- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Child Credit for Newborn born after June

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Credit for Newborn born after June

Hello, I wanted to give feedback about my process with Turbotax. I had a child in July, but the way that you ask your questions led to an incorrect filing. You asked how long my child had lived with me and I said 5 months. This led to her not being considered a Dependent for tax purposes. Unfortunately, after I filed my taxes I realized there was an error on your end, and now I have to submit a 1040x to correct this. Please change that screen to give an option for a newborn who lives with you full time (for any amount of the year).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Credit for Newborn born after June

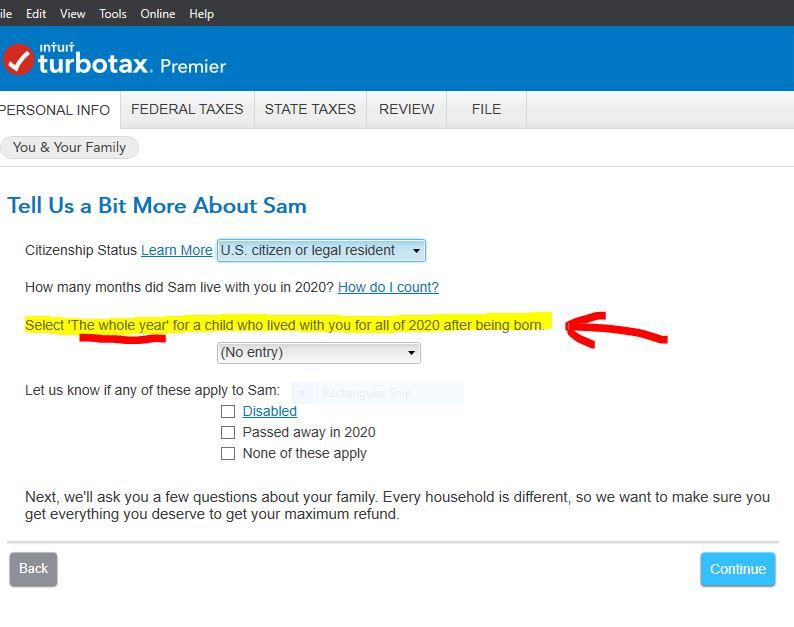

On the page for entering how long the child lived with you, it specifically states -

'The whole year' for a child who lived with you for all of 2020 after being born.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Credit for Newborn born after June

This has been an issue for years, and I don't know why TT asks the question that way, except perhaps to mimic the IRS rule. One would think, though, that since the program has the baby's DOB, it could figure out if the child lived with you more than 50% of the time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Credit for Newborn born after June

Thanks, this is helpful to see the exact wording (I couldn't find my way back to it). Reading it knowing what I know now, I would definitely know what to do.

But in that moment, I think because I was stuck in "my child has not lived with me for a year," I was still tripped up. I wonder if they could put "for the whole calendar year" or add a note that educates the customer - "You get dependent credit for your child no matter what month they were born (assuming they live with you full time after they were born)."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Credit for Newborn born after June

@SweetieJean - it is possible that a child is born in 2020 does not live with you the whole year; not frequent, but it can occur...

examples:

- baby is born July 15 and is adopted by others on August 15. Can the adopted parents check 'the whole year'?

- baby is born on July 15; parents split up on August 15 and Mom and Baby go live with Grandparents; Grandparents want to claim Baby in 2020. Can Grandparents check 'the whole year'?

But to build on your approach, why couldn't TT use the birthdate and the number of months that is checked by the taxpayer to determine 'the whole year'. So if a baby is born in August and the taxpayer chooses "5 months', then TT knows that it has to be 'the whole year'.

PS - I think this issue of 'whole year' may only be an issue if the taxpayer chooses 1-6 months as you appear to not meet the "over 6 month' conditions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Credit for Newborn born after June

Yeah, I like that idea of just having the program automatically do the math. Then the language of "whole year" which can be interpreted in different ways depending on situation wouldn't be an issue. So...does TT read these things? It's been hard to find a place to contact them directly. I have tried a couple of different methods and can't seem to get through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child Credit for Newborn born after June

- baby is born July 15 and is adopted by others on August 15. Can the adopted parents check 'the whole year'?

Can't find any reason why not in any IRS Pub I looked at. I started with IRS Pub 17. The IRS has a whole set of rules for adoptive parents, as well as foster parents.

- baby is born on July 15; parents split up on August 15 and Mom and Baby go live with Grandparents; Grandparents want to claim Baby in 2020. Can Grandparents check 'the whole year'?

Now that depends and this is covered in IRS Pub 504. For starter's, mom has first dibs per the rules, since the baby lived with mom for more nights, than with dad.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

julialpn45

New Member

jessicawinn05

New Member

sopa643479

New Member

greeneyedmonster

New Member

walidboulos-comc

New Member