- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I am a contractor/My wife is an employee.When I pay my tax quarterly, should I file Single or Married Filing JointlyWe always file tax returns "Married Filing Jointly"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

When you pay quarterly estimated taxes you are not asked for a filing status...you will pay them using your SS# NOT a filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

Married Filing Jointly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

If you were legally married at the end of 2019 you cannot file Single. Are you confusing that with filing married filing separately?

If you were legally married at the end of 2019 your filing choices are married filing jointly or married filing separately.

Married Filing Jointly is usually better, even if one spouse had little or no income. When you file a joint return, you and your spouse will get the married filing jointly standard deduction of $24,400 (+$1300 for each spouse 65 or older) You are eligible for more credits including education credits, earned income credit, child and dependent care credit, and a larger income limit to receive the child tax credit.

If you choose to file married filing separately, both spouses have to file the same way—either you both itemize or you both use standard deduction. Your tax rate will be higher than on a joint return. Some of the special rules for filing separately include: you cannot get earned income credit, education credits, adoption credits, or deductions for student loan interest. A higher percent of your Social Security benefits may be taxable. Your limit for SALT (state and local taxes and sales tax) will be only $5000 per spouse. In many cases you will not be able to take the child and dependent care credit. The amount you can contribute to a retirement account will be affected. If you live in a community property state, you will be required to provide additional information regarding your spouse’s income. ( Community property states: AZ, CA, ID, LA, NV, NM, TX, WA, WI)

If you are using online TurboTax to prepare your returns, you will need to prepare two separate returns and pay twice.

https://ttlc.intuit.com/questions/1894449-married-filing-jointly-vs-married-filing-separately

https://ttlc.intuit.com/questions/1901162-married-filing-separately-in-community-property-states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

When you pay quarterly estimated taxes you are not asked for a filing status...you will pay them using your SS# NOT a filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

And when you file your 1040 tax return you file your self employment income on the same Joint return with your wife's W2 income.

Here's some info....

To report your self employment income you will fill out schedule C in your personal 1040 tax return and pay SE self employment Tax. You will need to use the Online Self Employed version or any Desktop program but the Desktop Home & Business version will have the most help.

For the future, you should use a program like Quicken or QuickBooks to track your income and expenses. There is a QuickBooks Self Employment bundle you can check out which includes one Turbo Tax Online Self Employed return....

http://quickbooks.intuit.com/self-employed

You need to report all your income even if you don't get a 1099Misc. You use your own records. You are considered self employed and have to fill out a schedule C for business income. You use your own name, address and ssn or business name and EIN if you have one. You should say you use the Cash Accounting Method and all income is At Risk.

After it asks if you received any 1099Misc it will ask if you had any income not reported on a 1099Misc. You should be keeping your own records. Just go through the interview and answer the questions. Then you will enter your expenses.

Self Employment tax (Scheduled SE) is automatically generated if a person has $400 or more of net profit from self-employment. You pay 15.3% SE tax on 92.35% of your Net Profit greater than $400. The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. So you get social security credit for it when you retire. You do get to take off the 50% ER portion of the SE tax as an adjustment on Schedule 1 line 27. The SE tax is already included in your tax due or reduced your refund. It is on the Schedule 4 line 57. The SE tax is in addition to your regular income tax on the net profit.

Here is some IRS reading material……

IRS information on Self Employment

http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Self-Employed-Individuals-Tax-Center

Pulication 334, Tax Guide for Small Business

http://www.irs.gov/pub/irs-pdf/p334.pdf

Publication 535 Business Expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

Thanks for your reply. @Critter

The thing is when I use an online payment system. They still ask me to choose Select Filing Information.

