- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: form 3531 request for signature or missing information to complete return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

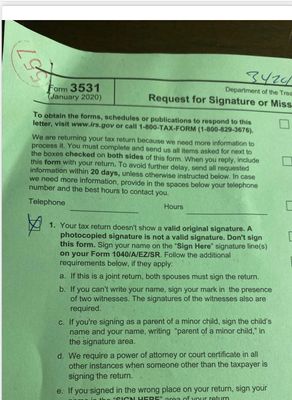

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

Well then that is even easier ... you failed to SIGN the return and attach the tax forms required.

Do so now as requested and return it so that they may process it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

Box 1 what ? A?

And box 4 says you are mixing 2 or more tax years on the same return ... you cannot do that. So you are being told the return you sent is invalid so they sent it back for corrections. In that situation you will need to complete the return again from scratch.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

Well then that is even easier ... you failed to SIGN the return and attach the tax forms required.

Do so now as requested and return it so that they may process it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

Hi if anyone can please help me...I got this letter today with box 1 and box 6 checked off.

I'm seeing box 1 just means that I need to sign my return but what does box 6 mean? please help I am totally lost. Thanks in advance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

What does the letter say? The correspondence has instructions and gives addresses to mail back the missing information. There are 20 - 30 different possibilities you could have received that form for - beside the return missing a signature.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

hi thank you for helping me

box 6 on form 3531 says: Your form 1040/A/EZ/SR is blank, illegible, missing or damaged and we can't process it. You must resubmit the original completed form along with all applicable schedules, forms and attachments. Your original signature is required.

I used turbo tax for the 1st time this year to file. I had identity fraud the year before so mu pin got sent to a different address and I wasn't aware. When I filed this year on turbo it asked for a pin and I didn't have one so it made me print out my whole tax file and mail it in to the IRS. I received this letter today asking for my signature (which is box 1 that was checked off) and box 6 checked off.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

The return may have been damaged by the Postal Service or the IRS.

Either way, they need a copy of your return with an original signature.

To get a copy of your 2019 tax return that you filed this year, sign back in to the account you used to file this year's taxes and either:

- Select Download/print return if your return has been accepted.

- Scroll down to under Your tax returns & documents (select Show if needed) and select Download/print return (PDF).

- Once your return has downloaded, locate the PDF and open it.

- Select printer icon at the top of the screen, or open the File menu in the upper-left corner and select Print if you see that.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

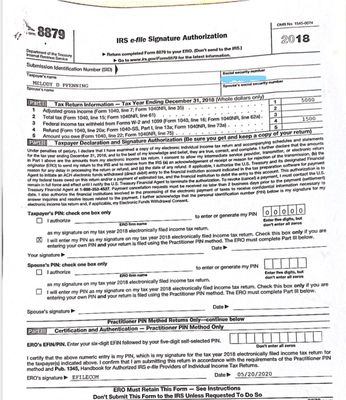

My question is, the 3531 form also came with this 8879 form. I returned all of my completed 1040 forms with the requested signed form. My question is what do I do with the 8879 form? because it says DO NOT return to the IRS. it says to return it to ERO? I have looked everywhere imaginable on the IRS site as well as called them too many times to count only to be hung up on. LOL!

However I did an e-file. Very confused. please help as it is much appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

If you mailed in the return you were supposed to sign the form 1040 so sign it and return the paper copy as the IRS is requesting. The form 8879 is only used by paid tax pros when they efile a return to capture your ink signature to keep in their files.. it is not used by the Turbotax program. Did you mail in the 8879 form by accident ? Did you use turbotax to complete a DIY return or did you use a paid tax pro ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

I had accidentally mailed in the 8879 form originally and they sent it back. So I’m pretty sure it’s just for record keeping sake?

or am I making an assumption?

and yes today, I returned all 1040 forms with my signature to the irs. So I’m assuming I should be good to go yea? Also along with the 3531 letter. Just for their reference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received form 3531 from the IRS. ( top right box ) N is checked off, with Box 1, and 4 checked off. What do i need to do?

Thank you by the way for taking the time to help me. Means a lot!

kind regards,

Melody

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

eadievsampson30

New Member

MIA3310

New Member

klipsansands

New Member

ph00756-

New Member

libragopi

New Member