- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- The USA and Chile have a double taxation treaty for both income tax and social security tax. How do I zero out self employment tax in turbotax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The USA and Chile have a double taxation treaty for both income tax and social security tax. How do I zero out self employment tax in turbotax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The USA and Chile have a double taxation treaty for both income tax and social security tax. How do I zero out self employment tax in turbotax.

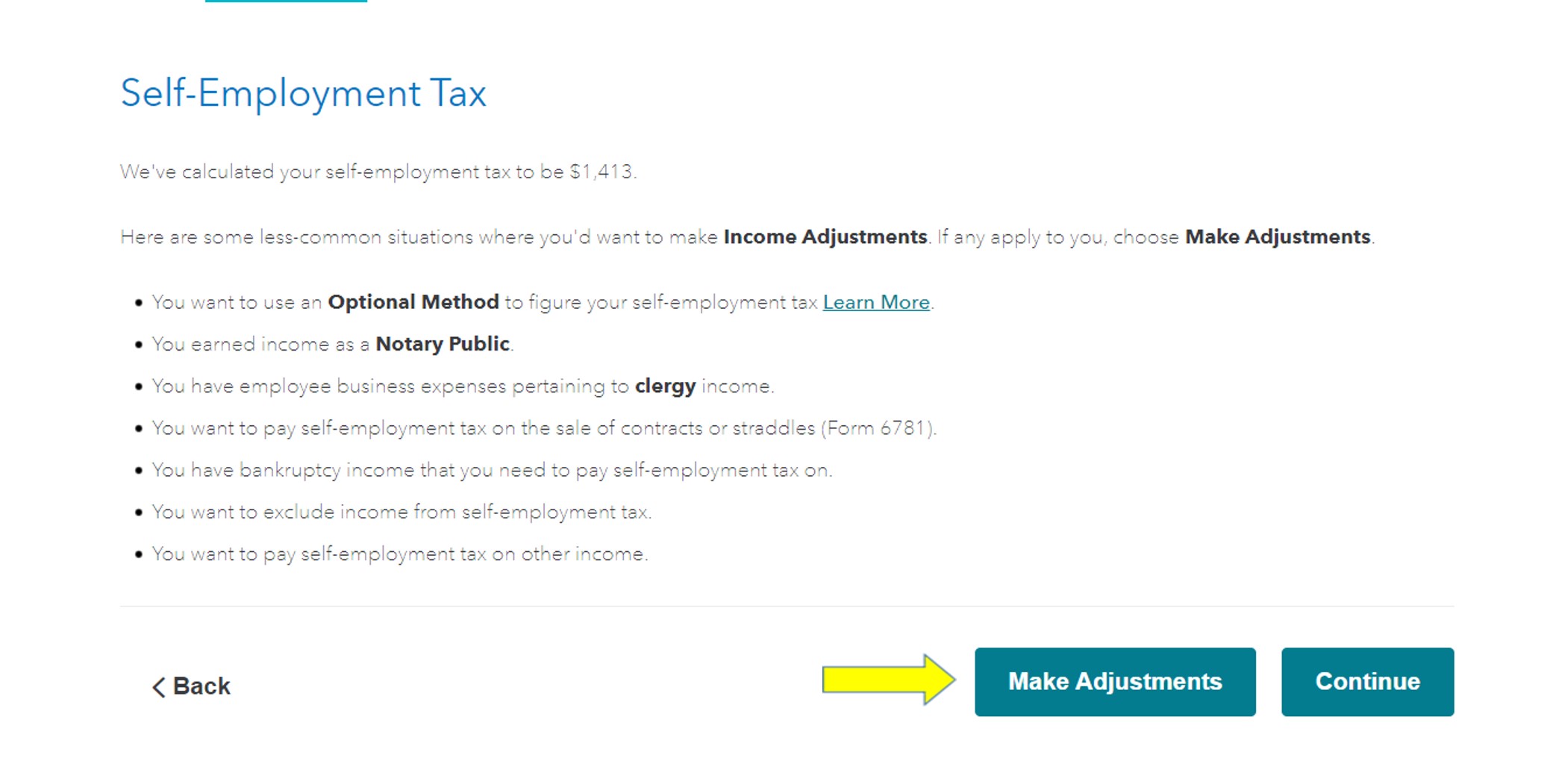

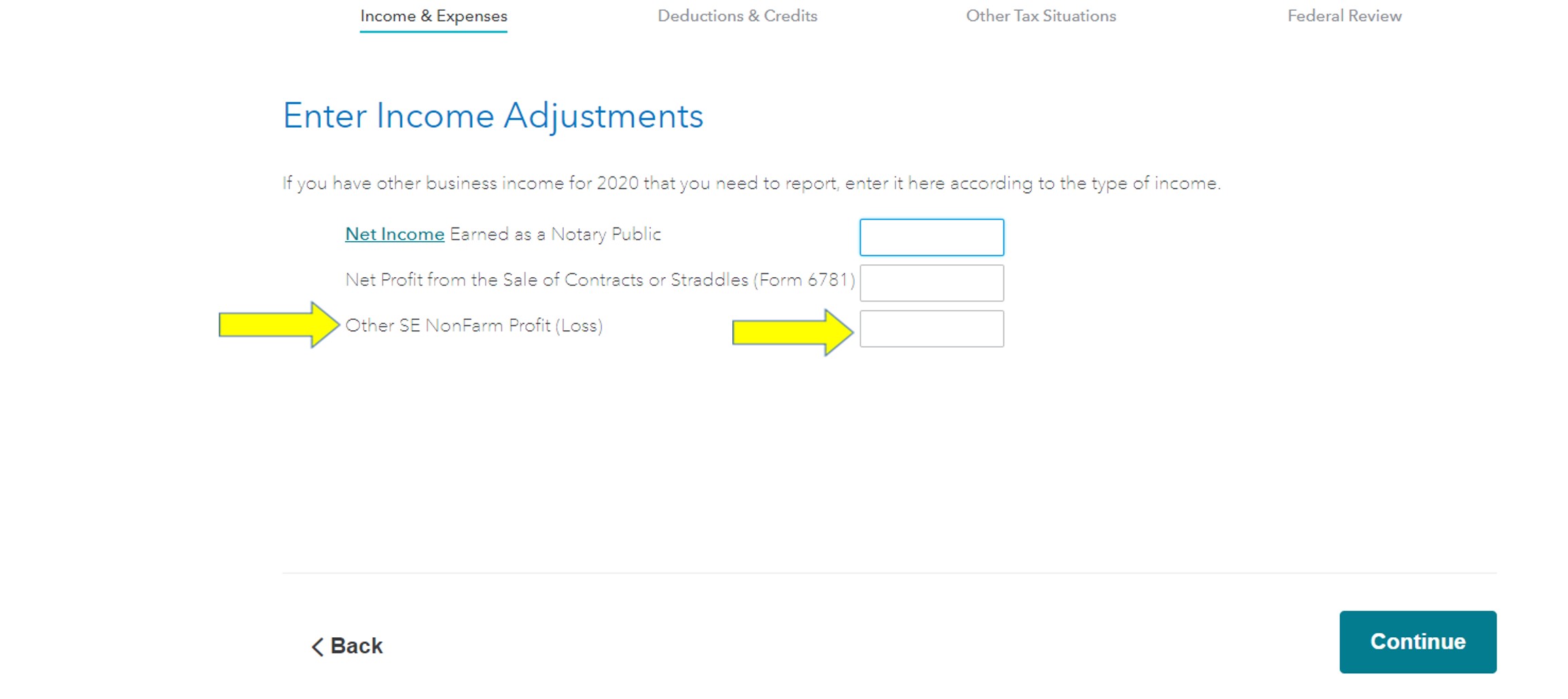

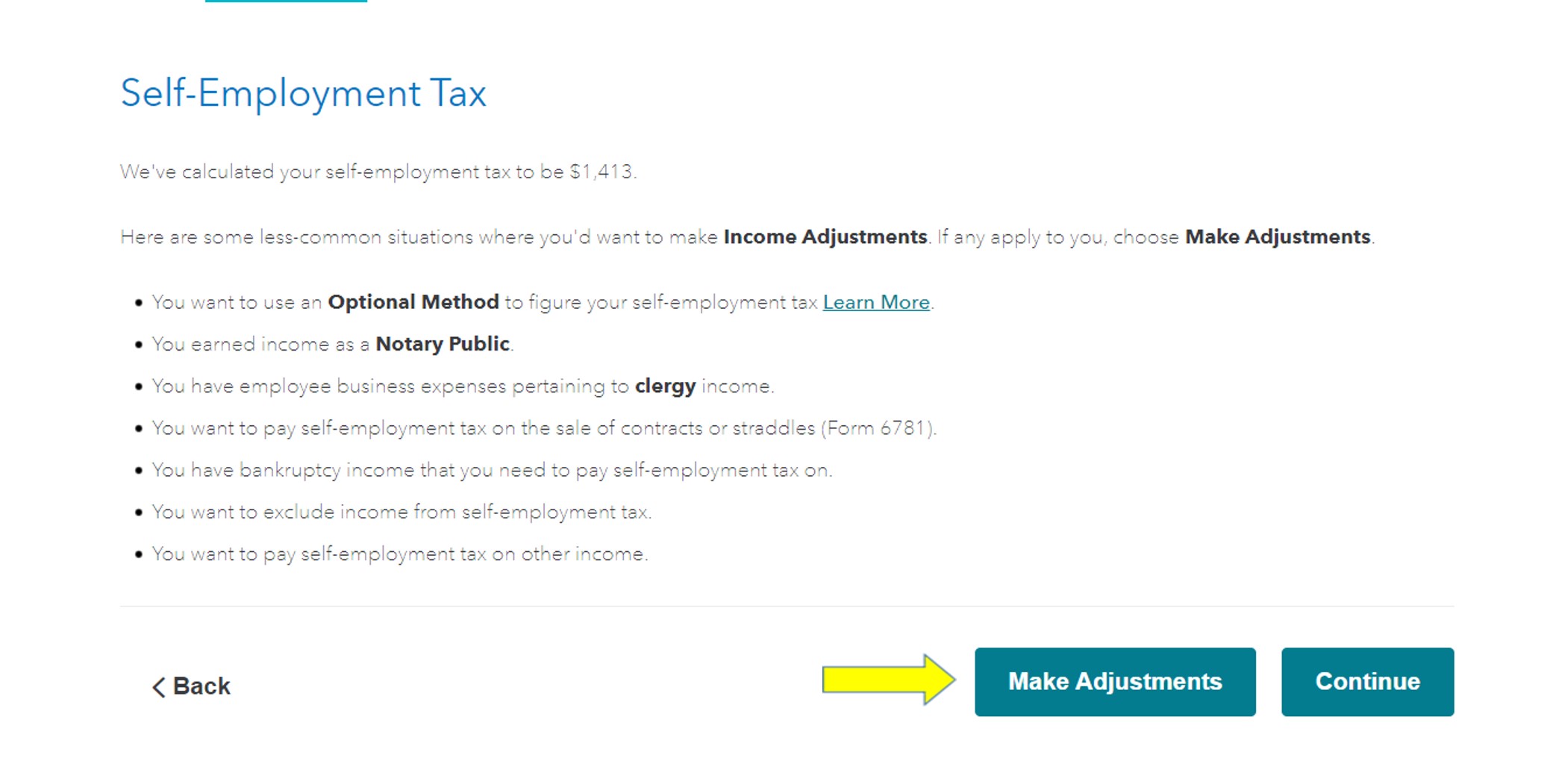

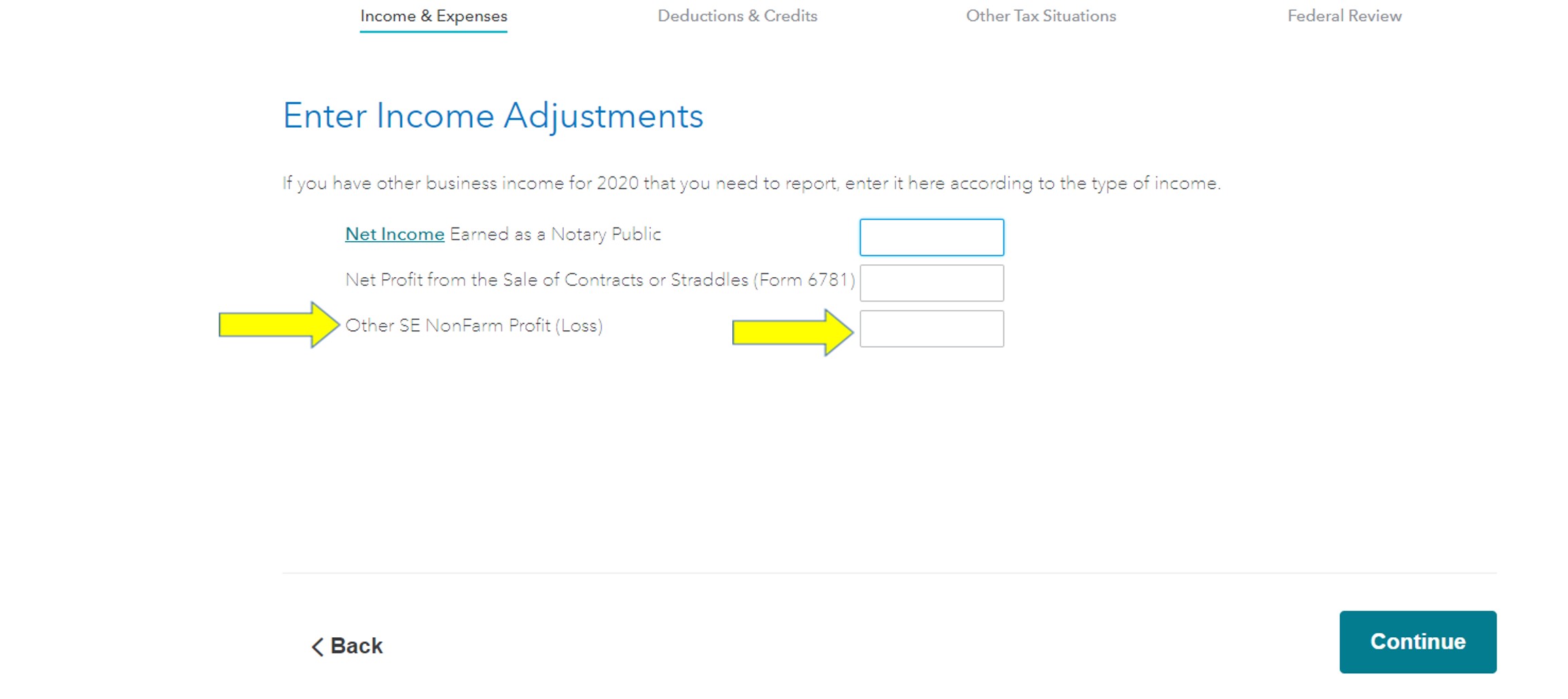

You can adjust out your self-employment income by going to Other Tax Situations, Business Taxes and Deductions, Self-employment tax.

Enter your Self-employment profit as a negative on this screen:

