- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

I couldn't find any information on this, can I rid off of my taxes and where ?.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

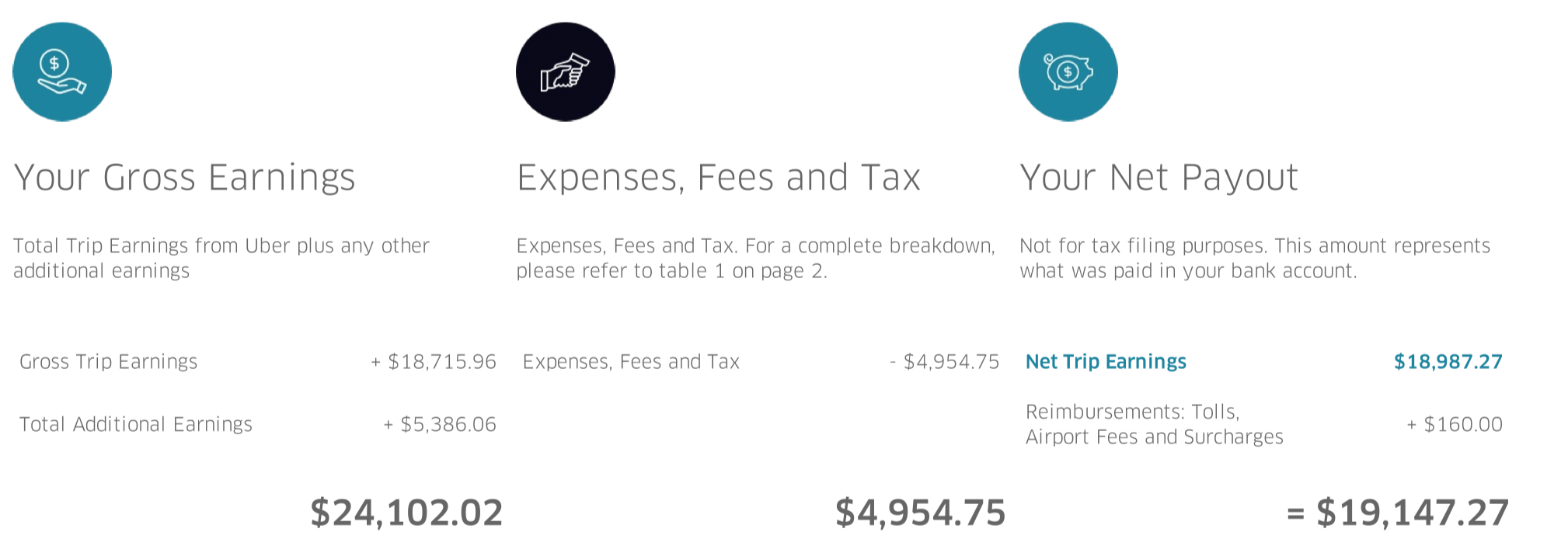

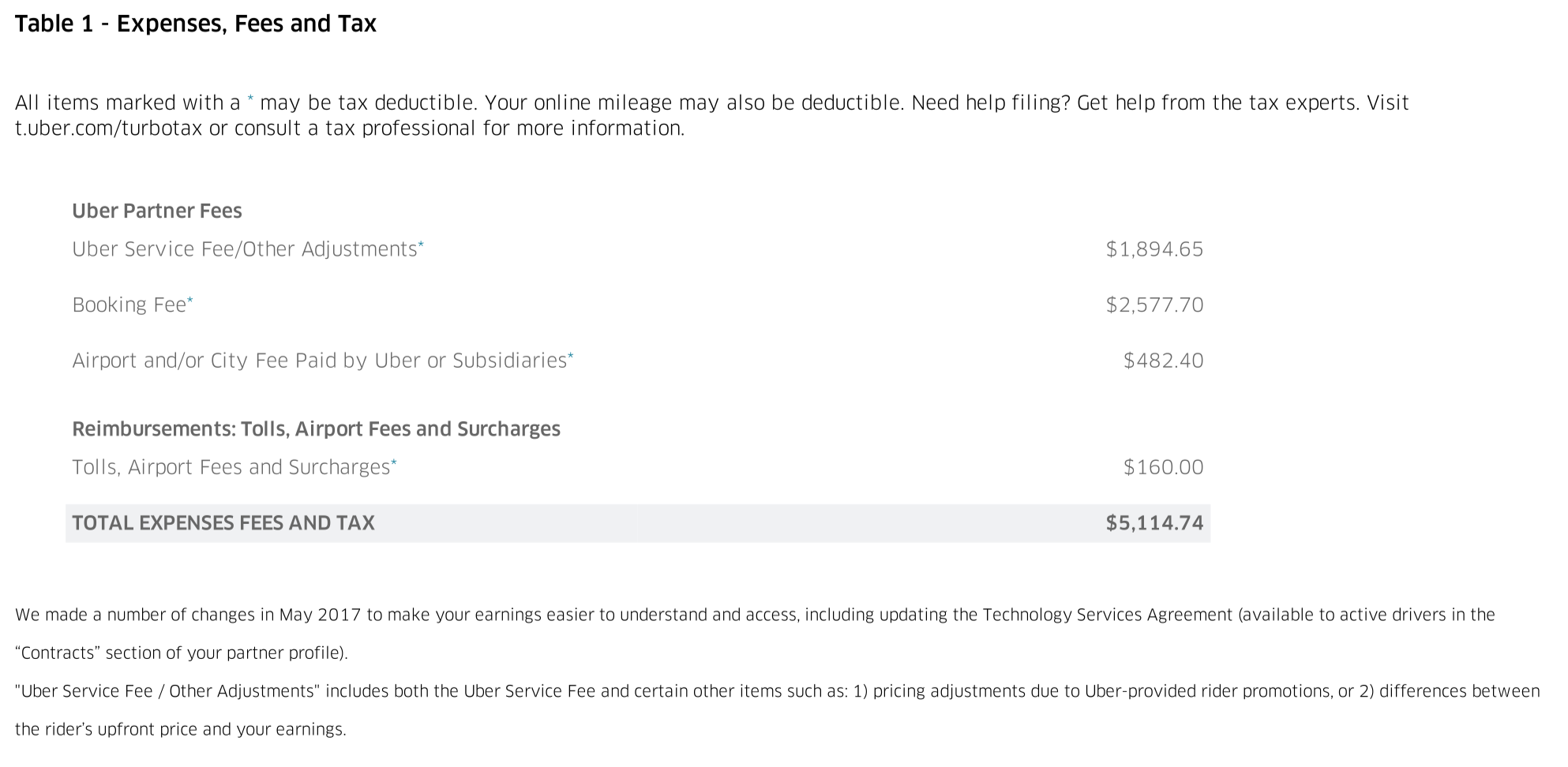

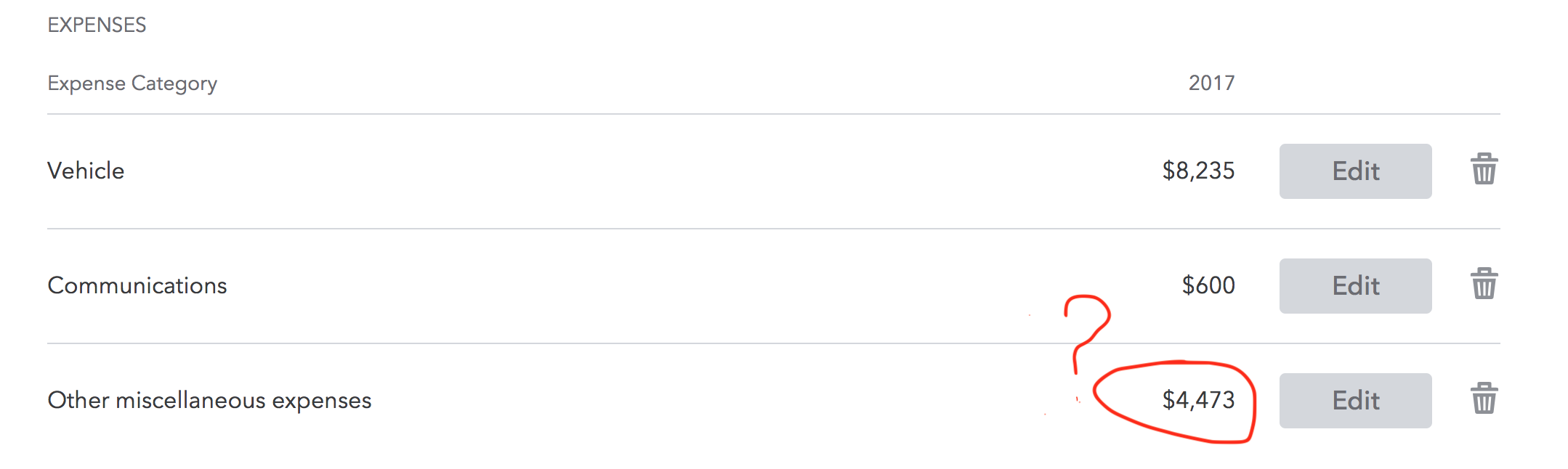

You would take all expenses except that last one of $160 (because that is a reimbursement). The total expenses from the statement should be $4,954.75 for your 'other miscellaneous expenses' category.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

Thank for clarifying it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

What do you mean airport/city fees paid by Uber?

If the fees were included in the gross amounts reported to you on a statement on 1099-K, then they would be deductible as a business expense.

Tax Tips for Car Sharing Drivers

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

