- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

To file a return for a prior tax year

If you need to prepare a return for 2016, 2017, or 2018 you can purchase and download desktop software to do it, then print, sign, and mail the return(s) Buy Deluxe. All of the desktop software which you must use has all of the same forms and schedules. The more expensive versions like Premier or Home and Business give you more help with investment income, rental income or self-employment income if you have to upgrade as you work on the returns. Of course, if you are really in a mess because you have not filed in three years, you could seek local paid tax help.

https://turbotax.intuit.com/personal-taxes/past-years-products/

Remember to prepare your state return as well—if you live in a state that has a state income tax.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Note: The desktop software you need to prepare the prior year return must be installed/downloaded to a full PC or Mac. It cannot be used on a mobile device.

If you are getting a refund, there is no penalty for filing late. If you owe tax due, then file and pay the amount due as shown on the Form 1040, but expect a bill later from the IRS for the penalty and interest you will owe. Only the IRS will calculate this—TurboTax will not calculate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

Oh---and I should have said too that each year must be mailed in its own separate envelope. Do not combine tax years by mailing them together or you risk one being overlooked or thrown away. Prepare and MAIL each tax return separately. Federal and state returns go to separate addresses as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

To file a return for a prior tax year

If you need to prepare a return for 2016, 2017, or 2018 you can purchase and download desktop software to do it, then print, sign, and mail the return(s) Buy Deluxe. All of the desktop software which you must use has all of the same forms and schedules. The more expensive versions like Premier or Home and Business give you more help with investment income, rental income or self-employment income if you have to upgrade as you work on the returns. Of course, if you are really in a mess because you have not filed in three years, you could seek local paid tax help.

https://turbotax.intuit.com/personal-taxes/past-years-products/

Remember to prepare your state return as well—if you live in a state that has a state income tax.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Note: The desktop software you need to prepare the prior year return must be installed/downloaded to a full PC or Mac. It cannot be used on a mobile device.

If you are getting a refund, there is no penalty for filing late. If you owe tax due, then file and pay the amount due as shown on the Form 1040, but expect a bill later from the IRS for the penalty and interest you will owe. Only the IRS will calculate this—TurboTax will not calculate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

Oh---and I should have said too that each year must be mailed in its own separate envelope. Do not combine tax years by mailing them together or you risk one being overlooked or thrown away. Prepare and MAIL each tax return separately. Federal and state returns go to separate addresses as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

Thank you very much for your help. I really appreciate it 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

If I buy the deluxe package will it allow me to file all 3 years missed? When I went to purchased it just said 2018. Does it mean I have to purchase a package for each year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

Sorry, You have to buy each year separately. The program is only good for 1 year. You can only buy the last 3 years so currently 2016-2018 and 2019 of course.

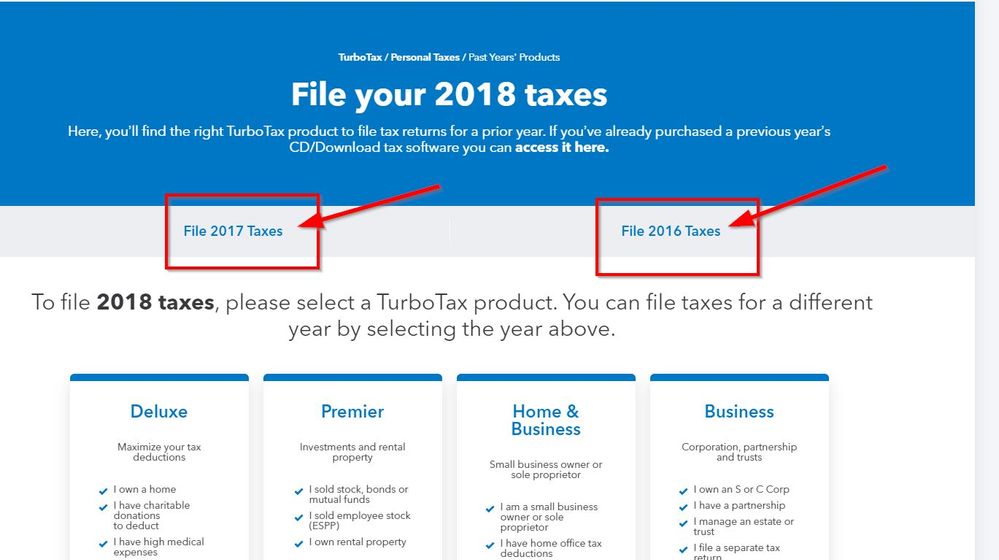

On this link do you see File 2017 and File 2016 below the big blue box at the top that's for 2018? Click on each of those to buy.

https://turbotax.intuit.com/personal-taxes/past-years-products/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

Made you a screen shot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

Penalties in Tennessee for filling late?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Havent filed taxes for the last 3 yrs. Need help knowing what forms to fill out or what turbo tax to buy.

@Coreycarney69 Tennessee has no state income tax.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Nickstax15

New Member

maxfinder7

New Member

jcroeder

New Member

smith_maire

New Member

fivegrandsons

New Member