- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: direct deposit instead of mail check for tax due

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

direct deposit instead of mail check for tax due

I am planning to file by mail so can i do direct deposit of my tax due directly using IRS website and attach the proof in my return? I ran out of bank checks so i am thinking whether direct deposit is possible with file by mail process instead of mail check for paying my tax due?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

direct deposit instead of mail check for tax due

When printing and mailing a tax return the direct deposit option is also available. The bank routing and account numbers are entered directly on your federal tax return, Form 1040, on Lines 20b and 20d.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

direct deposit instead of mail check for tax due

I think you are talking about Direct Debit not Deposit. Don't know if you can do that on a mailed return. But you can pay directly at the IRS. That will be quicker too. Because if you owe too much there may be interest accruing. Then you will know it got paid.

PAY IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

direct deposit instead of mail check for tax due

doing direct bank debit on IRS should also be possible instead of entering in form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

direct deposit instead of mail check for tax due

thats correct i meant direct debit from bank. If i do it from IRS website then do i need to attach copy of payment proof with my return or no need?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

direct deposit instead of mail check for tax due

If you use the IRS website for payment of the taxes owed on the federal tax return, you do not have to attach anything to the return for proof of payment.

Your proof of payment will be the confirmation number received from the IRS using their payment website and your bank statement.

If you do use the IRS website to pay the taxes owed, then in TurboTax where asked how you want to pay the taxes use the pay by mail with the Payment Voucher option. Then you can either e-file or print the return for mailing and do not mail a check with payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

direct deposit instead of mail check for tax due

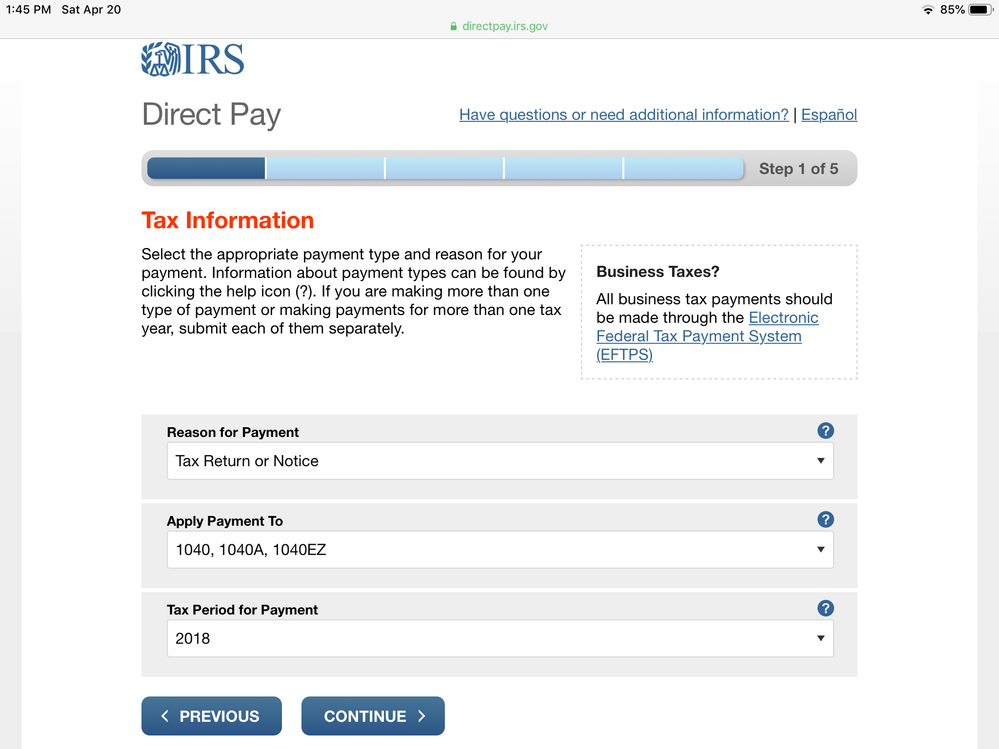

No proof needed to attach. Be sure to pay using your ssn and select 2018 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

direct deposit instead of mail check for tax due

See this screen shot

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

unionfan

New Member

crystaloconnor10

Level 1

Cmarie89

New Member

Kiish2013

New Member

henry1959

New Member