- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

Ok where are you seeing Business taxes? If you have a Net Profit on Schedule C you pay self employment tax on it. But that is included in the total refund or tax due on your return.

The SE tax is already included in your tax due or reduced your refund. It is on the 1040 Schedule 2 line 4 which goes to 1040 line 15. The SE tax is in addition to your regular income tax on the net profit. You do get to take off the 50% ER portion of the SE tax as an adjustment on 1040 Schedule 1 line 14 which flows to 1040 line 8a. Turbo Tax automatically calculates the SE Tax and Adjustment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

If you are preparing your 2019 taxes now using the Online SE version.....STOP....you can only work on 2020 taxes now. in the "Online" software. Desktop/download software is now required to work on any 2019 tax return.

Certainly you can download whatever your 2019 tax file was if it was prepared before Nov of 2020......but after that you had to use one of the desktop Deluxe, Premier or Home&Business versions to finish them and then MAIL them in on paper yourself. Late 2019 taxes can only be mailed in now...no E-filing.

_______________________________.

As long as your prior taxes paid also cover your SE taxes, and you are still getting a refund beyond that (line 20 on the 2019 form 1040) , then no penalties and interest would be assessed.

________________________

Will penalties and interest apply if you file 2019 late and the only taxes owed are for the SE taxes on your business profits and zero liability for regular income taxes? Probably,, but I am a bit unsure, as I've never considered that particular tax subtlety. Someone else with more experience with self employment taxes would have to comment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

....added some clarifications to the answer above...after reading thru your question again and thinking on it more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

Yes, I meant to say that I'm using home & business download but there wasn't enough space to write so it was abbreviated SE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

...jsut a side note:

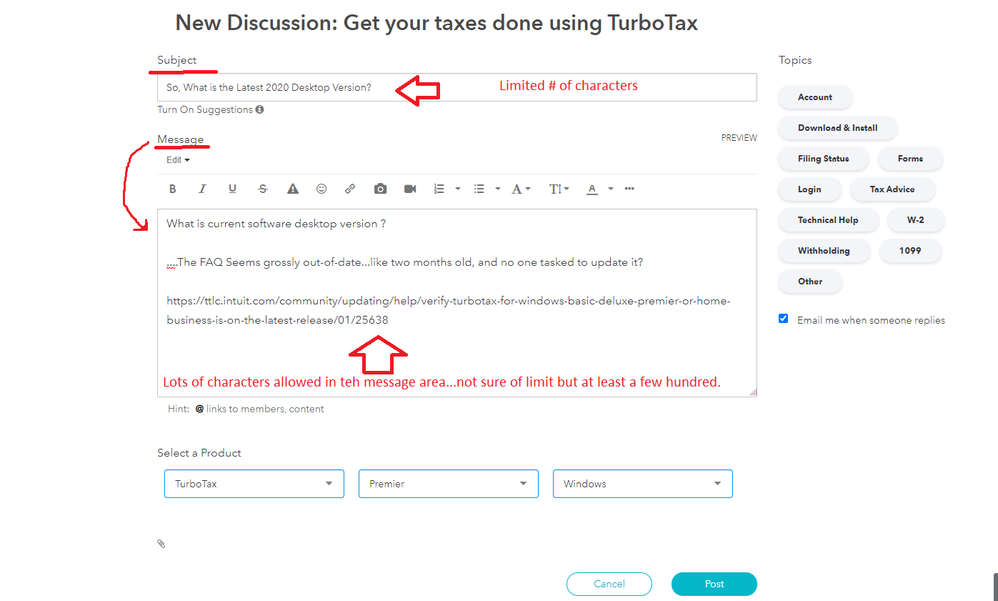

When posting an original question, (and not just a comment/reply to someone else) ...the main Question/Title box is character-limited...but there is a lower box for adding details that is extremely extensive. I've seen some details that go on for two screen pages.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

Ok where are you seeing Business taxes? If you have a Net Profit on Schedule C you pay self employment tax on it. But that is included in the total refund or tax due on your return.

The SE tax is already included in your tax due or reduced your refund. It is on the 1040 Schedule 2 line 4 which goes to 1040 line 15. The SE tax is in addition to your regular income tax on the net profit. You do get to take off the 50% ER portion of the SE tax as an adjustment on 1040 Schedule 1 line 14 which flows to 1040 line 8a. Turbo Tax automatically calculates the SE Tax and Adjustment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

Like this:

_____________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

Thanks!! That clarifies it because it would be very misleading to show a refund in TT (green), but yet in a (small) line item there is a SE tax due. It could be easily missed. So you're saying that it is there for reporting purposes. However, it has already been factored in, or captured, within the calculation process of TT, when it calculated the refund. Correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, using turbo tax SE, after calculating income and expenses, I'm due a refund, however, I noticed an amount in Business Taxes, Do I need to pay it, do penalties apply?

Right. Just follow all the lines on your tax return. Follow the math.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Kleyop

New Member

lydiagp7090

Returning Member

happyguy

New Member

morg2019

Level 2

SmallBizFiler

New Member