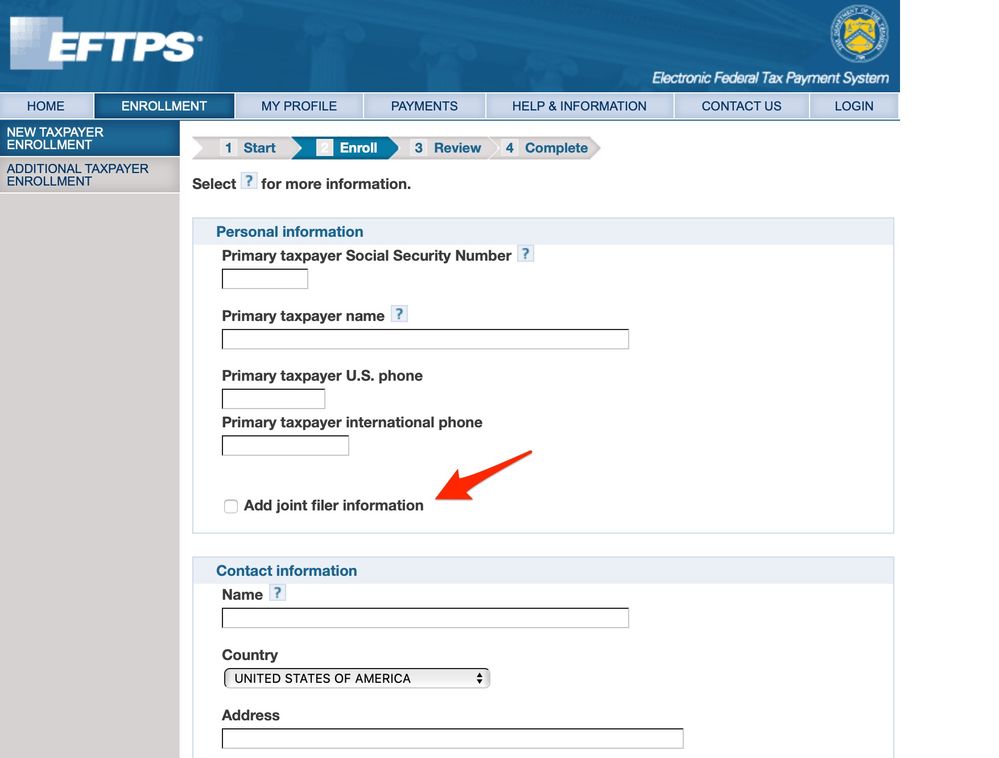

For Federal tax

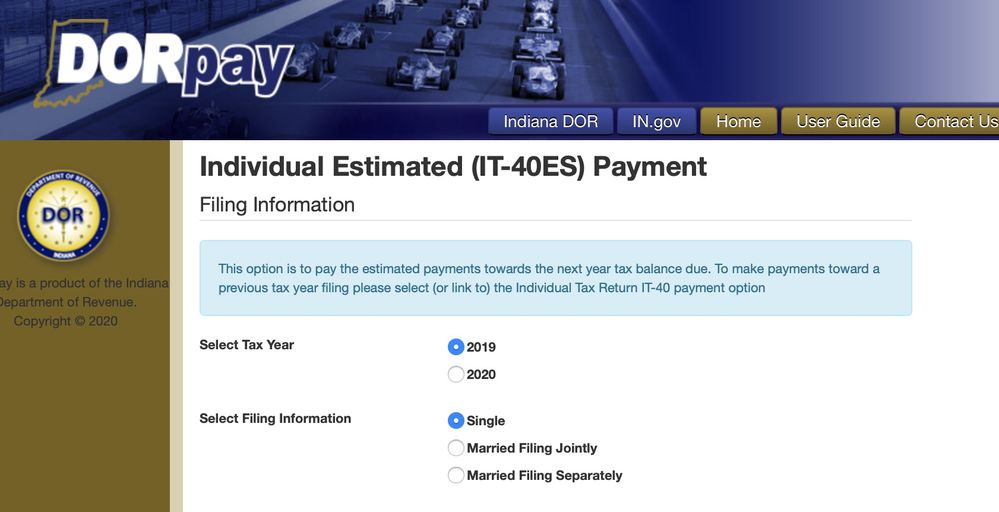

For State tax

I am still a little confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a contractor/My wife is an employee. When I pay my tax quarterly, should I file Single or Married Filing Jointly We always file tax returns "Married Filing Jointly"

Ok ... well your situation is for both the fed & state which are different ... for the fed ... you will only enter the spouse info if they are also making estimated payments which in your case they are not ... just skip that section or fill it in ... it doesn't matter.

For the state ... just pick jointly since that is how you will be filing ... don't over think the process.

Still have questions?

Make a post