- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Dependent or not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent or not?

My child is under 24 and in college. Over have of their support comes from investment income (div, interest and capital gains), not from wages. Is my child a dependent? I swear Turbo Tax recent update changed the wording on the step by step to use the words "Earned income" whereas before it was just income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent or not?

Lastly, what are the implications of forms 1098-T? If they are a dependent, I enter this on my taxes. If they are not a dependent, they enter on their taxes. What about if they are a dependent, but I choose not to claim them - who enters the 1098-T in that case?

That is all correct. You can use the worksheet for support (I posted the link) to determine that.

You never have to claim a dependent, but that person cannot claim them self if they *could* be claimed whether they are actually claimed or not.

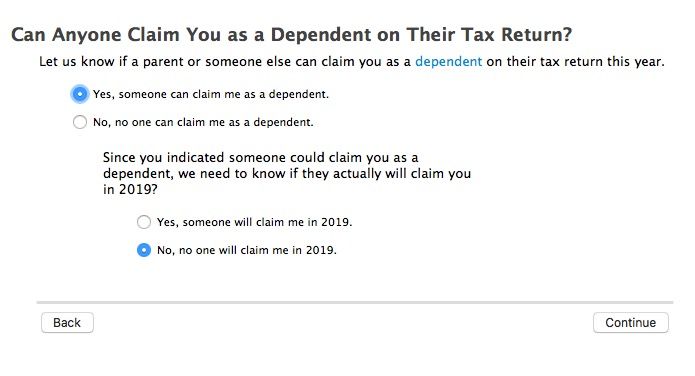

Your last questions is precisely why there are two questions about being a dependent - *Can* you be a dependent and *were* you claimed as a dependent. (see screenshot).

The ONLY difference when answering no to the 2nd questions is so the child can then claim certain educational credits (1098-T, etc.) on the child's tax return that the parent would claim if they claimed the child.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent or not?

The support test is is he provides more than half of his own support. The nature if the money that he used to do that is immaterial, whether it comes from wages, investment income, or savings in a bank account. It is if he provides the money that pays for the support from his funds or not.

See Worksheet 3-1. Worksheet for Determining Support

https://www.irs.gov/publications/p17#en_US_2019_publink1000171012

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent or not?

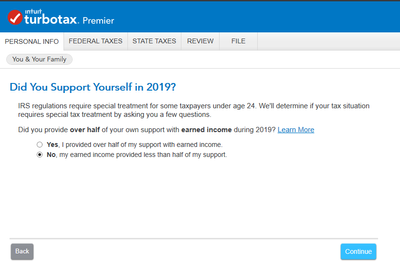

Thanks for the reply. So take a look at this screen shot from TurboTax step by step. Based on what you are saying, this is incorrect?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent or not?

Yes for his tax return if he did not pay for his his own support from *earned* income.

That questing is different from the dependent support test that only asks if the child paid for half of their support from any of the dependents funds.

The screen you posted would deem to come form the 8615 (Children with unearned income) to determine the tax on that income. That has nothing to do with being a dependent.

Edited to add information about the 8615 form for unearned income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent or not?

@jonblauch I edited the above comment about your screenshot to add information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent or not?

@macuser_22 - I much appreciate your engagement. So let me get this straight. To determine if my child is a dependent or not, the source of the income does not matter. So lets say my child is not a dependent as investment income covered most of their expenses. Then when I fill out their return, the question is for a different purpose. In my case, my child did not provide more than half of their support from earned income, the implication of which is that the kiddie tax ( form 8615 ) applies. If she did provide more than half her support from earned income, then the kiddie tax would not apply.

Alternatively, lets say they child did not pay half their support from investment income, I still have the option of not claiming them as dependent. I think the reason I would consider that is if my income disqualifies me from any education credits.

Lastly, what are the implications of forms 1098-T? If they are a dependent, I enter this on my taxes. If they are not a dependent, they enter on their taxes. What about if they are a dependent, but I choose not to claim them - who enters the 1098-T in that case?

Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent or not?

Lastly, what are the implications of forms 1098-T? If they are a dependent, I enter this on my taxes. If they are not a dependent, they enter on their taxes. What about if they are a dependent, but I choose not to claim them - who enters the 1098-T in that case?

That is all correct. You can use the worksheet for support (I posted the link) to determine that.

You never have to claim a dependent, but that person cannot claim them self if they *could* be claimed whether they are actually claimed or not.

Your last questions is precisely why there are two questions about being a dependent - *Can* you be a dependent and *were* you claimed as a dependent. (see screenshot).

The ONLY difference when answering no to the 2nd questions is so the child can then claim certain educational credits (1098-T, etc.) on the child's tax return that the parent would claim if they claimed the child.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

lettersnumbersdashesaunderscores

New Member

KFauver

Level 1

narviaf

New Member

eyeluvmyboys

New Member

2Indian R

New Member