- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Is my plan feasible, leveraging low income situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

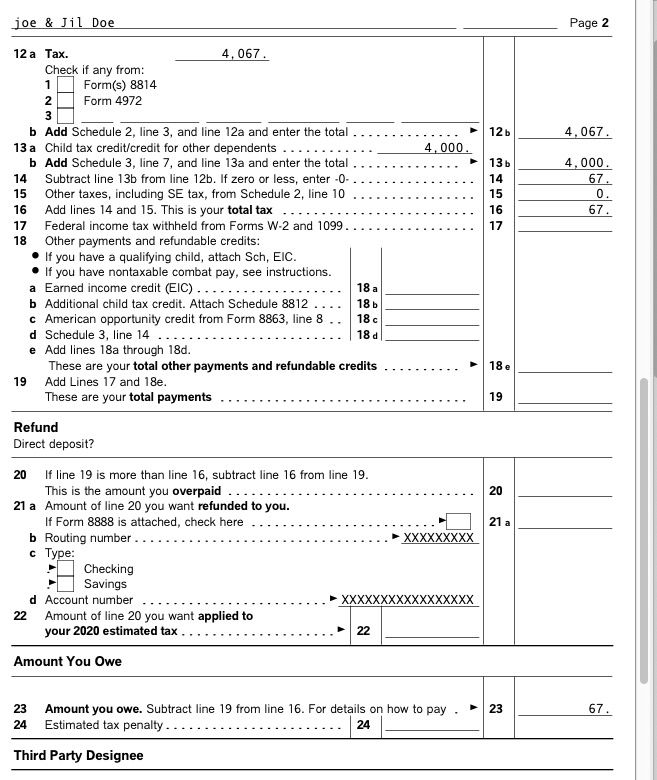

Is my plan feasible, leveraging low income situation.

Heres my tax situation in 2020. Total estimated earned income is $3000 between me & non-working wife. Have two kids under 16.

Is following scenario possible? Could you help if I missed anything ?

My Plan:

$3000 - Earned income

$29,250 - Rollover from husband Trad IRA to Roth IRA

$29,250 - Rollover from wife Trad IRA to Roth IRA

-------------------------------------------------

$61,500 = Total income

My Taxes:

| Total Income | $61,500 |

| Total Deductions | $24,800 |

| Total Exemptions | $0 |

| Taxable Income | $36,700 |

| Regular Taxes | $4,009 |

| Child Tax Credits | $4,000 |

| Total Tax with Credits | $9 |

| Marginal Tax Rate | 12% |

| Tax Amount Owe | $9 |

I also read that lower-income taxpayers may be eligible for the "saver's credit" if they contribute to an IRA.

Is tis possible? Could you help if I missed anything ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

Sounds about right, but how can you support a family of 4 on $3,000 of income? and if that is taxable compensation eligible to make a IRA contribution, then that could result in about $200 savers credit and leave you with no income at all to live on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

Also---you are assuming you get $4000 child tax credit. With only $3000 of income from working you will not get that. The refundable portion of the child tax credit is based on how much you earned. You get the refundable "additional child tax credit" on amounts over $2500 of earned income. So you would be able to get 15% of about $500 in additional child tax credit (about $75) IF your children have Social Security numbers. If the kids do not have SSN's you do not get the child tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

The Child Tax Credit of $4,000 is based on the 1040 line 12b (tax liability), not earned income. If the savers credit was taken then that could reduce the $4,000 somewhat (schedule 3 line 4 is subtracted form 12b) which could make the tax liability less then $4,000 which would limit the amount of CTC, but would then qualify for a small amount of ACTC in addition to the CTC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

@macuser_22 and @xmasbaby0 Thank you for your inputs.

@macuser_22 you are correct, cant survive family of 4 in $3000 income. I ended up using savings from prev years income.

@xmasbaby0 I think I will put numbers in Turbo Tax online for 2020 and see what it brings up in terms of child tax credit.

In worst case I see that I could rollover 24,800 to Roth IRA between me and my wife without additional tax liabilities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

The 2020 online software becomes available in mid-to late November. Right now the online program for 2019 is shut down for new returns and cannot be used. If you want to use the 2020 software you will need to wait for it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

@xmasbaby0 Good point, while I wait for 2020 version to be available I will use my desktop 2019 version to get ballpark idea.

