- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Is Turbotax now able to handle depreciation on a car used partly for business if the first year's depreciation was already done without Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Turbotax now able to handle depreciation on a car used partly for business if the first year's depreciation was already done without Turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Turbotax now able to handle depreciation on a car used partly for business if the first year's depreciation was already done without Turbotax?

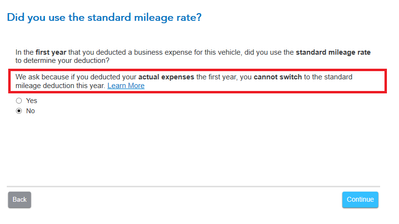

Are you referring to the situation in the screenshot at the bottom of this post?

Regardless, TurboTax should be able to handle your case provided you use a desktop version, which will contain all of the requisite worksheets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Turbotax now able to handle depreciation on a car used partly for business if the first year's depreciation was already done without Turbotax?

No, it wasn't about standard mileage rate versus actual expenses. I did it based on actual expenses last time and will continue the same way this time. The issue a few years ago was just that the depreciation had already been started in a previous tax year, not using Turbotax. So using Turbotax, it was not possible to continue the depreciation for a subsequent year.

Perhaps the issue will be the software version, then. I was using the web-based version. If the desktop-installed version of Turbotax can handle this situation but the web-based version cannot, then that answers my question. I just want to be sure, because at that time (a few years ago), the customer-support agent did not know the correct answer at first. And I don't want to enter a huge amount of data only to find out that it still doesn't work with Turbotax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Turbotax now able to handle depreciation on a car used partly for business if the first year's depreciation was already done without Turbotax?

@ellsworth2019 wrote:Perhaps the issue will be the software version, then. I was using the web-based version.

I think that might be the case. Take a look at the screenshot of the worksheet (below and it is a partial view) from the 2019 version of TurboTax Home & Business; most all of the worksheet is fillable and should fit your needs.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

roypimjasmine2485

New Member

johnpollett

New Member

dmarchello

New Member

dmarchello

New Member

cparke3

Level 4