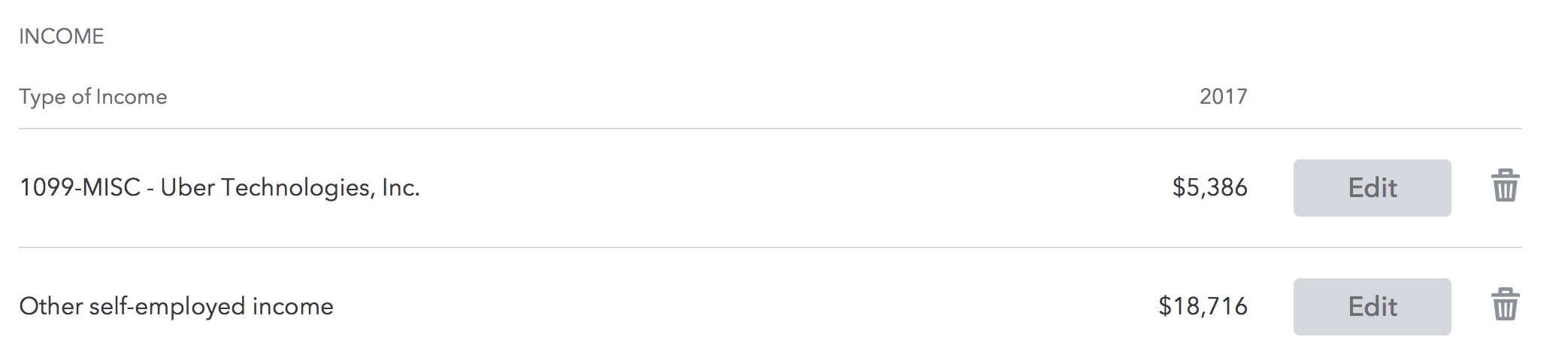

First of all, I did not receive 1099-K, as far as I made < 20k but 1099-MISC and Yearly Summary.

I'm confused about this line: All items marked with a * may be tax deductible. Please explain what that means ?. And which one I should

Currently, I have entered Gross Trip Earnings and Total Additional Earning (from MISC-1099) as income

I took the standard deduction based on online mileage (provided by Uber) + miles between pickups (personal calculation) as a result 8235$ are deductible + 600 cellphone expense, that it. The part I'm really confused is should I enter Uber Service Fee/Other Adjustment + Booking Fee + Airport and/or City Fee Paid by Uber or Subsidiaries as expenses?. Or which one I can deduct. I hope I'm clear this time. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

You would take all expenses except that last one of $160 (because that is a reimbursement). The total expenses from the statement should be $4,954.75 for your 'other miscellaneous expenses' category.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

Thank for clarifying it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

You are welcome 🙂

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

I thought Turbotax will take care of inserting those expenses automatically after I gave access to Uber account. But apparently, I had to do it manually. API integration could be batter, please pass my proposal to engineering team fro future consideration.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Airport and/or City Fee paid by Uber or Subsidiaries deductible?

Will do. All comments suggestions are welcomed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

leechipturner

Level 2

global9

Returning Member

jimmyboy2003

Level 1

Jayadams15

New Member

cbp13

Returning Member