- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

Just curious as to what my new husband's contribution (or subtraction) to my taxes would be and Turbo Tax won't let me get past entering my W2 info first. I would like to enter his info and see the tax implication and then go back and fill in my info.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

UPDATED FOR TAX YEAR 2019

The desktop version of TurboTax offers a What-If Worksheet. It's probably easiest to enter the information on both you and your husband in the return first. Then open the What-If worksheet and delete his information in the next column to get a side-by-side comparison.

You will get error messages if you try to enter your W-2s, etc. as spouse when there is no taxpayer. To open the What-If worksheet, please follow these steps:

- When you are in your return, click on Forms in the upper right of the screen.

- When in Forms mode, click on Open Form in the upper left of the screen.

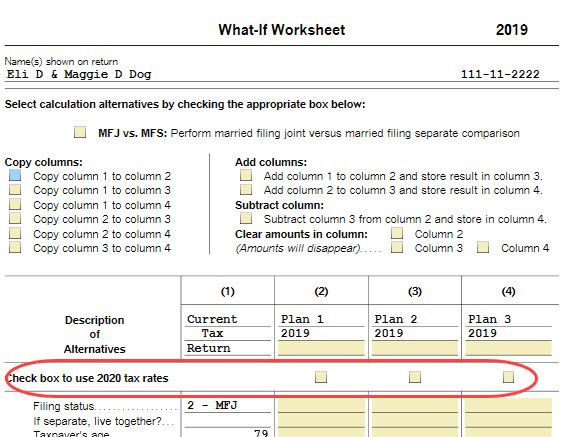

- Type in what-if and double-click on the result to open the worksheet. With the What-If Worksheet open you can use the 2019 tax rates or check the box(es) shown to use the 2020 tax rates for each scenario you will be running. [See screenshot below.]

[Edited | 3/19/2020 | 1:10 pm PDT]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

UPDATED FOR TAX YEAR 2019

The desktop version of TurboTax offers a What-If Worksheet. It's probably easiest to enter the information on both you and your husband in the return first. Then open the What-If worksheet and delete his information in the next column to get a side-by-side comparison.

You will get error messages if you try to enter your W-2s, etc. as spouse when there is no taxpayer. To open the What-If worksheet, please follow these steps:

- When you are in your return, click on Forms in the upper right of the screen.

- When in Forms mode, click on Open Form in the upper left of the screen.

- Type in what-if and double-click on the result to open the worksheet. With the What-If Worksheet open you can use the 2019 tax rates or check the box(es) shown to use the 2020 tax rates for each scenario you will be running. [See screenshot below.]

[Edited | 3/19/2020 | 1:10 pm PDT]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would like to do a "what if" with my new husband's tax information. Is there a way to do this?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

GreenSteele

Level 1

sam_va

New Member

ang222

New Member

victorbarrera197

New Member

ozrick

New Member