- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

Yes, you'll use TurboTax Quick Employer Forms (see info linked below) to prepare and issue your 1099-MISC to your contractors. You can print the 1099s for mailing using the program. Then you can file your individual tax return whenever you're ready to. Read more in the TurboTax FAQ linked below.

https://ttlc.intuit.com/community/forms/help/what-is-quick-employer-forms/01/25916

*Please click the thumbs-up icon if this response was helpful.

**Please click "Mark As Best Answer" if your question has been resolved. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

Thank you @Kat

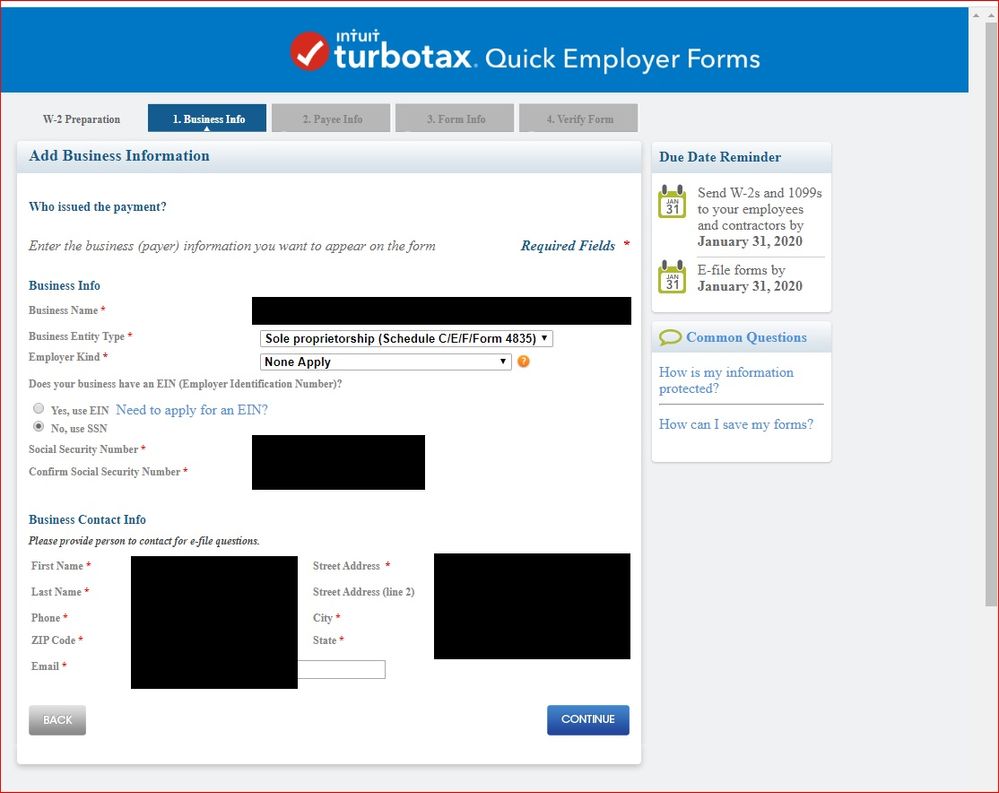

Do you know, when filling out this form as a DBA, do I use my name or my DBA name in the business name field? My name and dba name are too long to include both in the one line it gives me. I use my SSN not EIN. It looks like if I put the business name, it automatically adds my name next to the phone number so maybe that would be best so both are there.

Also wondering - after e-filing, to get them to the individuals do I just print out and mail them a copy?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

I'd enter the DBA name since the field asks for the business name.

And yes, once you've prepared your 1099s, you'd just print them and mail to each contractor.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

