- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Child Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Tax Credit

I qualify for the child tax credit and have three children. I know it was raised to $2000 for the credit but I'm only getting $401 for the child tax and $2329 for EIC. Why am I not getting the full amount for my kids?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Tax Credit

it depends on you income level....

the child tax credit won't take you below zero liability ("non refundable tax credit").

EITC can create a refund even if your tax liability is zero ("refundable tax credit"), but the amount of the tax credit is a function of your income.

curious: does TT say you are getting a refund of $2329?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Tax Credit

So the child tax credit will offset your tax before it gets to being refunded. The $401 looks like the refundable portion. So you might owe tax of $5,599 which is offset by part of the child tax credit and the remainder ($401) is refunded. You are also limited on the child tax credit by your income level. If you do not make enough money you only get part of the credit. It's something like the credit is limited to 15% of your earned income less $2,500. If you can view form 8812 you can see the calculation of any limitation or amount applied to your tax liability.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Tax Credit

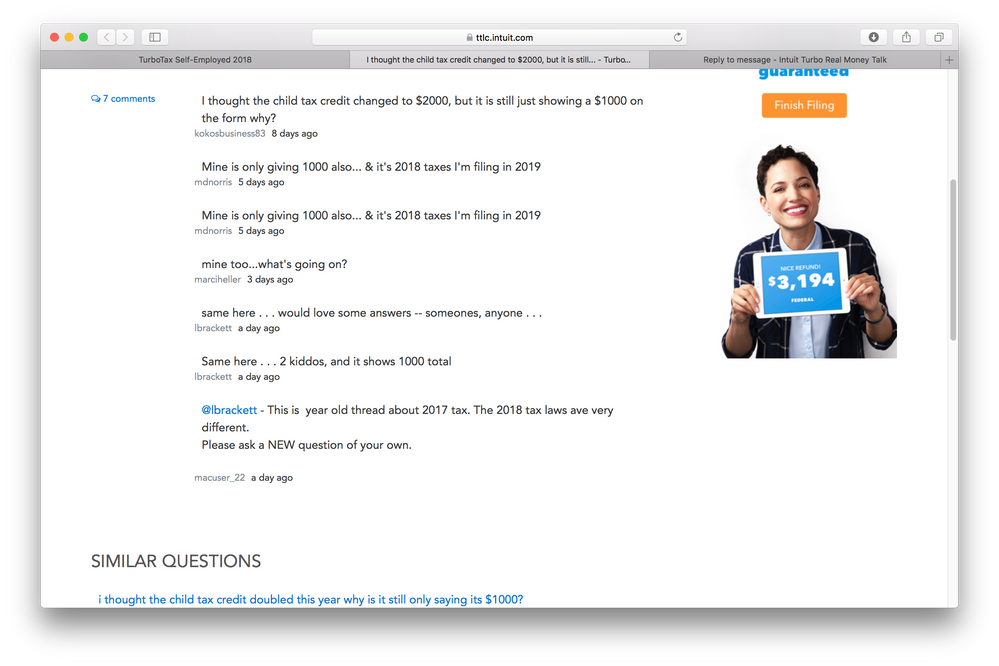

This may be slightly different than your situation, but I meet all the requirements. My daughter is only 2. Im easily between the income requirements. I definitely have a tax bill more than the $2000 credit. TurboTax online even said I am receiving the $2000 Credit, but in reality, its only reflecting $1000 in my refund. Ive been scouring the forums for answers and Ive found multiple people that use the software instead of online that said they had this problem and it was fixed by updating the software. Personally, I use online and its still showing an issue. Ive found several others having this issue. Ive attached an image from another thread with people with the same problems. Its an old thread, but the people commenting are current and referring to this problem...

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kvthompson2

Level 1

rbrower42

New Member

ambass1977

New Member

terriwood29-iclo

New Member

srfrgyrl

New Member