- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Injured spouse and stimulus payment

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Hi ! Trying my luck if you could help me answer this question . I didn’t receive yet my stimulus check while it shows in Get My Payment IRS, it will be deposited in my bank account on May 6 .

I applied thru our joint IRS from 2018 . I found out just 3 days ago that our accountant didn’t file the form 8379 for injured spouse while he was doing it in the previous tax refund . Do you think I will still get my $1,200 ?

We already filed the 2019 .

Any answer will be appreciated . Thank you .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

You have to submit one every year and you still can submit it whenever IRS opens they should fix it. You have time being that it's still closed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I filed one on our 2018 and 2019 taxes and sent one for stimulus just to cover our tracks they still took the whole thing bc there was a glitch in the system they say the irs has to fix according to the TOP! IRS has a live chat now but they dont tell you **bleep** I have been on there 5 times today and they are rude and dont know anything !! Also we have been waiting on our refund for over 13 weeks now!! We will see what they do they act like people who pay child support or have back child support dont have other children to take care of!! This is the biggest mess ever!! Go sign the petion on Change.org/injuredspouse

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

It’s just all ridiculous! I have A daughter as well and still waiting on my tax return after 15 weeks. I did talk to someone at my local tax advocate office and they said there is nothing can be done until the irs opens back up to finish processing my tax refund which they said should be soon. Is all they were told. She only showed me getting only 1450 from stimulus which went to child support. I should have got back 2900 because I filed married filing jointly and I have a qualifying child. She couldn’t understand it either but once again nothing I can do until the IRS opens back up. I’m sick to death of all this BS and I’m filing a complaint bigger than crap. So not fair for my child to not get anything or myself. I’ve always got back my full refund every year filing the injured spouse form and I better get it this year. There’s no date as to when the irs will open back up but they were told very soon. It’s gonna be crazy with calls I just know it. I will hold for hours if I have to just to give them a piece of my mind!! How do you talk to an irs representative thru online chat? Is it on the irs.gov website because I looked and couldn’t find anything. Thanks for the Input. I hope justice is served for all the injured souses out there! God bless everyone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I dont think theres an online chat or like you I would be raising hell as well. The treasury explained to me my joint return only showed 1200 an it should be 2900 because of my daughter. I keep hoping my 1700 just got split an will be mailed to me but no guarantee with the irs. I did file an injured spouse form as I do every year but this year being everyone's hardest year you would think they would fix their errors. What blows me away is how they make sure the child parent on child support receives their part instantly but forget the child with the present marriage which is unfair Even more unfair is while every place is opening up the irs seems to be home ....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Go to the irs page click pay sit on that page for just a minute it will pop up!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Get ready to raise hell as fast as your fingers will type go to the irs page on top of the page it says pay go to that page sit on that page for a minute and wait it will pop up!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

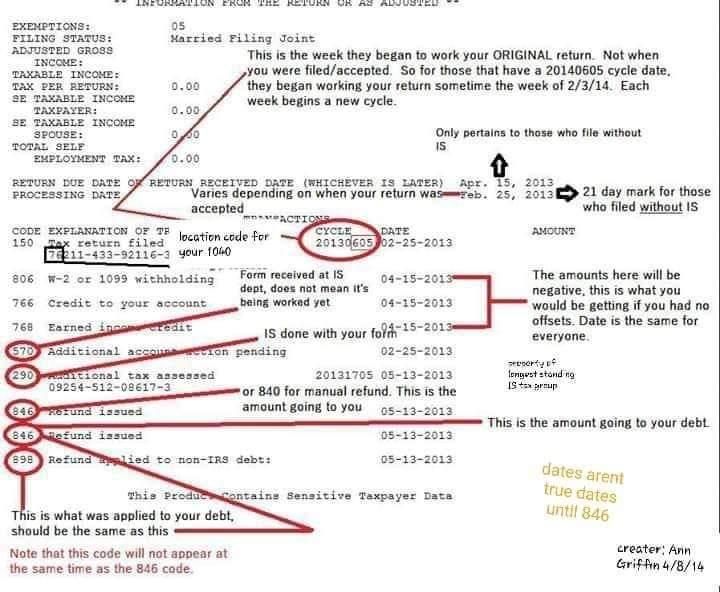

I've never really been a group chat person, but every since this 2020 Injured Spouse mess up, I've been chatting with the TT community and several FB Inj Sp groups. It's amazing how people have come together to discuss the IS topics. We let out anger...frustration...share stories...show support.... but also its been a great educational tool. I've started reading Congressional updates and I've learned how to decipher the codes and cycle dates on my transcripts. It's also has taught me patience.....I can now stalk my bank account, Where's my Refund, Get my Payment and check my IRS account daily without going the F#$% off.... ahem.. without going off....

I even (finally) spoke with a live person at the IRS who told me absolutely diddly-squat, but I politely told her thanks for I know it's not her fault. I know soon the funds will come, so I will relax and take it one day at a time Cue theme song "this is it...this is it...this is life the one you get so go and have a ball..." Geesh...showing my age :( Have a good day everyone!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

What is the fb group you speak of and how do you read your transcripts should I be able to see mine if the return wasn't complete! I'm in Virginia no call center is opened up here yet I hope soon i will sit for hours if i have too

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

How did you speak to a live person at the IRS? And do you have any webpages you can share that tell you how to read you transcript.

?That would be so helpful. I have a Facebook group for this issues. Injured Spouse Stimulus Ughhhhhh

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

On the irs home page irs.gov? I clicked on pay but did not see sit. Confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I am in VA too, but I just called [phone number removed] which is IRS collection BUT you can speak with a rep who may be able to provide you an update/status on your specific account. I didn't wait long for an answer either.....entire call took less than 10 min.

I've joined private FB groups "Longest standing injured spouse tax filing group" and "Injured Spouse".... they provide helpful info within the post/comments

I got most of my transcript help from people posting within the groups that lead me to do a Google search. RefundTalk.com has transcript code help as wel as the IRS site https://www.irs.gov/pub/irs-utl/6209-section-8a-2012.pdf

Good luck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

To whom it may concern i Josephine m boyd am the injured spouse part texas child support receive what should have come to me last 4 of social security is 5336

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

No i haven't i have the paper work what should i do know

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

You know you just posted this on a public forum right?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jennabaldwin02

New Member

kwenholz-gmail-c

New Member

sarahannleamy

New Member

skatedogg132

Returning Member

jrich501501-gmai

New Member