- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Error Message in entering W2 info for a non-qualified pension plan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

My W2 for a non-qualified pension plan shows a value in Box 1 and 11, however for my state (PA) there are no values just zero is listed. TurboTax is saying I have an error if I report box 16 & 17 as zero numbers which my W2 lists, the program is saying the info in Box 11 does not match box 15 for my state of PA. Each time I type in the info TurboTax takes it out and gives me the error message - how do I correct this to eliminate the error message?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

At this point, we may need to look at your file to pinpoint the specific issue you are having regarding your W2 issue. What we are going to ask you to do is to share your tax return information with your entire personal information scrubbed clean. All we will look at is the numbers in the return.

If you are using the online version. go to tax tools>tools>share my file with agent. once you select this, you will receive a token number. What is that token number?

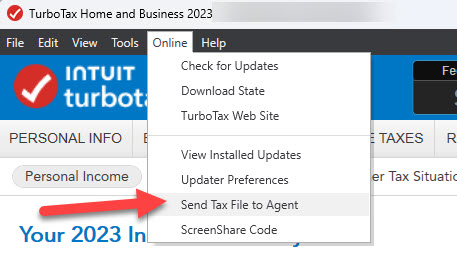

If you are using the software, go online>share tax file with agent. Press send at the next screen and this will give you a token number. What is that number please?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

DaveF1006 - Do you need to only see the W2 info loaded or all the information loaded, I’m a little hesitant to send my full tax return. And if I do share the return, how do I scrub all my personal information, including account numbers etc.?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

Also - I just tried to follow what you mentioned in your previous message but did not see anywhere to "share tax file with agent"?

If you are using the software, go online>share tax file with agent. Press send at the next screen and this will give you a token number.

Bob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

You'll find Online in the TurboTax header (black bar at the top of the screen) in all versions of TurboTax for Desktop. See screenshot below. Note that the program removes all personal information from the file that is prepared for sharing.

Please respond to this post with the token number, tag (@) the Expert who requested it, and list all States in your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

Token # - 1182900, PA only state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

In reviewing your return, I would suggest editing your W2 entry in your federal return. In Box 15, record this as PA. For the State ID#, use the EIN that you recorded in your W2. In Box 16, record $194.28. Leave Box 17 blank. This should clear the error. I get no errors in my diagnostic return with this procedure.

Let me know if this helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

Dave - thanks. The suggestion resolved the error message I was getting.

Much appreciated! Bob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

Dave - I have another question, this one regarding my PA State Return. How do I enter information from a PA Schedule RK-1 for income received from an Estate? The PA-40 Income Tax Return form, Line 7 states we need to fill out PA Schedule J, but I don't see where this information in inputted? We received a PA Schedule RK-1 that lists income from an estate.

Bob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

Dave - please ignore my previous message, I was able to work this out based on information on-line. Bob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Message in entering W2 info for a non-qualified pension plan

DaveF1006 - I am having a very similar error to what is being experienced by rlieberman10. As to your solution:

It sounds like you used the Federal EIN in Box 15. Correct?

As to Box 16, is the amount you reference of $194.28 the full amount of the non-qualified pension income reflected in Box 1?

As to Box 16 and inserting the $194.28, isn't doing this a problem since the actual W-2 says "$0.00"?

As to my specific issue, I have made a number of posts as PADenny for the subject W-2 Box 11 and I am awaiting further input as to my last posts posted within the past week. MonikaK1 said last Saturday that she was elevating this issue for further review.

Info of particular note is that my applicable plan is nonqualified for Federal as it did not satisfy the salary hierarchy discrimination test, but is qualified for PA state purposes as it meets PA qualification tests (and is therefore eligible (no tax) in PA.

Hopefully I will hear back from a TurboTax expert shortly since the tax deadline is fast approaching.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

j-solberg7ci

New Member

Lukas1994

Level 2

SterlingSoul

New Member

Jonson702ER

New Member

livingst

New Member