- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

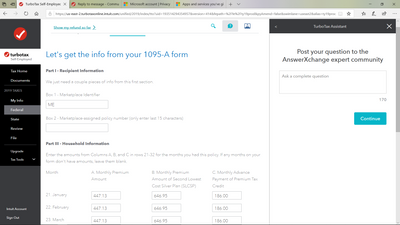

The TurboTax software was updated on 02/20/2020 to add the questions after completing the Form 1095-A.

Delete the Form 1095-A and re-enter manually.

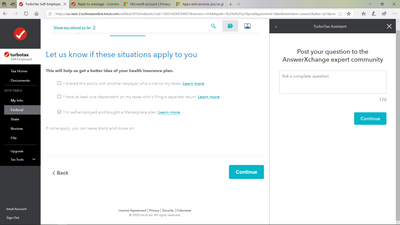

You must have a dependent being claimed on your tax return for the question about the dependent's MAGI to be available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

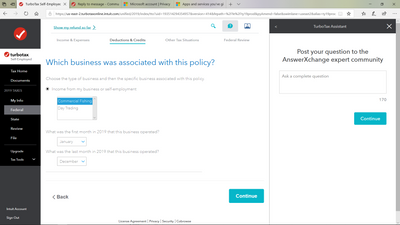

Yesterday I called and spoke to TurboTax rep and she said they were aware of the glitch and had fixed it, to login today and retry...it's still not corrected. All they need to do is add the code for Part II, which literally adds in which member of the household does this policy cover and push the info to box 2B on the 8962. For Self-Employed Fisherman that need to file by 3/15 this is starting to get a little stressful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

The TurboTax software was updated on 02/20/2020 to add the questions after completing the Form 1095-A.

Delete the Form 1095-A and re-enter manually.

You must have a dependent being claimed on your tax return for the question about the dependent's MAGI to be available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

I selected the I'm "self-employed and purchased a plan through marketplace.gov" one. And I have my daughter as my dependent on my taxes. I will try again. The rep also suggested clearing cookies and history which I did in both my internet browser and Microsoft history.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

I only deleted the identifier for the thread, it was in there for the filing 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

Part II Question is "Covered Individuals" aka me. That isn't being asked. Dependents MAGI is not relevant to the 2BDepLine being Empty I don't think?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FDI_8962_DepLine2BEmpty_ErrorHold. I posted a few days ago as the taxes were rejected twice due to the above error. missing Part II on the interview questions still.

@honey-sparrow wrote:

Part II Question is "Covered Individuals" aka me. That isn't being asked. Dependents MAGI is not relevant to the 2BDepLine being Empty I don't think?

Your AGI is already entered on the Form 8962 on Line 2a. If your dependent did not file a tax return then there will not be a need to enter anything on the Form 8962 Line 2b.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 3

cdogngeorge

Level 2

Daisy44

Returning Member

onebratso

New Member

edchen

Level 2