- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

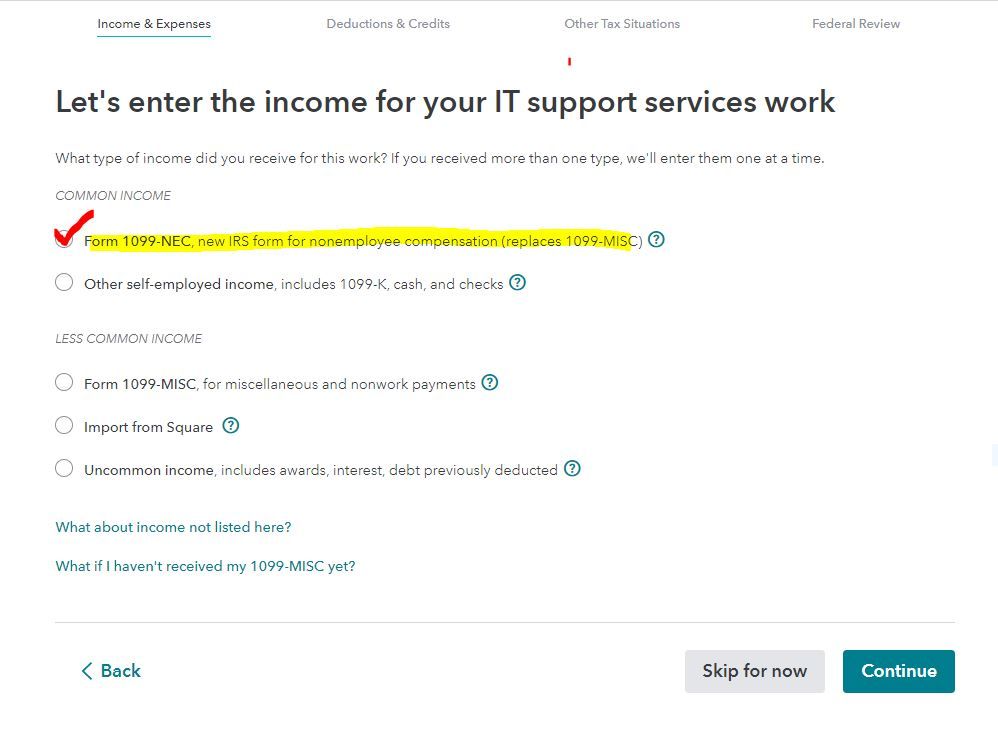

I reported my independent work income last year as 1099-MISC. But This year I have to report it as 1099-NEC. But I do not see the options on turbo to enter it?

Do anybody know how to do it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

You can enter it under General Income or wait for the developers to add the actual form to the program.

The General Income category has a description line where you can enter the name of the Payer and tax ID number if you would like to do so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

Do you know when the developer will have the form added?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

@Feng1 wrote:

Do you know when the developer will have the form added?

No, unfortunately I have no inside information and cannot give you a firm date.

I would, however, expect it to be within the next several updates (as in the next 2-3 weeks).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

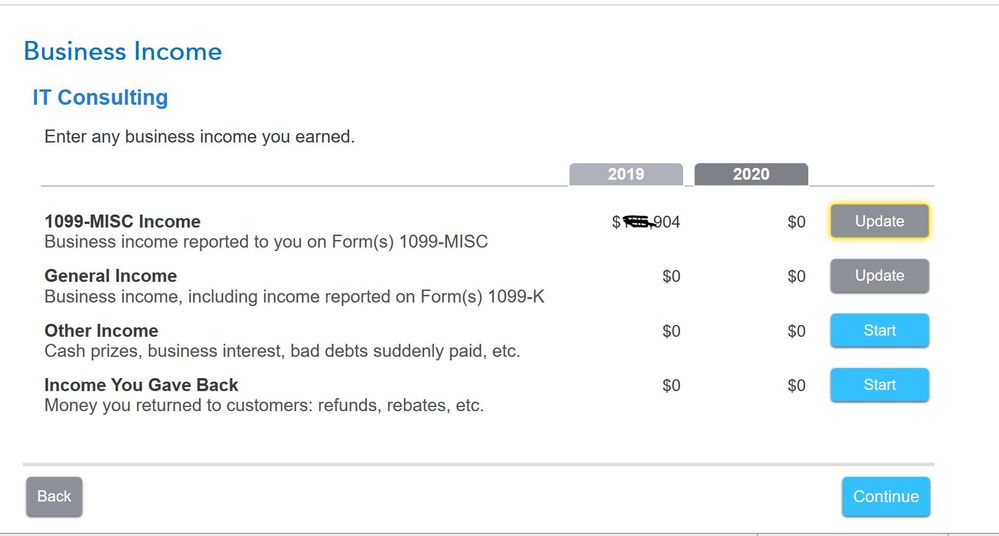

In the Desktop program you can switch to Forms Mode and open a 1099NEC and fill it out. It will populate your return. It will show up on the business income page on the 1099Misc line. That will probably be fixed when they update that part of the program.

If you have the Online version or even in the Desktop program just enter your total business income as Cash or General. You don't need to enter the actual 1099Misc or 1099NEC. Only the total goes to schedule C line 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

@Feng1 wrote:

Do you know when the developer will have the form added?

That's odd that the TurboTax desktop edition of Home & Business does not show the Form 1099-NEC in the Business Income section when the Self-Employed online edition does.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

@DoninGA wrote:

That's odd that the TurboTax desktop edition of Home & Business does not show the Form 1099-NEC in the Business Income section when the Self-Employed online edition does.

Interesting, so I guess there is some hope that Home & Business will show the form in the next update this coming week.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you know where do I enter 1099-Nec on turbo? It only give me the 1099-MISC choice.

I believe that schedule C is supposed to be updated on 1/7.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mkze

Returning Member

Mump51

Level 2

mvsickles

Level 1

annetteirene

Level 2

taxesohmy2017

Level 4