- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered reside...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

thank you all

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

Technically, you are a non-resident for the year 2019 and required to file a Form 1040-NR. On Form 1040-NR, you only need to report US-sourced income. Therefore, you do not need to report that income you made before moving to the US.

However, you have another option.

If you anticipate you will be staying in the US for at least 183 days in the year 2020 or meet the Substantial Presence Test SPT, you can make an election to treat yourself as a resident from October to December 2019, to file as a dual-alien alien. Please see FirstYearChoice- Residency Starting Date under the First-Year Choice.

If you meet the requirements, for the year 2019, you will be filing as a non-resident for the first ten months and a resident for the rest of the year. To read more about the pros and cons on dual status, click here: Dual status

If you decide to file as a non-resident for the whole year, as TurboTax does not support any nonresident tax forms, you are advised to contact Sprintax to file your 2019 taxes.

@sleemmz

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

Do you have a Social Security number or an ITIN? Do you have a visa status?

The following persons must file FBAR.

- A United States person, including a citizen, resident, corporation, partnership, limited liability company, trust and estate, must file an FBAR to report:

- A financial interest in or signature or other authority over at least one financial account located outside the United States if

- The aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

More information can be found here.

The instructions for IRS form 8938 Statement of Specified Foreign Financial Assets can be found here. You would need to determine whether you qualify as a specified individual (page 1 and 2). The reporting thresholds can be involved and can be found beginning on page 3.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

Thanks Jack. My question is rather in regards to my residential status. Am I considered resident or non-resident alien? If I'm a non-resident alien, do I still have to file those forms?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

and yes I have a SSN and a H1b visa

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

Technically, you are a non-resident for the year 2019 and required to file a Form 1040-NR. On Form 1040-NR, you only need to report US-sourced income. Therefore, you do not need to report that income you made before moving to the US.

However, you have another option.

If you anticipate you will be staying in the US for at least 183 days in the year 2020 or meet the Substantial Presence Test SPT, you can make an election to treat yourself as a resident from October to December 2019, to file as a dual-alien alien. Please see FirstYearChoice- Residency Starting Date under the First-Year Choice.

If you meet the requirements, for the year 2019, you will be filing as a non-resident for the first ten months and a resident for the rest of the year. To read more about the pros and cons on dual status, click here: Dual status

If you decide to file as a non-resident for the whole year, as TurboTax does not support any nonresident tax forms, you are advised to contact Sprintax to file your 2019 taxes.

@sleemmz

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

Hi Lina,

Thank you so much! this was very helpful. As I have been in the US for the entire period from 10/07/2019 - 12/31/2019, and I will meet the substantial presence test by mid-June, I will go with the 1st year choice to be treated as resident alien.

However, the IRS seems to require filing form 4868 for an extension, so I can meet the substantial presence test before I file as resident alien for 2019.

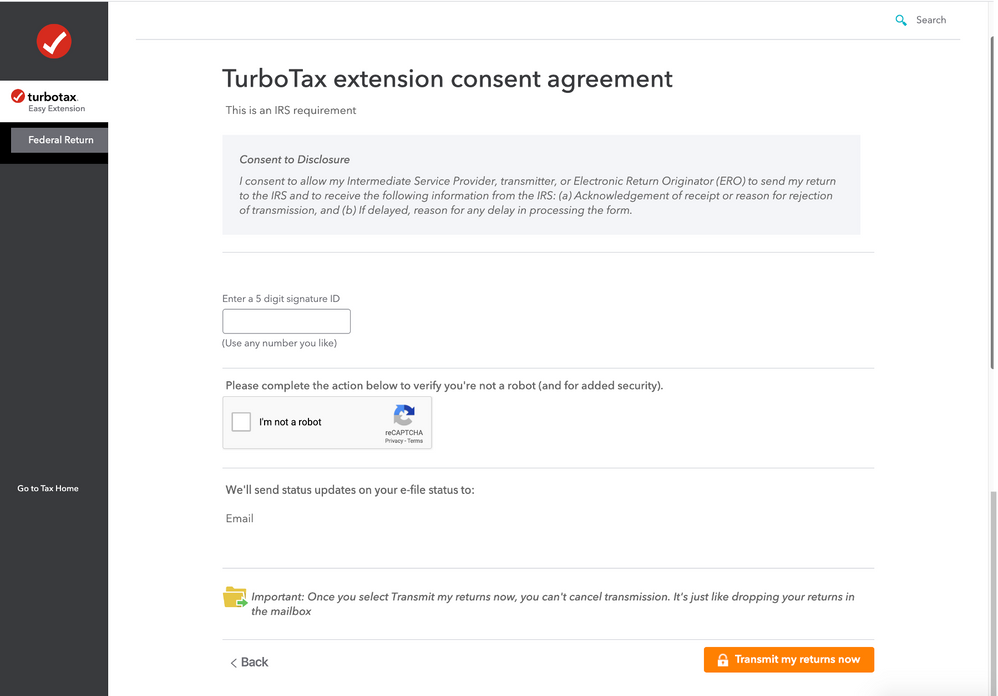

I was trying to e-file this extension request on turbotax, at the end I get a "transmit my returns now" button - I just want to make sure this means submitting the extension request and not really filing my taxes information which I have entered in turbotax.

Important: Once you select Transmit my returns now, you can't cancel transmission. It's just like dropping your returns in the mailbox.

Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

The filing deadline has been extended until July 15. You should just be meeting the 183 days.

If you are filing an extension, the income and tax liability will show. The rest of your forms would not file. It is fine for the numbers to change with your actual return.

You can file an extension now or wait and file by July 15.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

I mean does the message "transmit my returns now" apply to my tax returns or the extension request?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

This is for an extension request.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

@LinaJ2020 . Thank you so much - your recommendations are very helpful!

If I understand well, If I file as dual status alien, I am not eligible for the standard deduction, am I?

If make first year choice to be treated as resident alien, does that apply to all 2019 (Jan-dec)? If this is the case, do I get taxed for all income I earned while I was working in my previous country of residency, knowing that there's no tax treaty with the US, but apparently I could claim tax credits?

Anyone can explain how tax credits work? do I pay the difference if my previous country of residence has a lower tax rates?

Im just trying to understand what is the best filing to status to benefit from the standard deduction in my case without being taxed twice on my precious income before moving to the US.

each of the countries offers tax credits to eliminate most dual taxation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

Thanks for your reply. - it's really helpful.

I'd like to file as a resident alien to benefit from the standard deduction.

So I have two questions: Knowing that I will meet the SPT in 2020, if I make the 1st year choice:

1) am I considered resident alien for the entire 2019 or just part of it (dual-status)? Do I simply file as a resident alien?

2) to satisfy the SPT, knowing that I have been in the US since October 7th, non-stop, to calculate the SPT should I file only when i'm in the US for 183 days in 2020 - or I can start counting from October 7th, 2019?

thank you very mcuh!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi guys, I moved to the US recently and started working on 10/28/2019. Am I considered resident or non-resident alien?

Well, If I make the 1st year choice - am I eligible to the standard deduction in a 1st place, and can I benefit from the stimulus check?

In case im considered NR alien for part of 2019 (jan-october) - do I get taxed on my revenues I made while was working in the other country?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

grosiles

Level 1

Angel62

New Member

nelliecruise

New Member

molliecaitlyn-gm

New Member

Taxes=Slavery

New Member