- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

If you made a payment when you filed the extension, just

make sure TurboTax ultimately gives you credit for the

payment. It may populate the payment automatically for

you. If it doesn't, you can enter it (or check on it) as below:

To add,

change or delete a payment made with an extension request -

· Click on Federal Taxes (Personal using Home and Business)

· Click on Deductions and Credits

· Click on I'll choose what I work on

· Scroll down to Estimates and Other Taxes Paid

· On Other Taxes Paid, click the start or update button

On the next screen, scroll down to Payments with Extension

Once you have entered (or confirmed if pre populated)

the extension payment, then before filing verify that you are getting credit

for it. Look at Line 70 of your Form 1040 and verify that the Federal

figure is correct. A state extension payment is entered in the same

navigation steps as above.

To get the amount paid on a state extension to show up on

the state return……

When you are done updating your federal

return, you need to transfer the new federal information by going back through

the state tab and the state return. Nothing will change until you transfer the

fed info to the state again. If applicable, verify that it appears on the state

return.

NOW ... if you failed to make sure the payment was already included and accidentally paid a second time then you must wait for the feds and/or state process the return and find the error and return the excess payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

If you made a payment when you filed the extension, just

make sure TurboTax ultimately gives you credit for the

payment. It may populate the payment automatically for

you. If it doesn't, you can enter it (or check on it) as below:

To add,

change or delete a payment made with an extension request -

· Click on Federal Taxes (Personal using Home and Business)

· Click on Deductions and Credits

· Click on I'll choose what I work on

· Scroll down to Estimates and Other Taxes Paid

· On Other Taxes Paid, click the start or update button

On the next screen, scroll down to Payments with Extension

Once you have entered (or confirmed if pre populated)

the extension payment, then before filing verify that you are getting credit

for it. Look at Line 70 of your Form 1040 and verify that the Federal

figure is correct. A state extension payment is entered in the same

navigation steps as above.

To get the amount paid on a state extension to show up on

the state return……

When you are done updating your federal

return, you need to transfer the new federal information by going back through

the state tab and the state return. Nothing will change until you transfer the

fed info to the state again. If applicable, verify that it appears on the state

return.

NOW ... if you failed to make sure the payment was already included and accidentally paid a second time then you must wait for the feds and/or state process the return and find the error and return the excess payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

You can arrange for the Live help you are paying the extra fee for with your questions from 5 a.m. to 5 p.m. Pacific time Monday - Friday.

https://ttlc.intuit.com/questions/4124827-how-do-i-connect-with-a-tax-expert-in-turbotax-live

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

Hi,

I followed your instructions to check the tax paid at extension. I see a number there but it doesn't show up in the tax form 1040. I tried to change the number and play with it, but nothing changes. This seem to be a bug. I am using the desktop version.

Since I am supposed to get some money back from Federal as I overpaid at extension. could you please let me know how to get the refund?

Thank you,

Wei

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

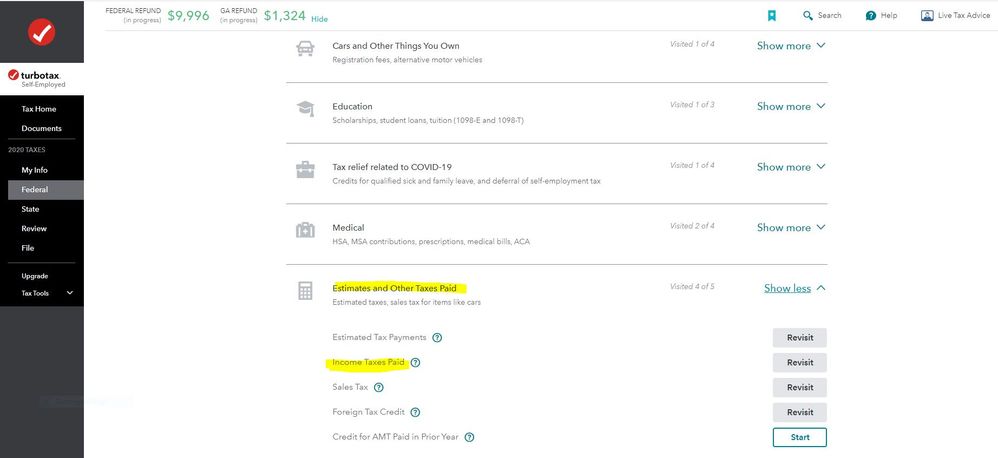

I dont understand how so many dont think this is a serious software issue. I am going thru the process right now, and the software isnt asking me anywhere what amount was paid upon extension. when i go to the screen the user mentions above via "Other taxes paid" i dont see the link mentioned:

HAHAH! I just tried to copy paste image of screen and i cant!

anyway, there is NO " On Other Taxes Paid, click the start or update button"

i see estimates, other income taxes, sales tax, foreign taxes and credit for AMT. THAT IS ALL. So where do i specify that i already filed for an extension!!?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

cause it kinda does it for you!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

Also what about the state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

When you requested your extension you were supposed to pay your estimated tax due. Did you enter the payment you made into your tax return? Go to Federal>Deductions and Credits>Estimates and Other Taxes Paid>Other Income Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid my estimated tax bill when I filed my extension, then turbotax let me pay my tax bill again when I filed. When will I get my duplicate payment back?

@sleepingtiger wrote:

I dont understand how so many dont think this is a serious software issue. I am going thru the process right now, and the software isnt asking me anywhere what amount was paid upon extension. when i go to the screen the user mentions above via "Other taxes paid" i dont see the link mentioned:

HAHAH! I just tried to copy paste image of screen and i cant!

anyway, there is NO " On Other Taxes Paid, click the start or update button"

i see estimates, other income taxes, sales tax, foreign taxes and credit for AMT. THAT IS ALL. So where do i specify that i already filed for an extension!!?

If you used the TurboTax Easy Extension to electronically file the extension request, Form 4868, and make the tax payment with the request, the payment should already entered on your tax return. Provided you used the same user ID for the 2020 online tax return as was used for the Easy Extension. You can check to see if the amount is on your tax return by clicking on Tax Tools on the left side of the screen. Then click on Tools. Click on View Tax Summary. Then click on Preview my 1040.

The federal extension payment will be shown on Schedule 3 Line 9. The amount from Schedule 3 Part II Line 13 flows to Form 1040 Line 31

To enter, change or delete a payment made with an extension request (Federal, State, Local) -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Deductions and Credits

- Click on I'll choose what I work on (if shown)

- Scroll down to Estimates and Other Taxes Paid

- On Income Taxes Paid, click on the start or update button

On the next screen select the type of extension payment made and click on the start or update button

Or enter federal extension payment in the Search box located in the upper right of the program screen. Click on Jump to federal extension payment

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jeanderson76-gma

New Member

mrhardrockcafe

Level 1

25519320565f

New Member

masonjayh

New Member

kevinlucas00-gma

New Member