- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My standard deduction for 1040SR is $15,700

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

Age 65+ gets a higher Standard deduction. Do you have a question?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

That doesn't seem to be one of the Standard amounts. What is your filing status? Are you Married filing Separate? That would be 13,700.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

What is your filing status? How old are you? Are you looking at the Form 1040 Line 12?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

Yes, age 65+ gets a higher deduction ,which with my single status I thought gave me a $15,700 standard deduction. you are only giving me $14.050 ??????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

@nlbslb2018 wrote:

Yes, age 65+ gets a higher deduction ,which with my single status I thought gave me a $15,700 standard deduction. you are only giving me $14.050 ??????

What is actually shown on the federal tax return Form 1040 Line 12? Is your date of birth correct in the My Info section of the program for your personal information?

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

i have similar situation. over 65+. Line 12 of 1040 is $14,050 on my 1040SR 2020 when previewing tax return. Turbotax determined that standard deduction was better for me than itemizing. my profile has correct birthdate. does $15700 appear automatically on line 12 for persons 65+? or is difference between $15700 and $14050 accounted for somewhere else?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

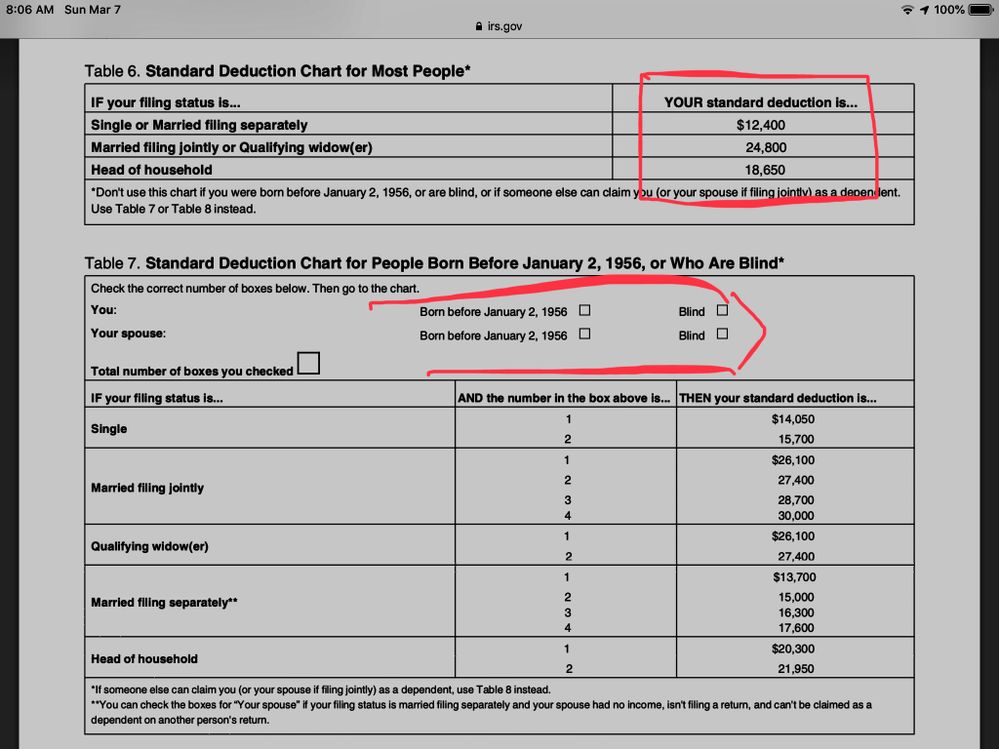

No. We don't know what the 15,700 is or what line it's on. That's not one of the Standard Deduction amounts. Looks like it would be Single over 65 AND Blind

12,400+1,650+1,650=15,700

For 2020 the standard deduction amounts are:

Single 12,400 + 1,650 for 65 and over or blind (14,050)

HOH 18,650 + 1,650 for 65 and over or blind

Joint 24,800 + 1,300 for each 65 and over or blind

Married filing Separate 12,400 + 1,300 for 65 and over or blind

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

If your Itemized Deductions are just a little over the Standard Deduction, it's possible for the Standard Deduction + the extra 300 charity on line 10b to be more than your Itemized Deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

Oh I have the chart

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My standard deduction for 1040SR is $15,700

Got it! thanks for listing standard deductions for different situations. $15700 is for single, 65+ and blind. standard deduction for single, 65+ is $14050. right amount on line 12 for me. so glad i didn't need to go back and amend.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

buckips

New Member

DavidDwight

Level 1

2016turbotx

New Member

Sactax74

Level 2

T_G_D

Level 2