was sold and then transferred to my Chinese US dollar account. The taxes for the selling of the stock was deducted in China.

I have received a 1099-B from the stock broker and shows that I did not pay anything to the US government in taxes (because I paid in China).

How do I represent this in Turbotax that I paid taxes in China for this?

Will I be double taxed because of this?

Need immediate help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

You should go ahead and report the 1099-B. You may be eligible for the Foreign Tax Credit for the tax you paid to China.

Credit can be claimed for tax paid to a foreign country on income that is also taxed by the United States.

Here is how to claim the Foreign Tax Credit in TurboTax.

- Make sure you've entered all your foreign income.

- From within your return, search for foreign tax credit and select the Jump to link in the search results.

- Answer Yes to Did you pay foreign taxes in 2019 or have credits to use from a prior year?

- Follow the instructions to get the credit or deduction.

In most cases, taking the credit works out better than the deduction. We'll help you decide which one's best for you when you go through this section.

If you choose to take the credit (most people do), we'll attach Form 1116, Foreign Tax Credit if your situation requires it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

Thanks for the quick reply.

I do not have a 1099-DIV for this part, do I need to have it in order to do this? Or perhaps do I just do the Simplified Limitation for AMT (Simplified Method)? I have done this in the past for 2018.

Where exactly would I enter the tax paid for the taxes that I paid for the stock?

And what type of Income is this for the Form 1116? Is it Passive Income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

1. You don't need a 1099-Div to enter dividend income.

2. See my previous post for how to enter foreign tax paid.

3. Dividend income is passive income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

@RobertG Thanks for your help...

I still need a bit of help on this to further understand.

So, the 1099-B that I received is for my Incentive Stock Option plan that I exercised in the 2019 tax year.

As stated above, I sold those stock and had to pay tax for that in China, which I will report on my Foreign Tax Credit sheet.

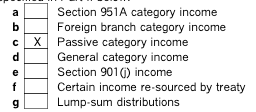

For reporting on this, which type of income is this income considered??? (just a reference screenshot)

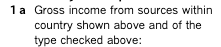

Is this where I put the amount on Form 1116, Line 1a for the income that I earned from selling the stock?

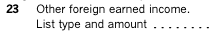

Additionally, do I have to report this as income on my Form 2555, Line 23?

Lastly, when I put my 1099-B into that portion of Turbotax, since this is an ISO, I assume I check the box as ISO (Incentive Stock Option)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

The income would be considered passive category income.

Once you enter your stock sale and your foreign tax credit information forms 1116 and 2555 will be completed by TurboTax.

If the stock is an ISO, you would enter ISO.

To enter an ISO you need Form 3921 or the information from Form 3921. Enter the sale information and select guide me step by step. Form 3921 information should be entered there for the stock sold.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

Thanks for the reply. Interestingly enough, Turbotax puts this income as "General Category Income" after I put this in the W-2.

Is that normal? Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living Abroad - Sold US Stock Options, paid tax in China - How to put in tax return?

The discount portion of the transaction, that is the difference between the price you paid for the stock and the fair market value of it, would be considered wage income, or general category income in this case.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

PipiR

Level 2

maestrmx

New Member

grosiles

Level 1

nortons1996-

New Member

oa1012yl

New Member