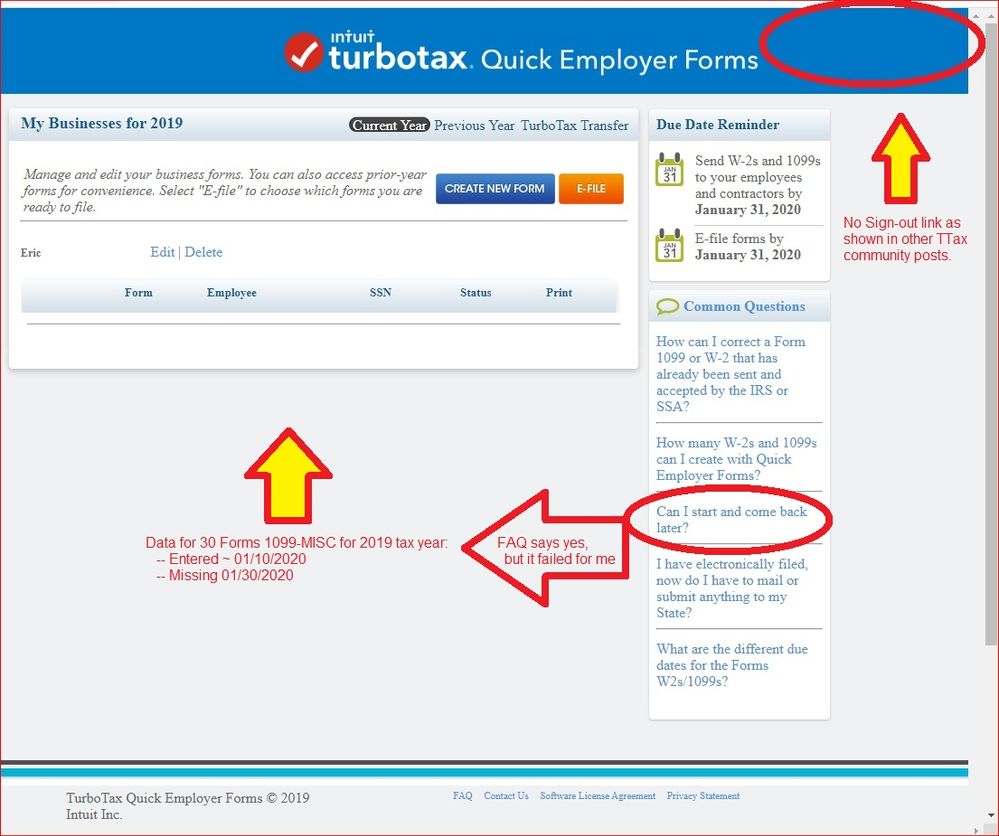

I’m not sure I trust what TTax says about Quick Employer Forms.

On about January 10, 2020, I (eventually) figured out how to enter payee data at the TurboTax web pages for eventual printing and eFiling of IRS Forms 1099-MISC (block 7, NEC Compensation) due tomorrow, January 31, 2020. [For my 2019 returns, I upgraded to TTax Home & Business -- specifically because I wanted the advertised ability to eFile my 1099-MISC forms and know that my current 2019 data would be saved online for quick & easy transfer to next year.]

