- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Child Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Child Tax Credit

I filed my taxes the other day and found I’m getting back around the same as I normall would. I later found out that the child tax credit is 2000 per kid this year instead of 1000. I am claiming my 2 kids on mine and if I’m readying it correct am only getting back 2759 for the both of them. They are ages 3 and 7 and were with me all year. Am I missing out on the extra 2000? If I am is there anyway to fix it? It has not been accepted by the IRS yet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Child Tax Credit

A portion of the Child Tax Credit is "refundable" (meaning that it can be actual money back to you) versus the "nonrefundable" portion that is a deducted from your total tax liability. This means it can show on different Schedules of your tax return. There are also income limits. Please see the following FAQ for more details on this What is the Child Tax Credit?

If you look at your tax return, and Schedules 3 & 5, it should be there if there are not income (or other limits) on your credits. If there is something that is not accurate, and you filed your return, you will need to wait until after your return is Accepted or Rejected by the IRS. If Rejected, you can fix it and re-file. If Accepted, you will need to file an Amended return (Form 1040X) after it is processed by the IRS.

See How to Amend a Return You Already Filed for instructions on amending. For 2018 instructions will be coming soon.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Child Tax Credit

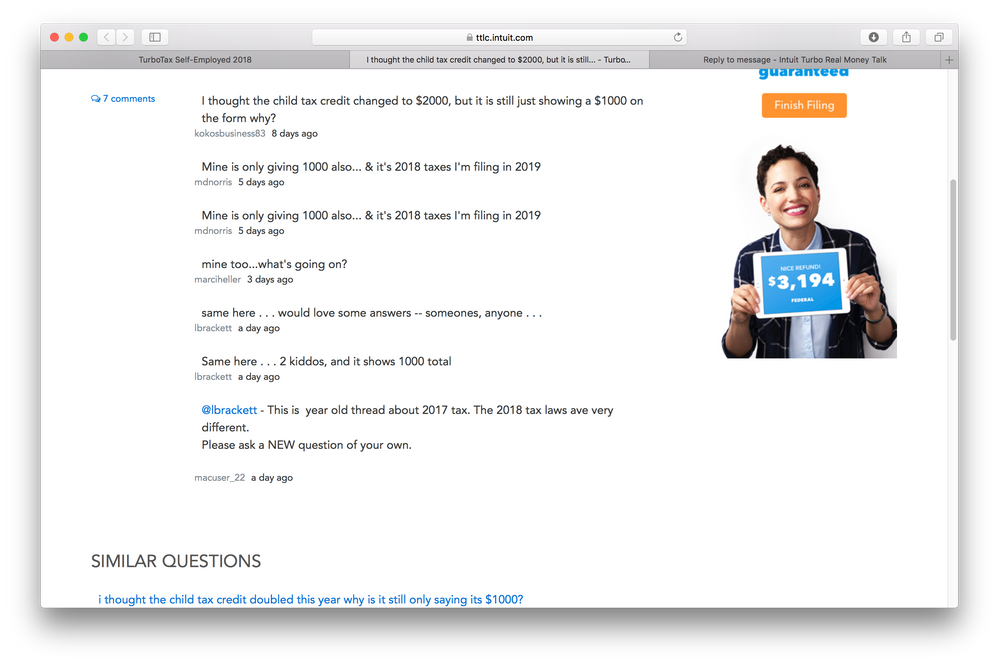

I believe there is a glitch in TurboTax. The same thing is happening to me and I meet all the requirements also. Ive found several others on TurboTax forums having the same exact problem. Ive attached an image from another thread. Its an old thread, BUT the people commenting with this problem are from this year, and referring to this glitch.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Noxlord1234

New Member

silentzypher

New Member

jantax29

New Member

ttoro

New Member

mbsvs1

Returning Member