- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: how to claim (deduct) foreign tax paid on foreign sock sale from US capital gain tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to claim (deduct) foreign tax paid on foreign sock sale from US capital gain tax

Hi Dear,

I would greatly appreciate some help on this.

I live in the US, last year, I sold a foreign company stock in that country and also paid local tax in that country, how do I file foreign tax sale ( I saw TT help saying just treat as a regular stock sale)

AND

how to deduct the local tax I have paid in that country from my capital gain tax paid in the US? (should I use itemized or tax credit?)

TIA

Dave

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to claim (deduct) foreign tax paid on foreign sock sale from US capital gain tax

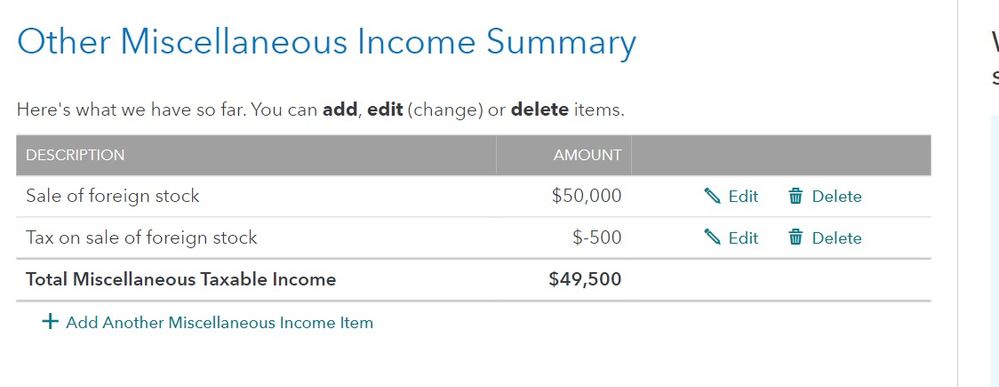

You could put it in as a 1099-B even though you don't actually have a 1099-B and the foreign tax paid as a credit under less common income.

You can also report both as:

- Wages and Income

- Less Common Income

- Miscellaneous

Someone else may have another solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to claim (deduct) foreign tax paid on foreign sock sale from US capital gain tax

Thanks for the information but I did stock sale, my understanding is that it is part of capital gain, not treated as regular income...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to claim (deduct) foreign tax paid on foreign sock sale from US capital gain tax

In that case, use the 1099-B as if you had been issued a 1099-B and mark it for capital gain.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

chunhuach

Level 1

roypimjasmine2485

New Member

natals99

New Member

kenning2

New Member

faxianjhuang

Returning Member