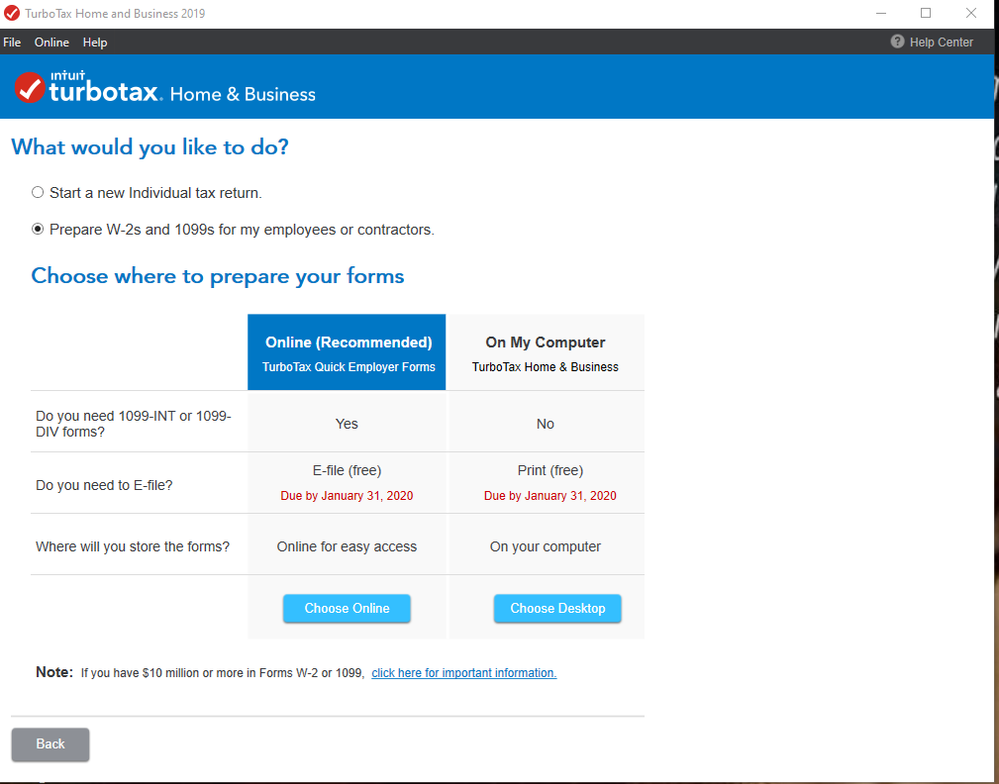

(1) It turned into a time-wasting hassle to (eventually) discover that the ability to enter 1099-MISC info via the online web pages could NOT be accessed from my freshly-created and therefore existing 2019 TTax file in my desktop computer. Instead, when first opening TTax I had to click the "Start a new return" button and from there choose to enter 1099-MISC (or W2, etc.) data. That worked and I manually entered data for about 30 payees. I chose not to eFile at that time (TTax FAQs explain that my data would be saved online for later eFiling and for transfer to next year). Instead of immediately eFiling, I opted to wait until the end of January (i.e., today, 01/30/2020) in case errors needed to be corrected before eFiling. [NOTE -- There was NO "sign out" link or button available on any of the screens that appeared for me, so I simply closed the browser window. Chrome browser.]

(2) Today, 01/30/2020, I am trying to get back to my previously-entered 1099-MISC data that is supposed to be stored someplace within my online account at TTax ... ... ... and, after successfully logging in with my username and password, I cannot find any of my previously-entered data. The option to enter brand new data appears, but NO saved data from a couple of weeks ago. AARRGGH! A link to previously-saved data does NOT appear when I use the "Start a new return" button when TTax first loads. I cannot find a link to my already-entered data when I go back into my already-started 2019 tax file that's stored in my desktop computer. AARRGGH!

Now I wonder why I wasted my time and money upgrading my TTax product so that I could (supposedly) enter and eFile 1099-MISC forms via TTax to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

@eric_l Oh my goodness! Let me (hopefully) help you out.

So when you first "Start a New Return" (this should be YOUR return using the Desktop Home & Business) software, you're asked if you'd like to start your return OR prepare W-2s and 1099-MISCs. If you choose to prepare your tax documents, as you did, you're given the option to prepare either online using Quick Employer Forms OR prepare these documents on your own computer. I'm betting that you prepared your documents using the computer and that your files are in that tax return. See the screenshot below.

Free e-filing is only available with the QEF online program. If you selected your computer, you can print and distribute your documents. However, you cannot e-file those documents. Have you already issued your documents to your contractors and/or employees?

You should be able to access your prepared documents from within your TurboTax program. Click on "Forms" in the header bar, and you'll be able to view the actual forms that you've prepared. You will need to print and mail the documents, along with the 1096 and W-3 (if applicable) and get them in the mail tomorrow. You should be good as long as you've postmarked them by 1/31/2010.

Please post back if you run into difficulty. I used to use the forms generated on my computer, but switched to QEF several years ago. So it's been awhile since I've worked with this specifically, but I should be able to find someone to help if you run into trouble.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

Thanks for the attempt to help, but...

