- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Capital Loss Calcs WRONG. Program BUG.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

2 1/2 weeks since asking this, so I’ll ask again in hopes of getting more than mere radio silence...

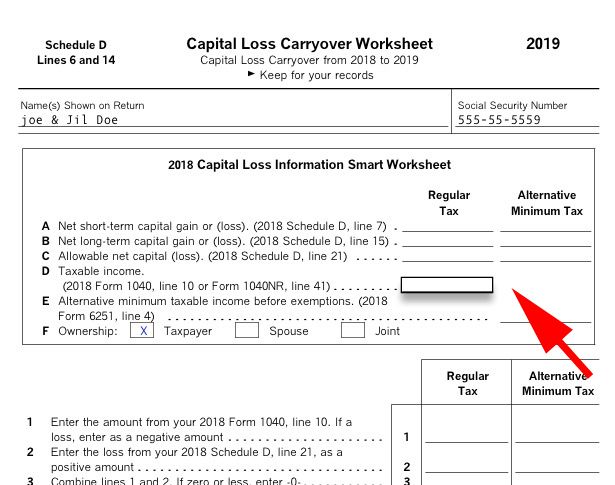

Turbo automatically imports CAP LOSS CARRYOVER from last year's return by combining 1040 Lines 9 and 10, but it clearly states that it only needs line 10. What's up with this? Should I correct it to only include the amount from LINE 10? Or should I go with the combined total which Turbo is self-populating? Don't want any red flags due to something stupid like this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

I can confirm that the 2018 1040 line 9 & 10 are indeed added together when imported to 2019.

I have submitted it to the Moderators to submit a bug report.

I find no reference in the IRS documentation that says to do that but there might be some late ruling that has not made it to the published forms (yet) that say if the QBI was deducted from income in 2018 then it must be added back in for 2019 - if there is such a ruling I can't locate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

Thank you for looking in to this I will await a final clarification on the matter.

In the meantime, I manually filled out paper worksheets using both scenarios .

SCENARIO 1: Just using LINE 10 as my input.

SCENARIO 2: Combining LINE 9 and 10 as turbo is currently doing.

In my particular case , it had no effect on the end result. However it may affect others.

Looking forward to a final determination on this from Turbo.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

Still waiting for a final answer to this.

In the interim, please just confirm something for me. Is this prompt feeding information into the IRS "CAPITAL LOSS CARRYOVER WORKSHEET"?

If so, simply looking at that IRS WORKSHEET (which I downloaded from the IRS Website) tells me last year's 1040 LINE 9 is not involved in this calculation.

With that in mind, I would simply like to enter the amount from FORM 1040 LINE 10 and move on with my life. Please confirm.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

@JayKepps wrote:

Still waiting for a final answer to this.

In the interim, please just confirm something for me. Is this prompt feeding information into the IRS "CAPITAL LOSS CARRYOVER WORKSHEET"?

If so, simply looking at that IRS WORKSHEET (which I downloaded from the IRS Website) tells me last year's 1040 LINE 9 is not involved in this calculation.

With that in mind, I would simply like to enter the amount from FORM 1040 LINE 10 and move on with my life. Please confirm.

This has been submitted as a bug. It will probably get fixed is some future update.

I doubt that any bug fix will even be able to fix any existing 2019 tax returns though. It seem to me that this error happens as a FIRST step when transferring 2018 to 2019. Once the transfer is done, the 2019 return knows noting about the what the 2018 QBI even was so there is no way to fix 2019 after the error has occurred as far as I can see, without starting a new tax return.

As a workaround if using the CD/download desktop program you can switch to the forms mode and view the

Capital Loss Carryover Worksheet line "D" and manually enter the 2018 1040 line 10 value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

My 2019 schedule D clearly shows a capital loss carryover, and this years check is fine until step 4 which tells

me to check the income from line 10 of form 1040. Line 10 of that form is NOT income, it is "Qualified business income deduction" . Plus that line is blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

I would think Turbo-Tax would respond to Kip and fix this bug.

In addition, last year Turbo-Tax pushed to have me use the Standard Deduction, with in fact got me a few dollars

more in my Federal Refund. However, when moving on to filing my State return that Standard Deduction cost me over $1000.00, not a good thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

It seems at nearly every login, TURBO asks you to install an update, yet they have been ignoring this LINE 10 thing for years now. Apparently these message boards fall on deaf ears.

Scoutmaster is right. Line 10 is NOT what turbo thinks it is. There is no excuse for this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Calcs WRONG. Program BUG.

This thread is about 2019 carry over form 2018. The lines are different in 2019 and 2020.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

PostOffice1102

New Member

Jackdmv5

New Member

stamperhs20

New Member

dbow58

Returning Member

AMC10

New Member