- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How many state and federal returns can I do with turbo tax

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

I wish you were correct, but I can't take the chance. My tax documents won't be available until March so I started my grandson's return. After I finished the federal, TurboTax said do you want to start your one state return. Normally, after I finish the federal, the program moves right on to the state and after the state is finished that is where I can choose to efile or not, and normally that is where you find out you can only efile one state but pay for additional ones. The message from Turbo Tax was after the federal was finished and before the state was started. My grandson's return is simple and I don't want to risk using my one and only state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

Are you both in the same state? The one state refers to one state PROGRAM download not returns. You need to download the state program. It can prepare all the returns you need to do in that state. You won't be using it up on the first return.

It is not a free state efile. It is $20 to efile each state return including the first one. Goes up to $25 in March. People always misunderstand that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

And nothing has changed this year in the Desktop program. It is still the same rules to efile. You get 5 free federal efiles. The rest you can print and mail. It is still $20 to efile EACH state return or print and mail state for free. You can do more than 1 state return. Why do you think it changed to only 1? You must have mailed one of the state returns last year if you didn't pay for it. Or you had the fee deducted from a federal refund so you don't remember paying for one. Check your credit card charges.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

I prepared returns for two people and I was able to get them both. So I was wrong before, and the reason was Turbo Tax asked (through the software) would you like to use your one free state now? Well at that point I didn't. I wanted to use it for the second return which was more complicated. As it turns out, I misunderstood the message but I was burned before by Turbo Tax and I didn't want to suffer again. I really thought I could e-file one state for free but Turbo Tax charged me $25.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

I purchased Turbo Tax Deluxe and have prepared my granddaughters fed tax and want to do her state. It is not complicated and I don't want to use up my own state submission e-return. Can I uses Turbo Tax to complete her state forms and print them for mailing and save the e-return for myself?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

@Jack1944 Is she in the same state as you? Yes you can print and mail all state returns for free. But if you are thinking you get 1 free state efile YOU DON'T.

In the Desktop program you get one free state PROGRAM download to prepare unlimited state returns. Then each state return (including the first one) is $20 to efile, usually goes up to $25 March 1. Or you can print and mail state for free.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

How many state and federal returns can I do with turbo tax home and business CD?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

@bhajialilou wrote:

How many state and federal returns can I do with turbo tax home and business CD?

You can create, complete and file as many tax returns, federal and state, as needed using the TurboTax desktop CD/Download editions. However, you can only e-file 5 federal tax returns. Any tax returns over 5 have to be printed and mailed. The number of e-files is set by IRS rules and cannot be changed or increased when using the TurboTax personal tax preparation software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

Hi,

So if I'm following you clearly, I can do say a Federal Return for me & my son as well as state return for both of us? And there will be no additional charges? I don't plan to really e-return. THANKS!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

Yes if you have the Desktop CD/Download program you can do unlimited returns and efile 5 federal for free. Or you can print and mail a federal return.

You can do unlimited returns for the same state and print and mail state for free or each state return is $25 to efile. You can only efile state if Federal was efiled and accepted. Oh except NY is free to efile.

FYI - To start a new return go up to FILE - New. But first be sure to save your return with a unique name so it doesn’t get confused with another return. Go to File-Save or Save As. Because if you do another return and they have the same first name or initial as you their return might save over yours.

And be in the habit of saving Frequently! When you are done save both the .tax data file and save it as a pdf file, go to File-Save to PDF. Then you won’t need the program installed to view or print your return in the future. Like if you need a copy to get a loan or something. And save backups off of your computer like to a flash drive or burn a CD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

@Hammr5311 Yes, you can prepare Federal and State returns for yourself and your son.

With the Desktop product, you can Efile up to five Federal Returns and three State Returns.

Click this link for more info on How Many Returns Can I Prepare in TurboTax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

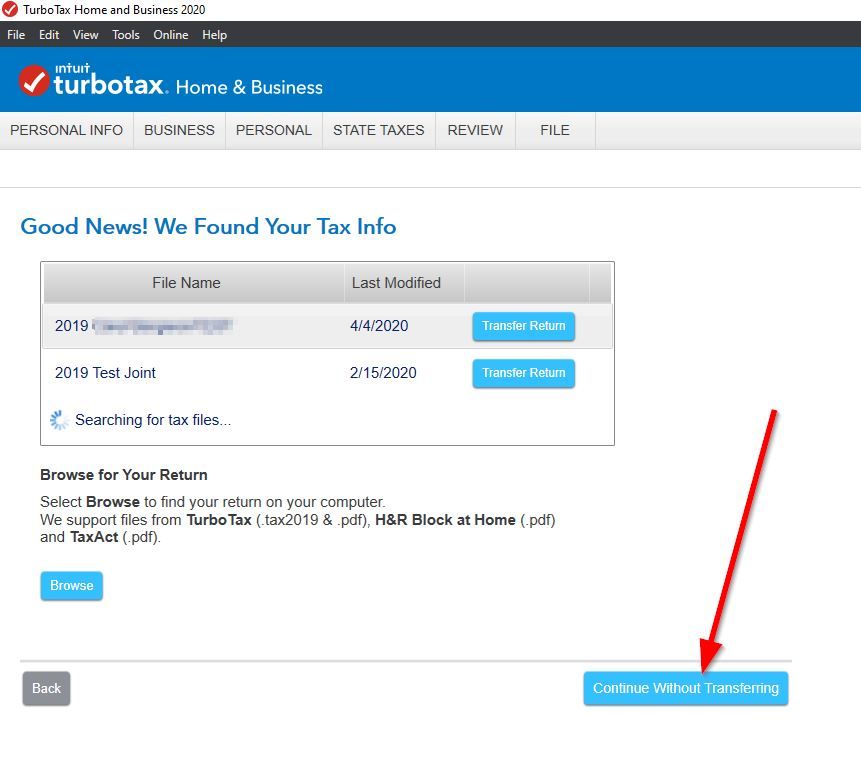

I cannot find the answer to my question. I have the desktop version of turbo tax 2020 on CD, and I understand I have up to 5 returns that I can file. But I do not see anything that explains the steps of how to start an additional return. When I open mine, and click on start new return, it shows me my own past or prior year into to transfer.

Alice J.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

If you are starting a new return, hit the Continue Without Transfering button. @alicejan7

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

But make sure you save the new file as a different name so you don't overwrite the returns you have started already.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many state and federal returns can I do with turbo tax

Actually in the Desktop program you can do unlimited returns and efile 5 for free. Do any of the returns have the same name initial as you or your spouse? There is a problem saving returns if 2 returns use the same initials, one will overwrite the other. So you have to be sure to save the returns with names completely different to keep them apart. Don't use the default name given by the program. Go up to File-Save As and give it a unique name before you start a new return.

Are you on Windows? Just Continue without Transferring

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

bmginger17

New Member

cnwa210291

New Member

mriv263247

New Member

mkeo901

New Member

anicole0578

New Member