- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

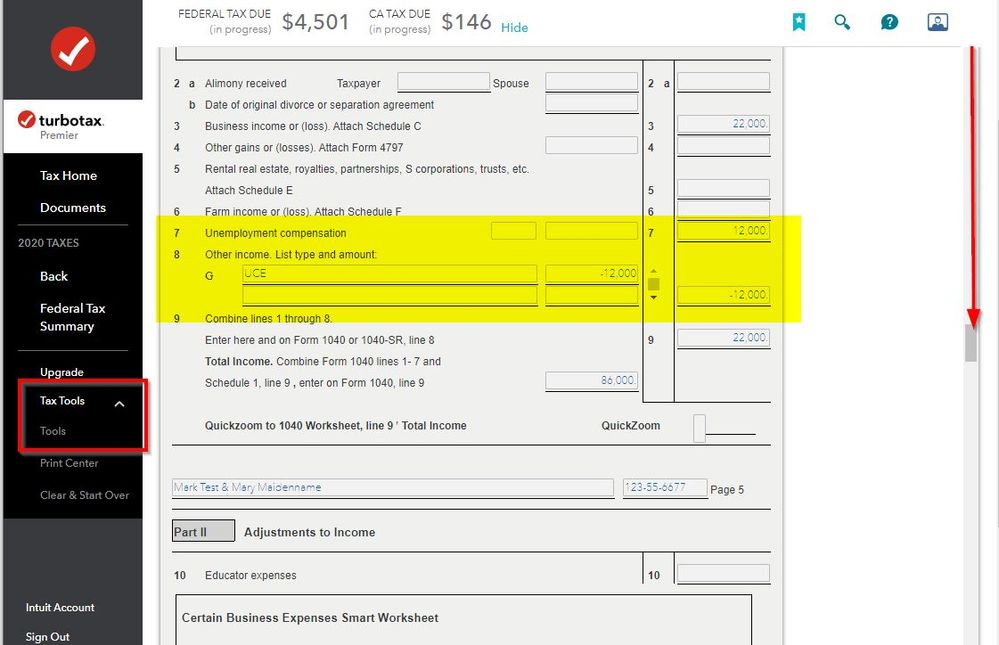

Here's my test account. I can see schedule 1 without paying the fees.

Go to left menu, TAX TOOLS -> Tools -> View Tax Summary

Then on the left side click on Preview my 1040

Then scroll way down to Schedule 1

I must have a 12,000 UCE subtraction for a married return. You must get a 20,400 exclusion for married even if only 1 person had unemployment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

look at schedule 1 line 8. there would be a subtraction noted as UCE. even if it isn't there, the IRS is automatically correcting returns for those that qualify. do not file an amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

Thank you! I should have specified this but I haven't paid the TurboTax fees yet and submitted my return. I want to make sure that they have factored that exclusion in before I pay and file. Is there a way to confirm this within the site?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

Your unemployment compensation will be on Schedule 1 line 7. The exclusion will be on Schedule 1 Line 8 as a negative number. The result flows to Form 1040 Line 8.

When did you file? If you have filed early before the exclusion, the IRS will recalculate your return for the new 10,200 unemployment exemption for you. There is no need for taxpayers to file an amended return unless the calculations make the taxpayer newly eligible for additional federal credits and deductions not already included on the original tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

Before filing, You can preview the 1040 or print the whole return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

Thank you! I should have specified this but I haven't paid the TurboTax fees yet and submitted my return. I want to make sure that they have factored that exclusion in before I pay and file. Is there a way to confirm this within the site?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

In case you missed my reply......

Before filing, You can preview the 1040 or print the whole return

Your unemployment compensation will be on Schedule 1 line 7. The exclusion will be on Schedule 1 Line 8 as a negative number. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

Here's my test account. I can see schedule 1 without paying the fees.

Go to left menu, TAX TOOLS -> Tools -> View Tax Summary

Then on the left side click on Preview my 1040

Then scroll way down to Schedule 1

I must have a 12,000 UCE subtraction for a married return. You must get a 20,400 exclusion for married even if only 1 person had unemployment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know whether TurboTax factored the IRS unemployment tax exclusion up to $10,200 into my return?

Thank you SO so much, this is perfect!!!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

angcln

New Member

kgaro113

Level 2

pyx_cs13

New Member

jtraini21

New Member

razor5

Level 3