In accordance with the US Chilean Agreement you are citing Agreement Between the United States and Chile, you should print and mail in your tax return with a copy of your Certificate of Coverage with the Chilean system.

The Agreement does not exempt you from payment into any system, only exemption from requirement to pay into both.

If you voluntarily pay into the Chilean system you are exempt from paying US Social Security and are eligible to get a Certificate of Coverage to establish your exemption.

If you are not voluntarily paying into the Chilean system you are not exempt from paying US Social Security.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The USA and Chile have a double taxation treaty for both income tax and social security tax. How do I zero out self employment tax in turbotax.

Unfortunately, the reason TurboTax doesn't allow you to zero out self employment tax for Chile is because Chile and the US do not have a standing tax treaty where withholding tax can be reduced to avoid double taxation. It was created in 2010 but still remains unsigned.

Here is a the list of tax treaties with the US. Chile isn't on the list.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The USA and Chile have a double taxation treaty for both income tax and social security tax. How do I zero out self employment tax in turbotax.

Not employee. Self employed

https://www.ssa.gov/pubs/EN-05-10175.pdf

The agreement exempts self-employed U.S. citizens who reside in Chile from U.S. Social Security coverage. As a result, if you are a self-employed U.S. citizen and reside in Chile, you do not have to pay U.S. Social Security taxes on your self-employment income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The USA and Chile have a double taxation treaty for both income tax and social security tax. How do I zero out self employment tax in turbotax.

You can adjust out your self-employment income by going to Other Tax Situations, Business Taxes and Deductions, Self-employment tax.

Enter your Self-employment profit as a negative on this screen:

In accordance with the US Chilean Agreement you are citing Agreement Between the United States and Chile, you should print and mail in your tax return with a copy of your Certificate of Coverage with the Chilean system.

The Agreement does not exempt you from payment into any system, only exemption from requirement to pay into both.

If you voluntarily pay into the Chilean system you are exempt from paying US Social Security and are eligible to get a Certificate of Coverage to establish your exemption.

If you are not voluntarily paying into the Chilean system you are not exempt from paying US Social Security.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

auntsoup66

New Member

decli5005

New Member

ddmespell

New Member

rcrain

New Member

dlj56

New Member