I just need to make sure the amount I need to rollover has no room for errors since I have only few weeks left till Dec 31st, 2020 to carry out rollover transaction. In my understanding, rollover carried out on or after Jan 1st, 2021 would be added to my 2021 income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

FYI The 2020 desktop software becomes available through retailers such as Amaon.com on 11-27-2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

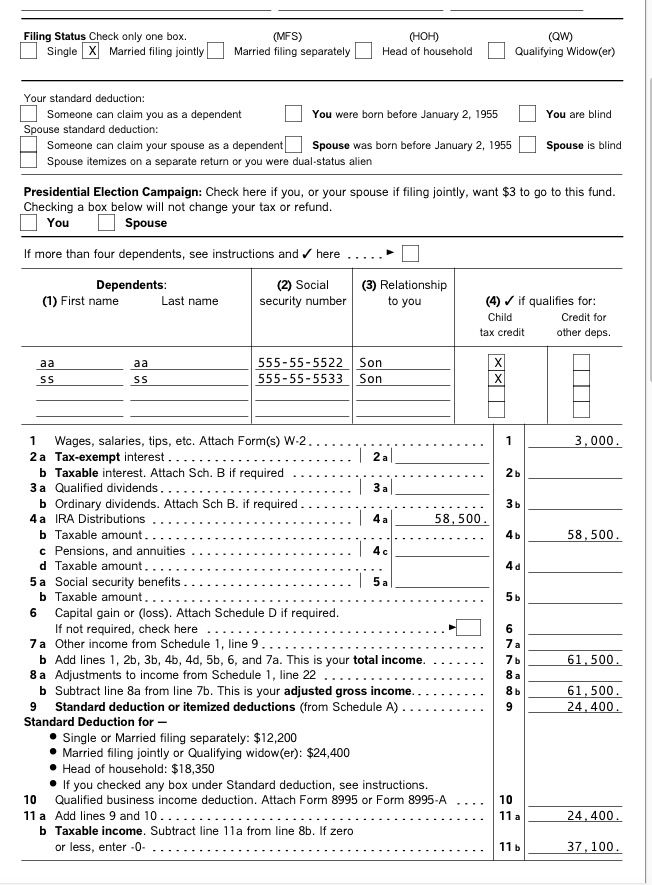

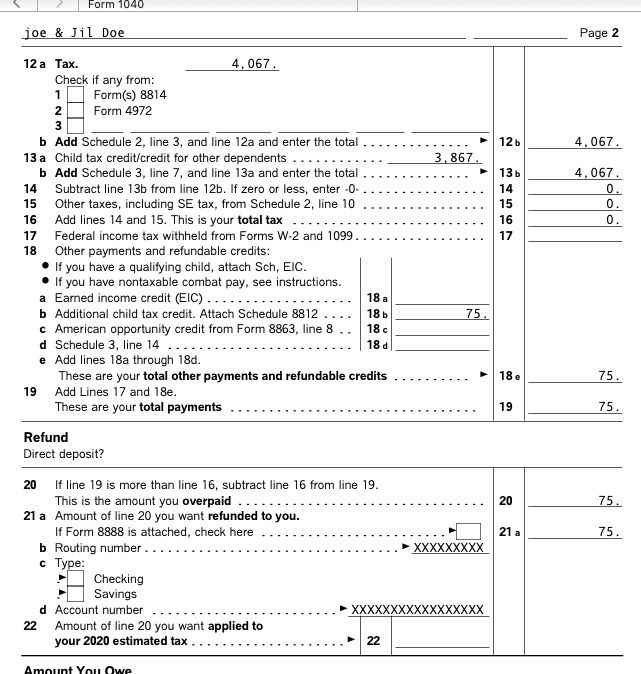

This is what your figures get on a mock 2019 return including the savers credit (assuming the $3,000 is wages).

Without the savers credit page 2 looks like this:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

Does the saver's credit apply to the rollover or only to new contributions? That would mean contributing up to the $3000 of earned income into a traditional or Roth IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

New contributions. The OP said they had $3,000 earned income. If from a source that is eligible to make a contribution. A Roth conversion is not a contribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

The saver's credit is moot since there are IRA distributions on the return ... so the form 8880 is not allowed thus making a roth contribution is a waste.

If you have the downloaded program then did you know this ....

This is my mini version of a tutorial that should be in the downloaded program:

What is Forms Mode?

Forms Mode lets you view and make changes to your tax forms "behind the scenes."

If you're adventurous, you can even prepare your return in Forms Mode, but we don't recommend it. You may miss obscure credits and deductions you qualify for, and you may forget to report things that will come back and haunt you later.

Forms Mode is exclusively available in the TurboTax CD/Download software. It is not available in TurboTax Online.

