- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I had a baby in December 2020 but Turbo Tax listed her as “Other Dependent” on my return? Why did she not qualify for child tax credit? She has a SSN.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a baby in December 2020 but Turbo Tax listed her as “Other Dependent” on my return? Why did she not qualify for child tax credit? She has a SSN.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a baby in December 2020 but Turbo Tax listed her as “Other Dependent” on my return? Why did she not qualify for child tax credit? She has a SSN.

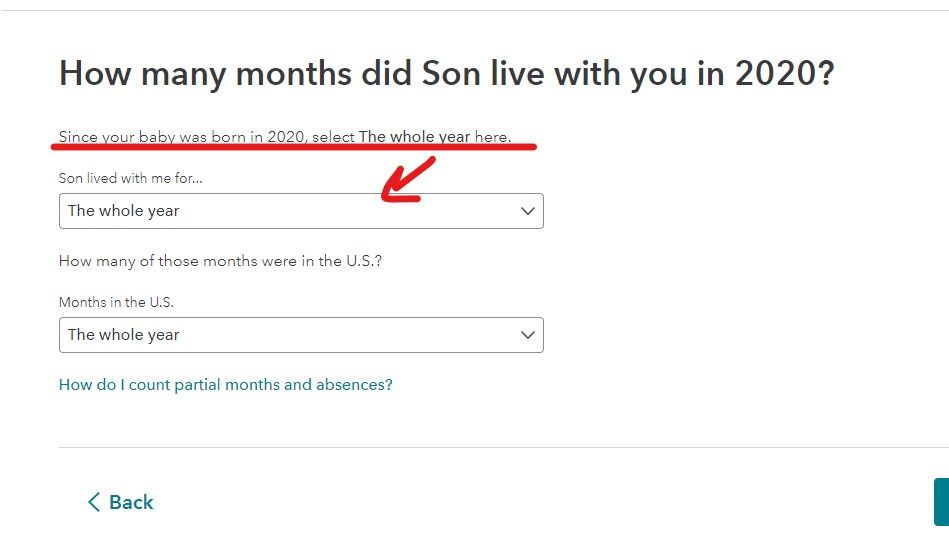

#1 reason is you failed to READ the direct instructions on this screen :

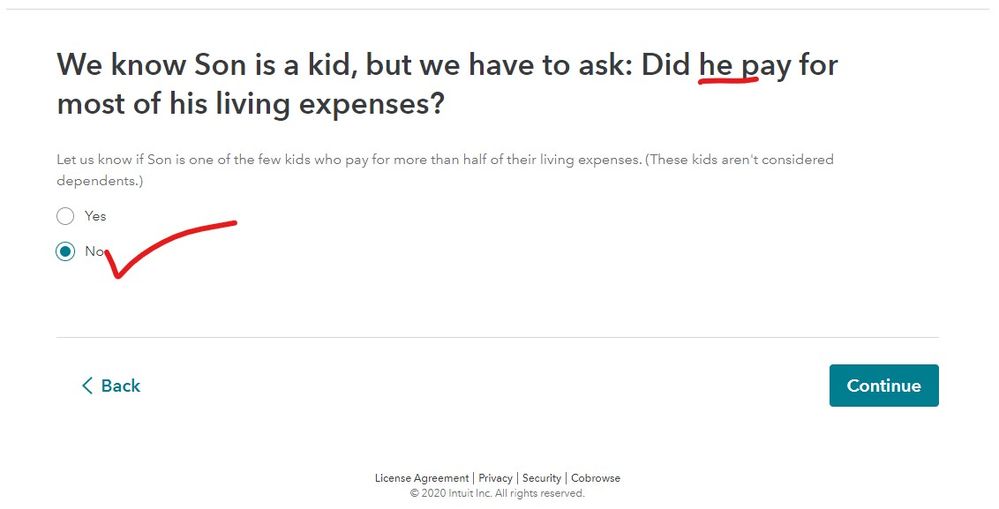

#2 reason would be this screen ... the question was NOT if YOU provided the support ....

Good news since you did not catch this on the original return you can amend it ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a baby in December 2020 but Turbo Tax listed her as “Other Dependent” on my return? Why did she not qualify for child tax credit? She has a SSN.

#1 reason is you failed to READ the direct instructions on this screen :

#2 reason would be this screen ... the question was NOT if YOU provided the support ....

Good news since you did not catch this on the original return you can amend it ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a baby in December 2020 but Turbo Tax listed her as “Other Dependent” on my return? Why did she not qualify for child tax credit? She has a SSN.

If you made a mistake about how long your child lived with you then you make the correction in My Info when you amend. You have to say a newborn child lived with you for the whole year in order to get the child related credits. Unfortunately, this is going to affect the monthly CTC payments. It is going to take a long time for the IRS to process your amended return, so you will have to wait and get the CTC for 2021 on your 2021 tax return.

Select your tax year for amending instructions:

What does it mean to "amend" a return?

· Do I Need to Amend my Tax Return?

Even during “normal” times it takes about four months for the IRS to process an amended return. During the pandemic and due to the severe backlog at the IRS it is taking much longer—six months or more for many amended returns. Do not expect quick results from amending. When the IRS issues a refund for an amended return it will be by check. They do not make direct deposits for refunds for amended returns. You can watch for information here:

https://www.irs.gov/Filing/Individuals/Amended-Returns-(Form-1040-X)/Wheres-My-Amended-Return-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a baby in December 2020 but Turbo Tax listed her as “Other Dependent” on my return? Why did she not qualify for child tax credit? She has a SSN.

Well now I feel stupid. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a baby in December 2020 but Turbo Tax listed her as “Other Dependent” on my return? Why did she not qualify for child tax credit? She has a SSN.

Not stupid ... just sleep deprived. Going forward review the entire return BEFORE you file and then sleep on it and review it again the next day. Most mistakes would be caught if folks just take a moment to review the return and review it again the next day. So many posts on this forum start with " I JUST FILED " and I see I made a mistake.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jbatting

New Member

melissaproffitt

New Member

lalaps23

New Member

cmacle03

New Member

PetesSake

New Member