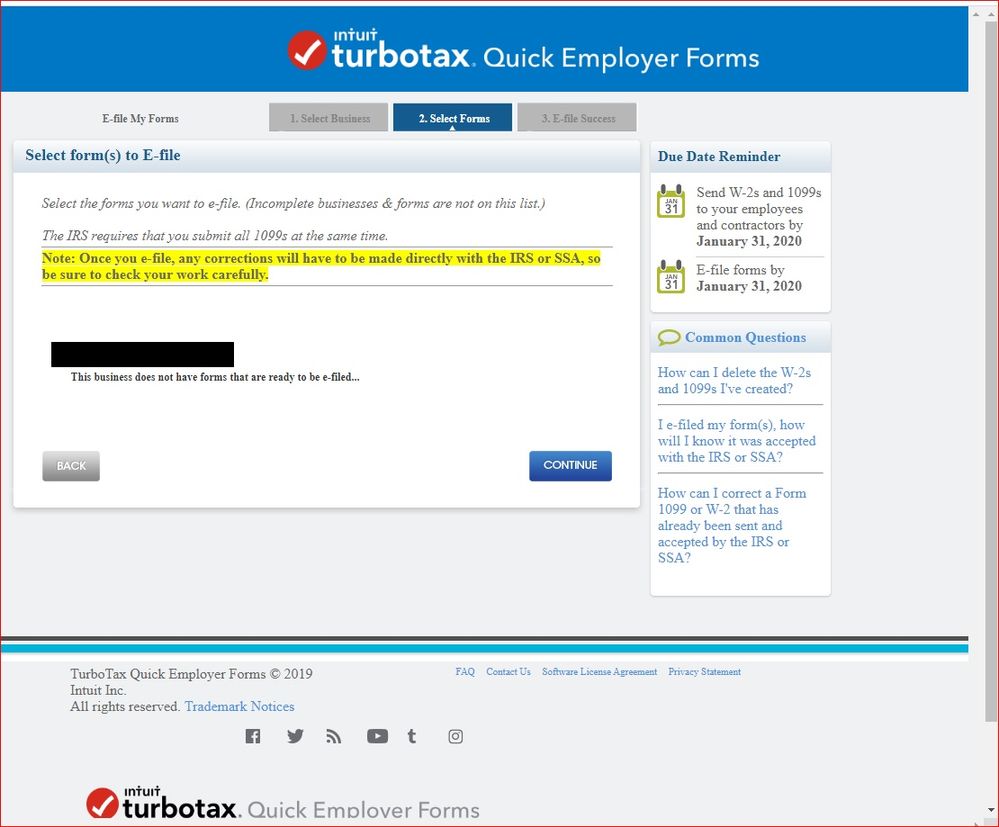

I very definitely did not use the Desktop program. I made sure to choose "online" so that eFile would be possible (unlike Desktop that requires me to print & mail the forms to IRS). The day I entered my data (~1/10/2020) I tested the Efile button, and noted how it allowed me to complete the action. But I stopped before authorizing the Efile so that I could return at the end of the month (today, 1/30/2020). I wanted to make any last-minute corrections to the forms BEFORE Efiling, because once Efiled any corrections must be made on paper.

Signing into my QEF online account today (1/30/2020) takes me to the page shown in this screenshot (personal account name is partially redacted). Clicking the "edit" button takes me to my account data but continuing from there takes me to the page that awaits input of 1099-MISC data. Clicking the Efile button shows that nothing is waiting to be eFiled. (Multiple screenshots w/personal data redacted)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

I am heartsick for you. Honestly. But DID you print and mail the tax documents to your contractors? I ask because it would seem that the files would certainly be saved if you actually generated paper documents for mailing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

Yes, copies to contractors were printed & sent way back on ~1/11/2020. That was to give them time to notify me if they saw any mistakes, etc. Now I just have to try again with Quick Employee Forms ... or go back to the old faithful method of printing and sending those official red-ink forms to IRS via US Mail.

Thanks for your replies. Maybe Intuit can make some significant changes to TTax Desktop Home & Business and how it interracts with Quick Employee Forms. Bi-directional EXPORT/TRANSFER/IMPORT options at both ends would be VERY helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

@eric_l Just to be sure (though you sound like you've been around the block with this), you have only ONE TurboTax account? I'm wondering if you possibly have another login to QEF besides this one? I may be grasping at straws, but I SO hate this for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

Only one TTax account and only one username and one password. I made sure of that when I first signed into QEF in early January 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

See if you have any other files on your computer ending in .tax2019. Both your personal return (and separate Business returns) and W2/1099s end in .tax2019. They should be in your Documents then in a Turbo Tax folder. Or search your computer for all files ending in .tax or .tax2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

That's all I can think of. I, too, would be so distraught at this late date and time. I'll post your issue where TurboTax Moderators will see it. I don't work for TurboTax; I'm a user just like you. I am just so very sorry this happened.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to provide 1099-MISC to ind contractors by 1-31 but I need to wait to file my own taxes. Can I submit 1099-MISC through turbotax prior to submitting mine?

RE: Any other files on my desktop computer that end in .tax2019 or .tax?

*.tax2019 -- Just one TTax file on my computer @ ~13.3MB (my preliminary tax file for 2019). Note: I have never used the TTax desktop software to enter Form 1099-MISC data for non-employee contractors. This year, for the first time, I opted to upgrade my TTax desktop software (from Premier to Home & Business) in order to try out the online Quick Employee Forms offered by Intuit/TTax.

*.tax -- Just some archived TTax files from 2007 and before.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

CarolineW

New Member

Michael22

New Member

CarolineW

New Member

burner718

Level 2

Magwheelz

New Member