Related Information:

- Why would I use Forms Mode?

- How do I switch to Forms Mode in the TurboTax for Windows software?

- How do I switch to Forms Mode in the TurboTax for Mac software?

- What is-the-meaning-of-all-the-different-colors-in-forms-mode

If you want to play around with different figures and tax scenarios without affecting your original return you can ….

- >>>In the TurboTax CD/Download software by creating a test copy:

- 1. Open your return in TurboTax.

- 2. From the File menu, choose Save As.

- 3. Give the copy a new name to distinguish it from the original (for example, by adding "Test" or "Example" to the file name).

- 4. Click Save. You are now safely working in the test copy and anything you do here will not affect the original.

- https://ttlc.intuit.com/questions/1900642-how-to-make-a-test-copy-of-your-return

- >> use the WHAT IF tool:

- - Click Forms Icon (upper right of screen) or Ctrl 2 (forms view)

- - Click on the Open Form Icon

- - In the “Type a form name.” area type What-If (with the dash), click on the name of the worksheet - click on Open Form

- - You will see the worksheet on the right side of the screen; enter the information right into the form

- - To get back to interview mode - click on the Step-by-Step Icon (upper right of screen) or Ctrl 1

It's always a good idea to make a backup copy of your tax data file, in case your original gets lost or corrupted. Here's how:

- From the File menu in the upper-left corner of TurboTax, choose Save As (Windows) or Save (Mac).

- Browse to where you want to save your backup.

- Tip: If you're saving to a portable device, save it to your computer first to prevent data corruption. Then, after completing Step 4, copy or move the backup file to your device.

- In the File name field, enter a name that will distinguish it from the original tax file (for example, add "Backup" or "Copy" to the file name)

- Click Save and then close TurboTax.

- Restart TurboTax and open the backup copy to make sure it's not corrupted. If you get an error, delete the backup and repeat these steps.

If you make changes to your original tax return file, repeat these steps to ensure your original and backup copies are in-synch.

Related Information:

- Retrieve a Tax File from a Portable Device

- What's the difference between the tax data file and the PDF file?

AND save it as a PDF so you have access to a copy even if you don’t have the program still installed and operational :

- How do I save my return as a PDF in the TurboTax software for Windows?

- How do I save my return as a PDF in the TurboTax software for Mac?

AND protect the files :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

@Critter-3 wrote:The saver's credit is moot since there are IRA distributions on the return ... so the form 8880 is not allowed thus making a roth contribution is a waste.

@Critter-3 Thank you, yes you are correct about "Savers Credit" ineligibility in the event of IRA distribution. I confirmed on IRS website and link it here for the benefit of current and future audience.

"Rollover contributions do not qualify for the credit. Also, your eligible contributions may be reduced by any recent distributions you received from a retirement plan or IRA, or from an ABLE account."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

@amit2020 wrote:

@Critter-3 wrote:

The saver's credit is moot since there are IRA distributions on the return ... so the form 8880 is not allowed thus making a roth contribution is a waste.

@Critter-3 Thank you, yes you are correct about "Savers Credit" ineligibility in the event of IRA distribution. I confirmed on IRS website and link it here for the benefit of current and future audience.

"Rollover contributions do not qualify for the credit. Also, your eligible contributions may be reduced by any recent distributions you received from a retirement plan or IRA, or from an ABLE account."

You are reading it incorrectly.

It is correct *rollovers* are not new contributions and do not count. You were asking (as I understood it) that you had $3,000 of earned income that you *could* use to make a NEW IRA contribution and a new contribution does qualify for the credit. IRA *distributions* can disqualify (as your quoit says) but a rollover/conversion does not count as a *distribution* and is specifically excluded.

From the 8880 instructions.

Enter the total amount of distributions you, and your spouse if filing jointly, received after 2017 and before the due date of your 2020 return (including extensions) from any of the following types of plans.

• Traditional or Roth IRAs (including myRAs), or ABLE accounts.

Don’t include any of the following.

• Distributions from your eligible retirement plan (other than a Roth IRA) rolled over or converted to your Roth IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my plan feasible, leveraging low income situation.

One caveat to the above - if you have tax withheld from the Roth conversion to pay the tax on the conversion then that withholding is NOT part of the excluded conversion so it does count as a distribution. (it is always better to pay the tax on a conversion from other sources anyway or you loose some of the advantage of doing a conversion because only part of the money for the Traditional IRA can continue to grow tax free.)

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

joesno94

New Member

noviceattax

Level 4

Anonymous

Not applicable

AdamE

New Member

tortdog

New Member