- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Box for state withholding at end of 1099-R manual entry?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

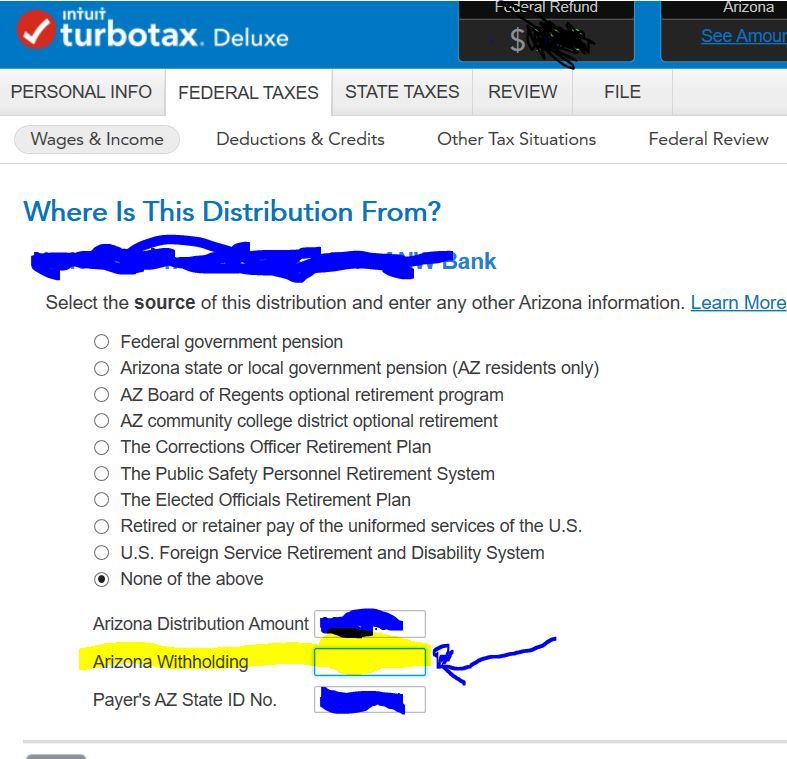

I was into the deductions part of TurboTax when my wife discovered we also had a 1099-R form. So I searched for topic 1099-R in Help, found it & jumped to it, chose to enter it myself (as my bank was not on the list to auto-import from), and I got to what I think is close to the end of the questions/worksheet, and its asking about my state withholding. see pic below. I did not finish the federal part of TurboTax, let alone the state. So not sure what to put there.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

Not 0 - BLANK. Return to the 1099-R section and delete the 1099-R, then re-enter it manually and do not enter anything in any boxes in box 12-14.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

If box 12 is blank or zero then ALL boxes 12-14 MUST be BLANK. No tax withheld on box 12 means there can be no state ID or state amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

No, not on my 1099-R. Box 12 is most definitely blank. Box 13 does contain a value for State/Payer's no. and box 14 does have the same value as Box 1. If it helps, I'm quite sure this was a direct rollover from one 457B to another 457B. Box 2a (Taxable Amount) says $0.00

Are you saying that what one enters in the empty box in my screenshot would normally come from what's in box 12 on the 1099-R? If so, how hard would it be for Intuit to clearly state that in the program? 🙄

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

I am saying that if there was no state tax withheld in box 12 then you must leave all boxes 12-14 BLANK.

Some payers just automatically entered their state ID even when there is no state tax withheld. TurboTax sees that as an error because if there is a state ID in box 13 or a state amount in box 14 then the only reason that there should be would be if state tax was withheld in box 12.

The IRS does not care about anything in boxes 12-14 so leave them BLANK for nothing in box 12.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

Well, I clicked BACK, and cleared out boxes 12-14 and advanced forward, and it still ended up at the same screen in my screenshot above. But the top box is 0 now. So I guess I just click Continue at this point?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

Not 0 - BLANK. Return to the 1099-R section and delete the 1099-R, then re-enter it manually and do not enter anything in any boxes in box 12-14.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

Thanks for your help! But later, as I walk thru the "Retirement Savings Contribution Credit" , it asks me "Did you have any distributions from a retirement plan after 2016 and before the due date of your 2019 return". If I answer YES, I'm asked to fill in the $ amount next to "Roth IRA, Traditional IRA, and Qualified Plan distributions". So should I just answer NO to this whole question? I mean of course I DID have a distribution, but not to me as income, again, it was just a rollover from one 457b to another 457b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box for state withholding at end of 1099-R manual entry?

A rollover is not a distribution and should not be entered.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Shaniac420

New Member

pahcant7

New Member

LouDog1

New Member

cabrinidongxi

New Member

sgeubank

New Member